The center of January marked the continuation of an already struggling value motion for Bitcoin, because it took on one other sharp downtrend. Early into February, the flagship cryptocurrency gave the impression to be on a free-fall, even breaching necessary psychological value ranges because it crashed.

One in all these ranges is the price foundation of one in all Bitcoin’s most influential investor cohorts – the Bitcoin ETF traders. Information from a current on-chain analysis reveals that Bitcoin has since traded beneath this value, and has continued to satisfy traders with rising warmth.

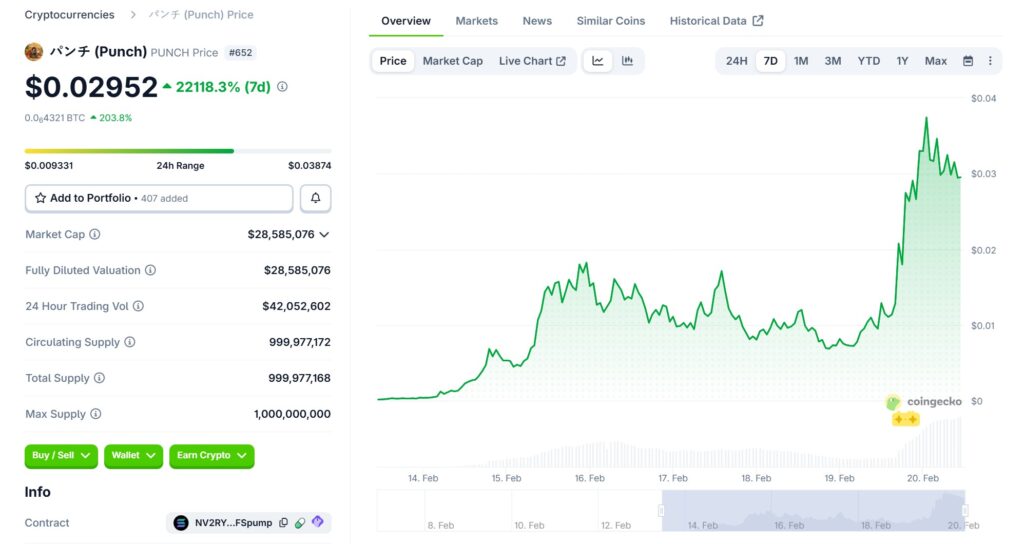

MVRV Falls Beneath 1 — What This Means

Market analyst PelinayPA has just lately taken to QuickTake to disclose that the Bitcoin value is buying and selling under the common realized value of Bitcoin ETFs, and the doable implications of this market setup.

Notably, the ETF MVRV (Market Worth to Realized Worth) index has additionally slipped underneath the 1 mark, reinforcing the agitated scenario of most ETF traders. Traditionally, a sustained transfer under an MVRV of 1 alerts rising stress situations throughout the BTC market, because it displays an awesome dominance of unrealized losses amid an investor group.

In keeping with PelinayPA, this situation could trigger sell-pressure to intensify, seeing as market individuals would more and more act on their feelings when dealing available in the market. As such, short-term restoration makes an attempt are more likely to be met with important resistance (as is at the moment the case) till the scenario sees a turnaround. It’s because traders who entered at greater value ranges would possible exit their positions at break-even, and even underneath minimal losses, to keep away from deep losses.

As a result of the realized value of Bitcoin ETFs is roughly $80,000, this value area might act as a powerful resistance degree within the occasion that the Bitcoin value makes an attempt a rebound. PelinayPA clarifies that if MVRV stabilizes throughout the 0.8–0.9 vary, it could possibly be an indication that the present bear stress is nearing an exhaustion level; a situation that would precede a short-term rebound in direction of the realized value.

Alternatively, if the MVRV continues to say no (because the analyst expects), it could possibly be problematic for the Bitcoin value. It’s because ETFs could be underneath important stress, which might set off sell-offs amongst this investor cohort. This may, in flip, enhance downward stress and additional ship costs downwards, particularly within the long-term.

Bitcoin Market Overview

As of this writing, Bitcoin trades for $68,000, reflecting a 1.58% development in 24 hours, in response to CoinMarketCap information. Per SoSoValue information, Bitcoin ETFs have recorded a complete web outflow of about $1.08 billion in February. That is after an much more staggering web withdrawal determine of $1.61 billion in January.