The cryptocurrency market is experiencing sharp volatility at the moment, wiping out billions of {dollars} in worth inside hours as each world shares and digital property transfer decrease collectively.

The whole crypto market has misplaced almost $90 billion, pushing many main cash to their day by day lows. On the similar time, U.S. inventory indices additionally slipped, displaying that buyers have gotten extra cautious throughout monetary markets.

Main cryptocurrencies fall shortly

Bitcoin dropped beneath $66,000, falling almost $3,000 in about one hour, which triggered roughly $70 million in long-position liquidations. Ethereum additionally declined, touching round $1,900, whereas a number of altcoins posted losses between 4% and seven%.

Market sentiment has turned extraordinarily weak, with the Worry and Greed Index falling into “excessive worry” territory, a sign that merchants have gotten extra defensive and risk-averse.

Why the market is falling

Analysts say a number of components are driving at the moment’s crypto decline:

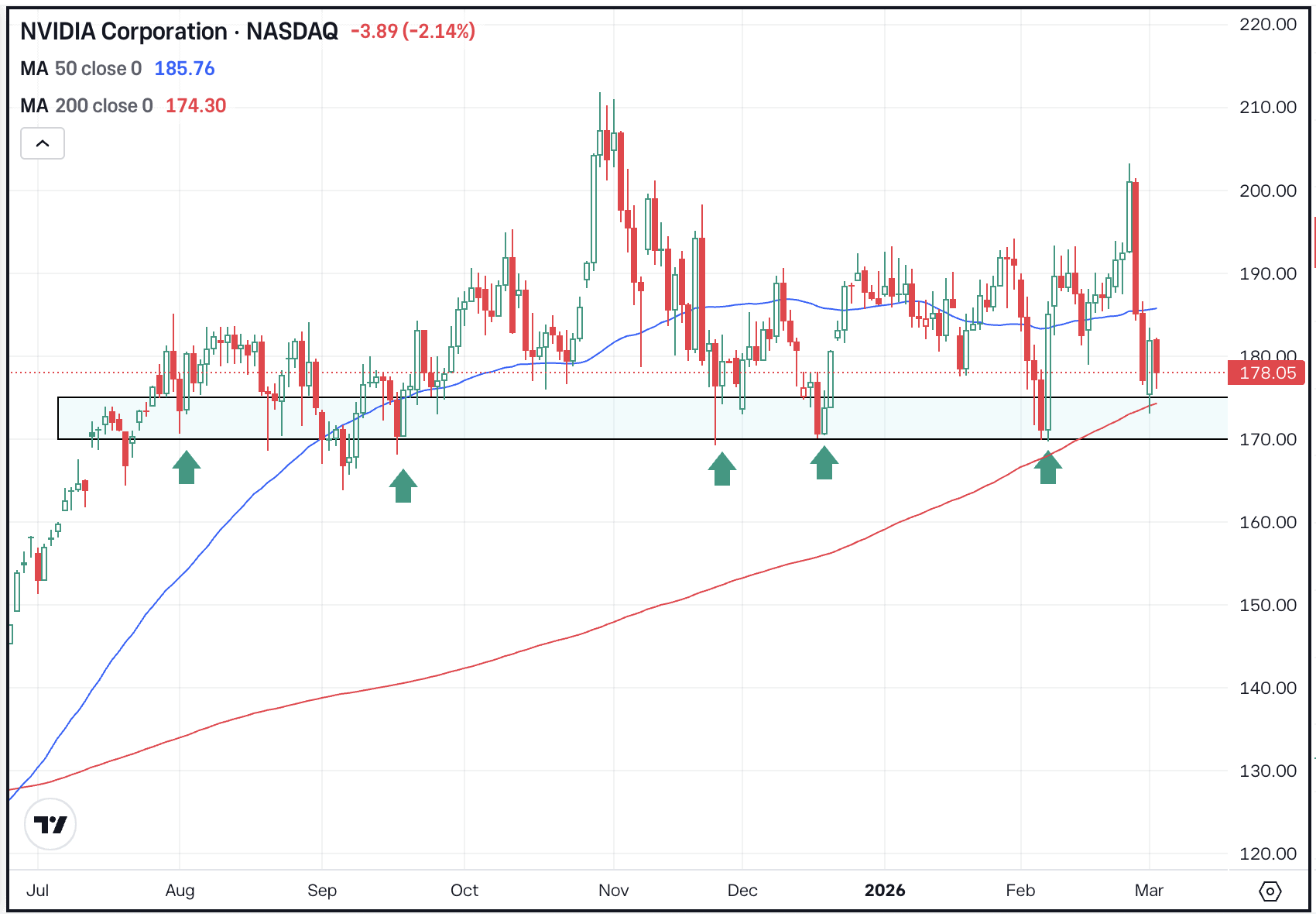

1. Inventory market weaknessMajor U.S. indices such because the S&P 500, Nasdaq, and Russell 2000 moved decrease, and crypto markets typically observe the identical path, particularly throughout unsure financial intervals.

2. Liquidations accelerating the dropAs costs began falling, leveraged merchants had been compelled to shut positions, inflicting extra promoting strain and sooner worth declines.

3. Bitcoin behaving like tech stocksA latest report from Grayscale Investments mentioned that Bitcoin is presently shifting extra like high-growth expertise shares slightly than a standard safe-haven asset akin to gold. Which means that when expertise shares face strain, crypto costs typically fall as effectively.

Oversold alerts seem

Regardless of the sharp drop, some technical indicators present that the market is approaching oversold ranges, which typically results in short-term rebounds. Nonetheless, analysts warn that volatility could proceed till buyers regain confidence and shopping for demand returns.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict Editorial Tips based mostly on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We try to supply well timed updates about all the pieces crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market circumstances. Please do your individual analysis earlier than making funding selections. Neither the author nor the publication assumes accountability in your monetary selections.

Sponsored and Commercials:

Sponsored content material and affiliate hyperlinks could seem on our web site. Commercials are marked clearly, and our editorial content material stays solely impartial from our advert companions.