Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is taking the lead within the crypto market as Bitcoin continues to consolidate close to its all-time highs. After months of lagging behind BTC, ETH is now making a powerful transfer, with bulls pushing worth motion towards the crucial $2,800 resistance. This stage, which has persistently capped upside momentum since early February, now stands as the important thing battleground for Ethereum’s subsequent main leg.

Associated Studying

Market sentiment has shifted as Ethereum exhibits indicators of reclaiming dominance, pushed by renewed spot demand and strengthening technicals. Prime analyst Ted Pillows has weighed in on the rally, emphasizing the significance of the $2,850 mark. In accordance with Pillows, that is probably the most important resistance Ethereum has confronted on this cycle, and breaking via it might unlock a strong transfer towards $3,000 and past.

Momentum has been constructing steadily over the previous few weeks, and ETH’s current resilience in opposition to macroeconomic stress is including to the conviction. If bulls handle to flip this resistance into help, it might mark the start of a broader altcoin surge. For now, all eyes are on Ethereum because it flirts with a breakout that would reshape market dynamics heading into June.

Ethereum Eyes Growth Part Amid Shifting World Dynamics

Ethereum is positioning itself for a probably expansive transfer as each technical indicators and market sentiment proceed to align in its favor. After weeks of consolidation and regular features, ETH is now testing the $2,850 resistance—a stage that has held worth down since February. The setup means that Ethereum is just not solely regaining momentum however might additionally lead the subsequent part of the crypto rally.

Whereas the crypto market features traction, broader macroeconomic forces are reshaping investor conduct. A current determination by the U.S. Federal courtroom to strike down former President Trump’s tariffs on varied nations has created contemporary uncertainty throughout world markets. This coverage reversal might introduce volatility in conventional finance, as commerce dynamics shift and new fiscal responses take form.

Regardless of this uncertainty, Ethereum seems to be thriving. There’s a view that crypto belongings like ETH might carry out properly below tight financial situations, and present worth motion helps that view. ETH is displaying resilience, supported by rising spot demand, a bullish construction, and rising investor confidence.

Pillows highlighted in his newest evaluation that if Ethereum reclaims the $2,850 stage within the coming classes, the trail to $4,000 will open shortly. This could symbolize a significant breakout and certain set off a wave of capital rotation from Bitcoin and stablecoins into altcoins.

For now, ETH stays just under a breakout level. If bulls can push decisively above resistance, it could verify the beginning of an expansionary transfer that would reshape the broader market, positioning Ethereum as a number one power within the subsequent part of the cycle.

Associated Studying

ETH Reclaims Weekly Key Ranges

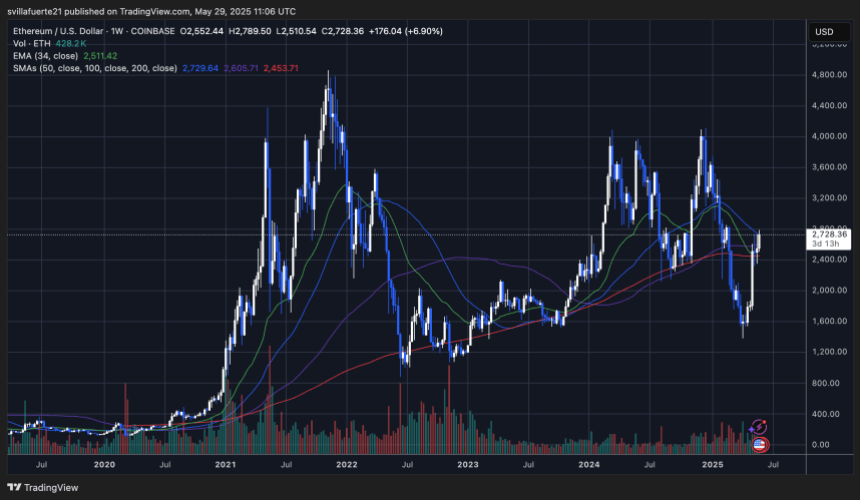

Ethereum is displaying renewed energy on the weekly chart, at present buying and selling at $2,728.36 after reaching a excessive of $2,789.50. This transfer marks a major restoration from current lows close to $1,600 and confirms the formation of a powerful uptrend. ETH has now reclaimed the 34-week EMA at $2,511.42 and is pushing above the 100-week SMA at $2,605.71. These transferring averages now act as dynamic help ranges, reinforcing bullish sentiment.

The following crucial stage to observe is the 50-week SMA, at present sitting at $2,729.64, simply barely above the present worth. A confirmed weekly shut above this stage would mark the primary time ETH has sustained energy above it since late 2023. That would open the door for a push towards the $3,200–$3,600 zone, with $4,000 in sight if momentum accelerates.

Quantity has additionally picked up on this current transfer, signaling wholesome participation from consumers. Traditionally, comparable recoveries from main transferring common clusters have preceded expansive legs in Ethereum’s worth.

Associated Studying

So long as ETH maintains this construction and closes the week above $2,700, bulls are prone to retain management. The breakout above $2,850—final defended in early 2024—stays the ultimate hurdle earlier than Ethereum can problem prior cycle highs.

Featured picture from Dall-E, chart from TradingView