Bitcoin’s (BTC) latest pullback could also be much less about crypto‑particular weak spot and extra about macroeconomic fears, in keeping with André Dragosch, Bitwise’s Head of Analysis for Europe.

In a social media submit revealed Wednesday, Dragosch argued that the world’s largest cryptocurrency seems to be pricing in a possible deep US recession. If that downturn in the end fails to materialize, he urged, Bitcoin may very well be positioned for a big rebound.

Is Bitcoin Dealing with A Quantum Danger Premium?

Dragosch described Bitcoin as essentially a macro‑pushed asset. Traditionally, he estimates that roughly 90% of its efficiency might be defined by broad financial forces corresponding to development expectations, international liquidity circumstances and financial coverage developments.

Nevertheless, he acknowledged that there are durations when Bitcoin quickly decouples from these drivers. In his view, the market might presently be in a kind of transitional phases.

Associated Studying

A part of the latest divergence, he famous, might stem from considerations unrelated to conventional macro components. Some market contributors have pointed to what Dragosch known as a “quantum low cost.”

This narrative means that lengthy‑time period holder promoting and hypothesis concerning the eventual emergence of quantum‑resistant cryptography may very well be weighing on Bitcoin’s valuation.

He noticed that Bitcoin’s relative underperformance in contrast with Bitcoin Money (BCH), which is perceived to have a clearer close to‑time period roadmap for quantum resilience, might mirror that line of pondering.

By his tough estimate, markets may very well be assigning as a lot as a 25% likelihood to quantum‑associated danger, whereas he believes a extra reasonable low cost can be nearer to five%, on condition that any significant “Q‑Day” risk probably stays far sooner or later.

Uncommon Macro Mispricing Alternative

Extra lately, Dragosch stated Bitcoin’s sensitivity to macroeconomic developments has begun to extend once more. That shift has coincided with weak spot in software program equities, including additional downward strain to the cryptocurrency.

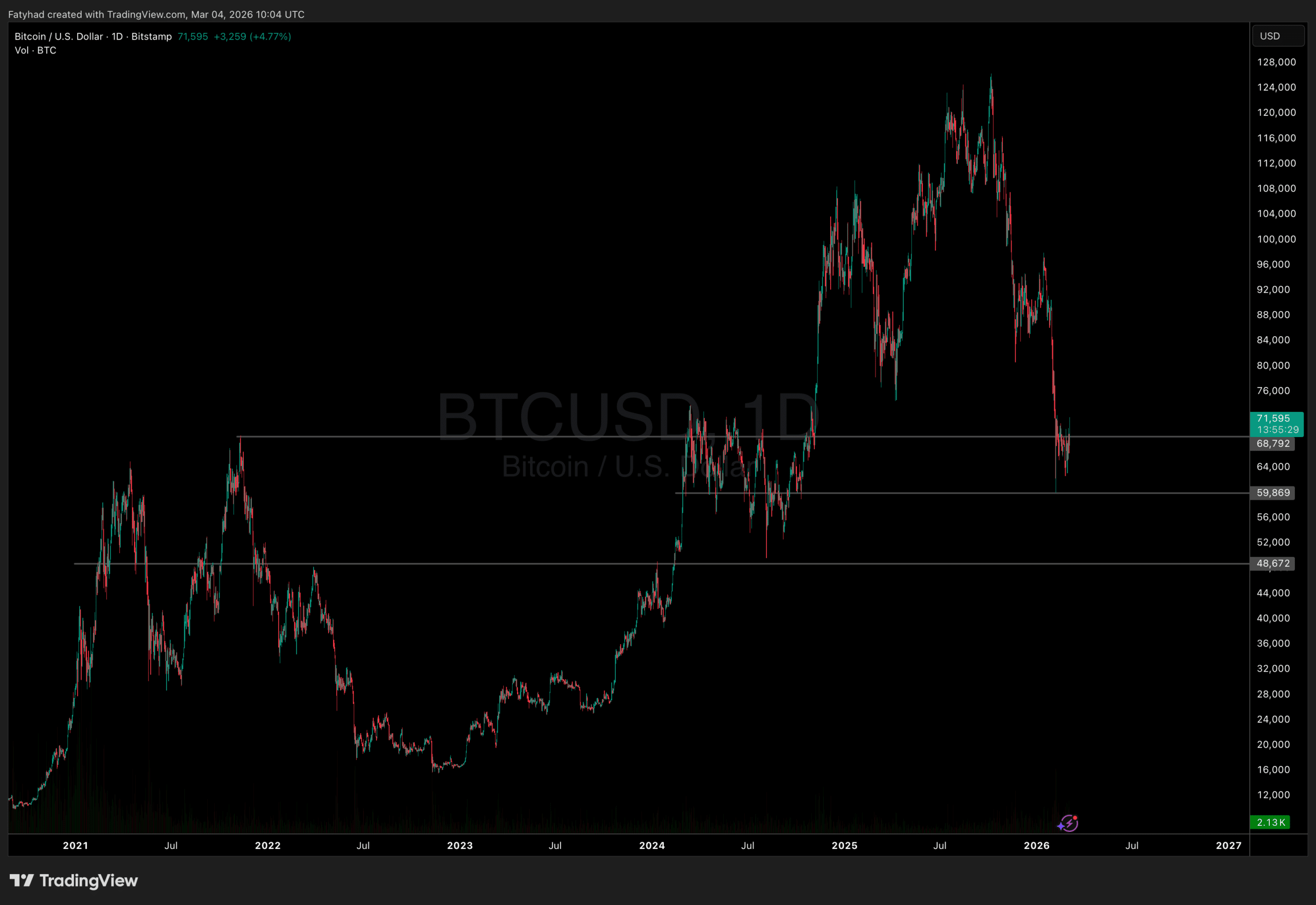

In his evaluation, the newest correction has produced one of many largest macro mispricings in Bitcoin’s historical past. He pointed to residuals between ahead‑trying financial indicators and Bitcoin’s implied development pricing, noting that the present hole is much more pronounced than throughout the COVID‑19 recession in 2020.

In sensible phrases, Dragosch believes Bitcoin’s present valuation displays expectations of a deep US recession. Ought to such a downturn fail to happen, he argues that the ensuing setup might characterize one of many extra uneven danger‑reward alternatives seen in Bitcoin up to now.

Associated Studying

He additionally emphasised that macroeconomic alerts should not uniformly damaging. Industrial commodity markets are exhibiting early indicators of renewed momentum, whereas US ISM information has returned to enlargement territory.

Main indicators corresponding to Germany’s Ifo survey and Taiwanese semiconductor export information are trending upward. Moreover, international price‑slicing cycles have traditionally preceded stabilization in ahead development expectations.

Taken collectively, these components counsel that international development prospects is probably not deteriorating as sharply as some concern. Such an surroundings, Dragosch famous, sometimes helps danger belongings like Bitcoin whereas diminishing relative demand for gold.

He highlighted that the BTC-to-gold ratio presently sits close to ranges that traditionally sign dislocation, which he views as one other potential signal of undervaluation.

On the time of writing, Bitcoin was buying and selling at $67,591, which is about 46% under the all-time excessive of $126,000 reached throughout final 12 months’s rally in October.

Featured picture from OpenArt, chart from TradingView.com