Whereas the market noticed notable bullish motion on Wednesday, Ethereum’s worth struggled to draw good points because it confronted a robust barrier. Nonetheless, ETH’s current worth efficiency hints at a possible restoration, which suggests a continuation of the renewed upsurge.

Technical Chart Sample Indicators Rally For Ethereum

Ethereum has moved briefly above the $1,900 mark following market resurgence. Whereas the upward transfer won’t seem important, the second-largest digital asset is displaying recent indicators of power resulting from an rising bullish chart sample on the 1-day time-frame.

Particularly, Dealer Tardigrade, a crypto analyst, has revealed a Bull Pennant Sample on the 1-day chart, hinting at a doable shift in momentum. A Bull Pennant formation is a bullish technical sample that alerts a continued upward development.

Much like a triangular pennant, it’s created when a interval of consolidation happens following a big worth improve, throughout which the worth strikes inside a narrowing vary. This consolidation is decided by converging development traces, whereas a breakout above the higher trendline confirms the continuation of the uptrend.

Based on the knowledgeable, Ethereum is at the moment breaking out of the bull pennant sample after a breakout from the trendline. ETH’s surpassing the trendline signifies rising upward momentum, growing the potential of a big rebound and the start of a brand new rally within the brief time period.

With the altcoin constructing power after the breakout, Dealer Tardigrade has predicted a rally again to the $2,250 stage. A transfer above the essential worth mark is prone to set off a chronic uptrend and entice broader market affirmation.

In a earlier publish, Dealer Tardigrade reported a bullish sign from the ETH’s Stochastic Indicator. Regardless of the prior risky interval, the Stochastic indicator is displaying a possible rebound from the oversold zone. ETH’s worth can be exhibiting an analogous transfer because it gears up for a bounce to $3,200.

Dealer Tardigrade’s prediction relies on previous traits the place ETH’s worth surged because the stochastic indicator recovered from an oversold zone. As noticed previously, the event occurred 3 occasions inside the final 2 years, triggering over 100%, 169%, and 99% upswings, respectively.

Spot Quantity For ETH Cooling Off

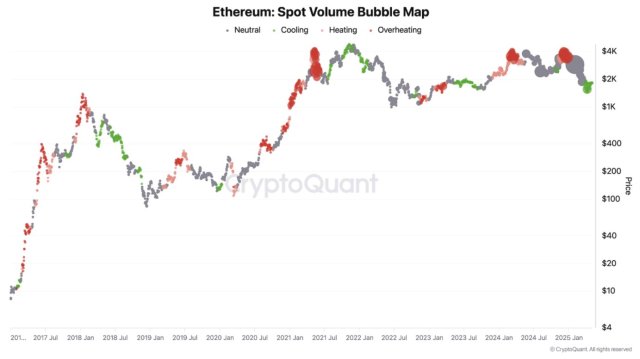

Amid earlier bearish worth actions, Ethereum Spot quantity skilled a gentle decline. Nonetheless, Darkfost, an on-chain knowledgeable and creator, highlighted that the cool-off “would possibly truly be a very good signal.”

Darkfost has underlined two attention-grabbing metrics. He famous that bubbles are used to symbolize spot quantity, and the bigger the bubble, the upper the quantity. Additionally, the speed of quantity change is represented by the colour of every bubble.

Provided that ETH has not too long ago been present process a correction, its spot quantity drop in such a context would possibly help in lowering volatility. Consequently, this may increasingly assist alleviate the promoting strain that has been influencing the market. So as to forestall misconceptions, Darkfost has said that the event doesn’t imply that ETH has reached a backside, urging traders to remain cautious.

Featured picture from Unsplash, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.