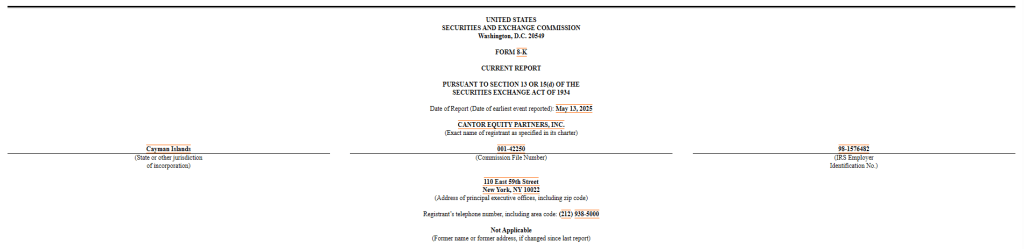

A significant stablecoin issuer has simply put almost half a billion {dollars} into Bitcoin. Based on a submitting with the US Securities and Trade Fee on Might 13, Tether purchased 4,812 BTC at a median value of $95,319 every on Might 9. That provides almost $460 million of Bitcoin to a particular escrow pockets tied to Twenty One Capital, a agency backed by Tether that’s working towards a SPAC merger with Cantor Fairness Companions.

Picture: Flipster

Tether’s Daring Bitcoin Transfer

Based mostly on reviews, Tether isn’t simply minting tokens anymore. It’s taking over direct value threat. By putting nearly $460 million into Twenty One’s Bitcoin stash, the stablecoin issuer steps into the realm of company holders. This buy boosts Twenty One’s complete to 36,312 BTC. Cantor Fairness Companions holds 31,500 BTC on Twenty One’s behalf, and the remainder got here straight from Tether’s reserve play.

Unstable Share Worth Patterns

Twenty One’s future shares will commerce beneath the ticker XXI as soon as its SPAC deal closes. The CEO, Jack Mallers, says approvals are in movement, although he stopped wanting naming a date. Traders have already seen wild swings: XXI shares jumped from $10.65 to $59.73 on Might 2, then slid again to $29.84, and climbed one other 5.2% in after-hours buying and selling following this newest purchase.

Huge Backers Onboard

Tether isn’t alone in funding Twenty One. SoftBank has pledged $900 million. Bitfinex, one other crypto agency, will convert about 7,000 BTC into fairness at $10 per share. Cantor Fitzgerald is main the SPAC, lining up $585 million to again extra Bitcoin buys. These names lend weight, however every companion brings its personal dangers, from market strikes to shifting methods.

BTCUSD buying and selling at $103,124 on the 24-hour chart: TradingView.com

Climbing Towards The High

With 36,312 BTC in its treasury, Twenty One Capital will rank because the third‑largest company Bitcoin holder. Technique (previously MicroStrategy) sits on the prime with 568,840 BTC. BMO-backed miner Marathon Digital holds 48,237 BTC. Twenty One is now chasing that third spot, hoping traders will see it as a go‑to car for pure Bitcoin publicity.

Picture: Elliptic

Bitcoin Per Share Focus

Twenty One’s pitch is straightforward: develop Bitcoin per share. Based on its SEC presentation, revenue gained’t drive its technique. As an alternative, each greenback raised will goal to purchase extra BTC. That contrasts with most public corporations, which measure success by earnings per share. Right here, an increase in BTC holdings is the purpose.

What’s Subsequent For Traders

The SPAC route nonetheless has hurdles. Studies disclose that SEC critiques can drag on, and traders will look ahead to any adjustments in capital‑elevate phrases. If Bitcoin surges, Twenty One may soar. If it dips, there’s no working revenue to melt the blow. For many who need straight Bitcoin bets, this may increasingly look engaging. However anybody craving regular returns from charges or providers may look elsewhere.

Within the coming weeks, market watchers will observe each the SEC’s inexperienced mild and the way Twenty One manages its increasing Bitcoin stash. The reply will form whether or not stablecoin issuers grow to be large new gamers within the Bitcoin recreation.

Featured picture from Gemini Imagen, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.