Key Takeaways:

Ripple has collaborated with Aviva traders to launch typical fund designs on the XRP Ledger. The enterprise is the inaugural European funding administration agency to enter into a serious partnership with Ripple in fund tokenization. Each leaders of the businesses will clarify the initiative on the subsequent occasion, the XRP Group Day.

Ripple can also be formally coming into the European asset administration area with a brand new enterprise into an settlement with Aviva Traders. The partnership will see the mixing of typical funding funds into the XRP Ledger (XRPL), marking a transition to onchain the location of regulated monetary merchandise.

Aviva Traders Spins into Onchain Finance

The asset administration division of British insurance coverage firm Aviva, Aviva Traders, intends to concern and repair its tokenized merchandise utilizing the XRPL. It’s the preliminary vital step of the agency to blockchain-based fund buildings. The businesses mentioned that the partnership will intention at introducing institutional-grade utility to the ledger by 2026.

Via using the XRPL, the Aviva Traders expects to reinforce velocity and value of managing its funds. The native traits of the ledger allow settlement virtually immediately and scale back operational overhead as in comparison with the traditional banking system. Ripple may even supply the technical help to permit these tokenization packages to adjust to the regulatory and safety necessities related to massive scale manufacturing.

Learn Extra: Ripple Expands UAE Push: RLUSD Meets AEDZ Stablecoin as XRPL Eyes $4T Market Increase

Scaling of Regulated Belongings on the XRPL

The collaboration is indicative of the bigger strategy by Ripple of creating XRPL because the dominant infrastructure of real-world belongings (RWAs). In distinction to most different blockchains, the XRPL was tailor-made to monetary transactions and had inbuilt compliance instruments. The above traits have made it interesting to large managers similar to Aviva who’re managers of billions of belongings.

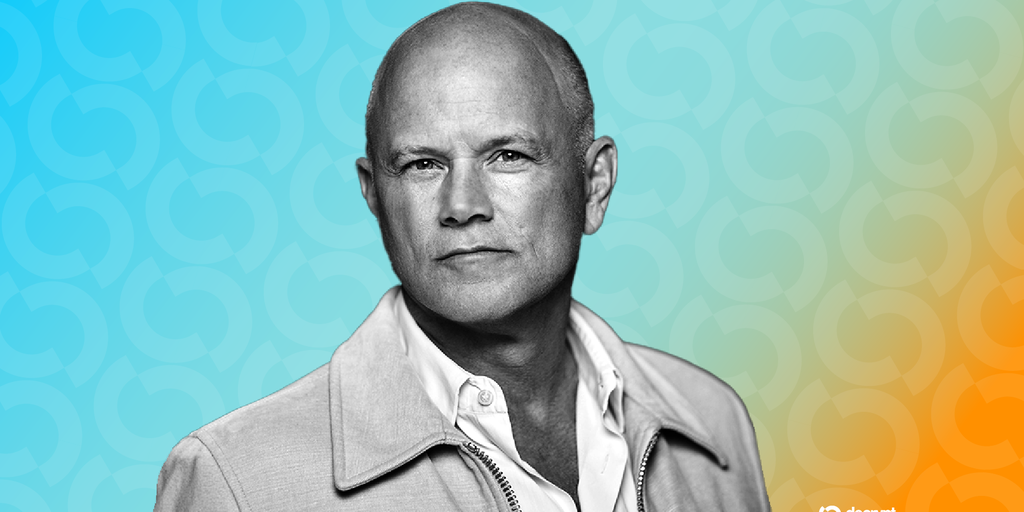

Markus Infanger, Senior Vice President at Ripple noticed that the blockchain expertise is out of the experimental stage within the business. He’s assured that tokenized types of funds will trigger nice efficiencies in the whole funding sector within the forthcoming ten years. The truth that the XRPL can retailer excessive volumes of transactions with out requiring power that’s intensive within the mining course of additionally concurs with the inexperienced ambitions of most modern monetary establishments.

Learn Extra: Ripple Secures $280M Diamond Tokenization as UAE Pushes Actual-World Belongings Onto XRPL

Onchain Technique Is Mentioned by Institutional Leaders

Professional Perception throughout XRP Group Day

This partnership will likely be a topic of dialogue through the subsequent XRP Group Day by way of its technical and strategic points. Alastair Sewell of Aviva Traders and Markus Infanner of Ripple seem promising to debate the way forward for onchain finance. They may discuss the way in which wherein the businesses introduced that they intend to combine typical finance and decentralized ledgers.

That is after a collection of comparable steps by Ripple to entice institutional gamers. The agency has of late prolonged its operations to different regulated corporations, together with the UK-based alternate Archax, as a way to deposit a whole bunch of thousands and thousands of {dollars} in belongings to the ledger. As Aviva Traders change into a part of the ecosystem, the XRPL retains increasing its affords as a regulated digital securities and tokenized funds hub.