A Deutsche Financial institution strategist argued that bitcoin has “decoupled” from gold and now not suits the “digital gold” label, pointing to a pointy divergence in 2025 efficiency as regulation uncertainty and ETF outflows weigh on sentiment.

In a Yahoo Finance interview, Deutsche Financial institution senior strategist Marion Laboure informed Government Editor Brian Sozzi and senior reporter Ines Ferré that bitcoin’s volatility hasn’t disappeared, it’s merely displaying up once more, at an ungainly second for a market that spent a lot of final 12 months promoting a cleaner institutional adoption story.

Is Bitcoin No Longer Digital Gold?

Laboure framed current weak spot as one other reminder that “volatility is a function of Bitcoin. It’s not a bug,” whereas flagging what she described as “numerous ETFs outflows” since October alongside a messy coverage backdrop in Washington. She pointed to the Stablecoin “Genius Act” being signed final 12 months, however stated the Readability Act “continues to be in Congress and supplies an extra layer of uncertainty.”

She additionally cited a pullback in retail participation. “In our newest survey, we regarded on the US crypto adoption,” Laboure stated. “And in July, we had 17% of People who had invested in crypto. And the quantity was right down to 12% in December.”

Bitcoin is “now not digital gold,” Deutsche Financial institution strategist Marion Laboure says. “Gold outperformed by 65% in 2025. Bitcoin declined by 6.5%.” pic.twitter.com/eBCYp4cxMt

— Yahoo Finance (@YahooFinance) February 11, 2026

Pressed on whether or not bitcoin nonetheless deserves the “digital gold” tagline, Laboure leaned on returns. “If you consider that, if I take a look at the 2025 efficiency, it’s not digital gold or it’s now not digital gold,” she stated. “Gold outperformed by 65% in 2025. Bitcoin declined by 6.5%. So we’re clearly seeing this divergence.”

Her broader framing was that bitcoin stays caught between narratives. “Bitcoin, I’d say it’s not a way of fee. It’s not a foreign money. It’s unlikely to switch gold or fiat currencies,” Laboure continued. “And I feel the way in which I see Bitcoin is we’re on this transition, we’re transitioning between a pure speculative asset to a extra reasonable use case.”

Laboure additionally returned to what she referred to as a “Tinkerbell impact,” describing a dynamic the place value rises on perception fairly than fundamentals, till it doesn’t. “So principally, it’s when the worth relies on wishful pondering, rather more than elementary elements,” she stated.

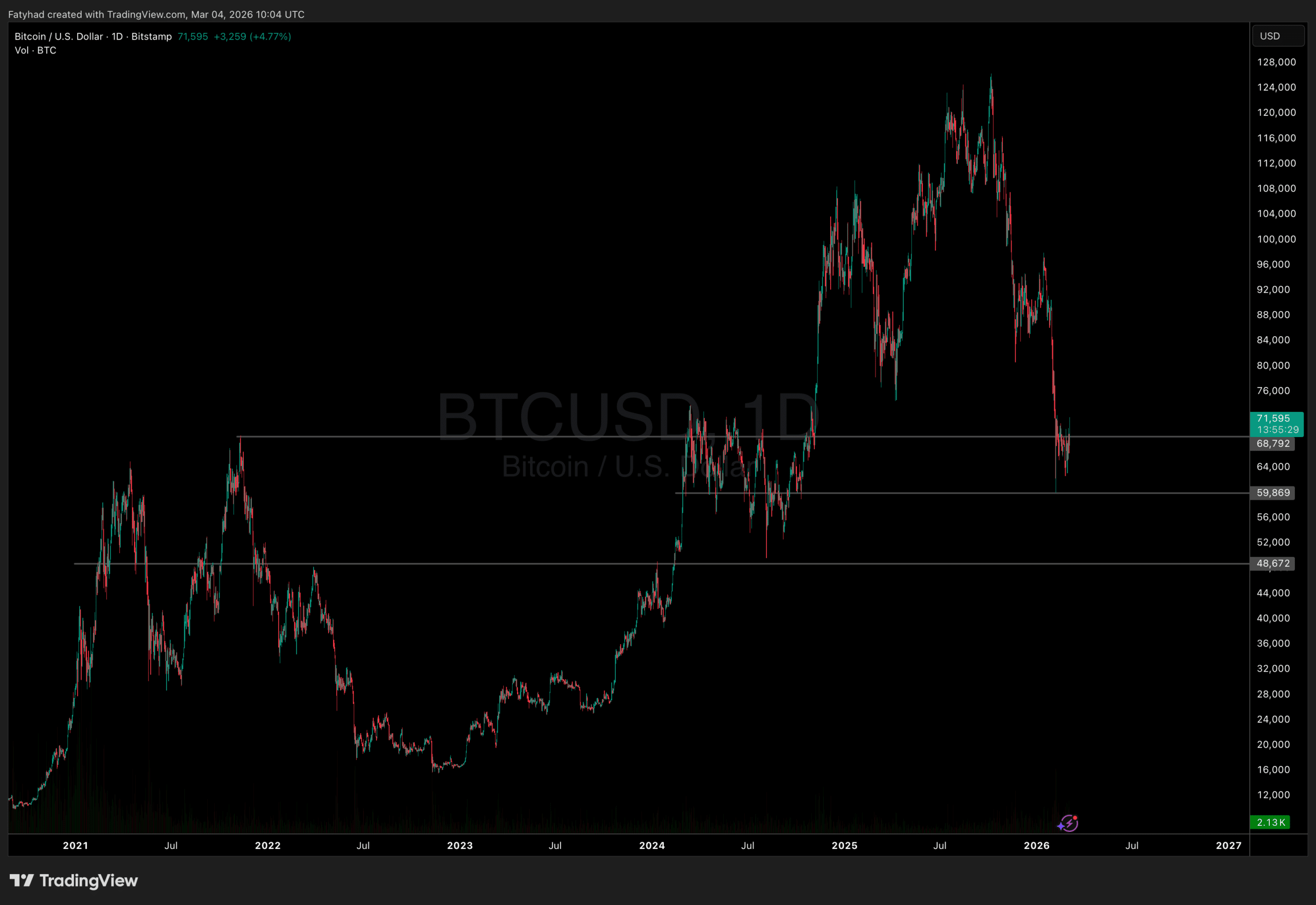

Requested what may reignite upside momentum, Laboure pointed again to the final two years’ catalysts and instructed the transfer nonetheless seems bigger than these inputs alone clarify. She famous bitcoin’s run from roughly $35,000 in November 2023 by means of a interval she referred to as “distinctive years,” citing ETF approvals, the halving, and a “very constructive stance” from President Trump after his election.

“However all these elements alone most likely didn’t absolutely clarify the transfer that we had from $35,000 in November 2023 to over $120,000 in October final 12 months,” she stated, arguing that the market continues to be looking for a extra sturdy anchor than narrative-driven flows.

X Pushes Again

Laboure’s “digital gold” critique drew rapid rebuttals on X. Bloomberg ETF analyst Eric Balchunas referred to as it “a high-quality argument to make” however added: “To hinge it on one 12 months’s returns is absurd. Does that imply it WAS digital gold in 2023 and 2024 when it was up 450%? However now it isn’t as a result of gold did higher in 2025. Make it make sense.”

Others went extra advert hominem. VP of Investor Relations at Nakamoto Steven Lubka dismissed the feedback as coming from a “CBDC shill,” referencing an older quotation the place she stated: “With regards to retail CBDCs, the query will not be whether or not it can occur, however when.”

At press time, BTC traded at $68,007.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.