The overall worth of property locked (TVL) on decentralized finance (DeFi) tasks recorded a 30% year-on-year decline to drop to its lowest level for this yr at $36.95 billion, per information from DeFillama.

Whereas DeFi tasks began the yr strongly, peaking at greater than $52 billion in April, the sector has witnessed six months of constant underperformance, dragging it to its present low.

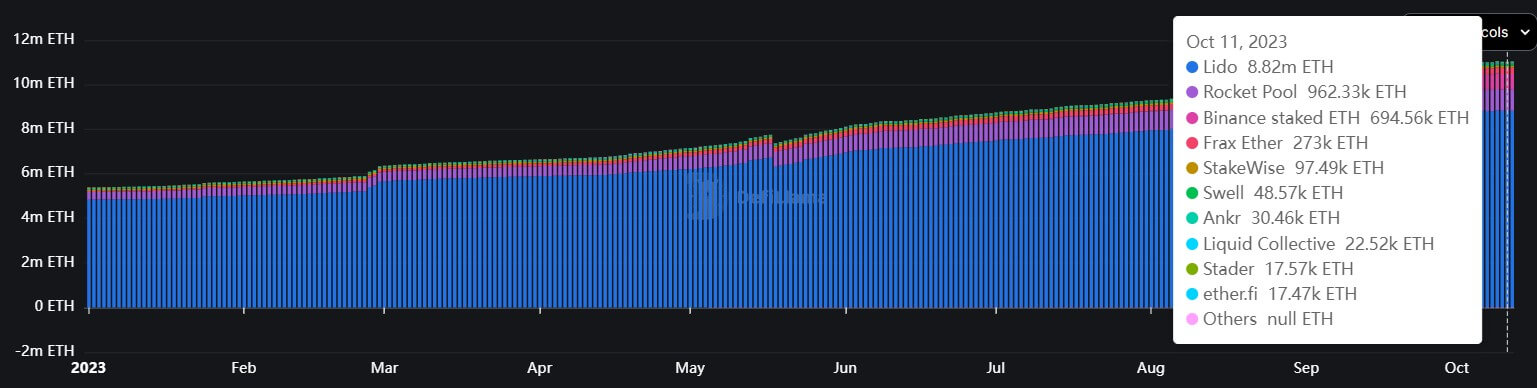

Liquid staking tasks thrive

Within the ever-evolving panorama of the DeFi sector, liquid staking tasks have emerged as a beacon of resilience, contrasting with the broader decline seen in different DeFi classes.

Regardless of the prevailing bearish sentiments, liquid staking tasks have thrived, returning virtually 300% from their 2022 low to almost $20 billion in TVL, in response to DeFillama information. As of the newest figures, TVL now stands at $17.67 billion.

Lido is the dominant participant inside this area of interest, sustaining over 50% of the market share, outpacing main contenders like Binance, Coinbase, and Kraken, as per insights from Nansen information shared with CryptoSlate.

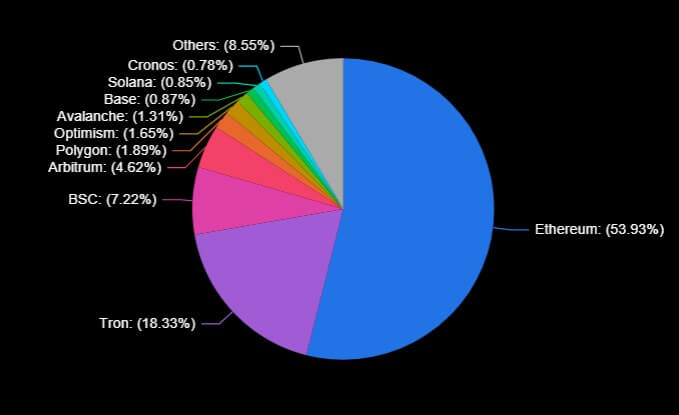

Tron-based tasks TVL rise

The Tron community, too, has witnessed important progress in its DeFi tasks, with their contribution to the general TVL hitting an all-time excessive of 18.23% from the 6.5% recorded earlier within the yr.

On-chain sleuth Patrick Scott attributed Tron’s elevated TVL to the expansion of the primary Actual-World Property (RWA) on the community, stUSDT. Based on DeFillama information, the challenge’s TVL is nearing $2 billion in simply 4 months since its launch.

Nevertheless, CryptoSlate reported that the challenge has come underneath scrutiny, primarily on account of its governance and transparency, whereas a few of its claimed companions, like Tether (USDT), have denied any affiliations.

In the meantime, Ethereum stays the first platform for DeFi tasks and purposes, controlling greater than 50% of the market. Different networks like Binance Good Chain, Polygon, Arbitrum, and others additionally host many tasks.

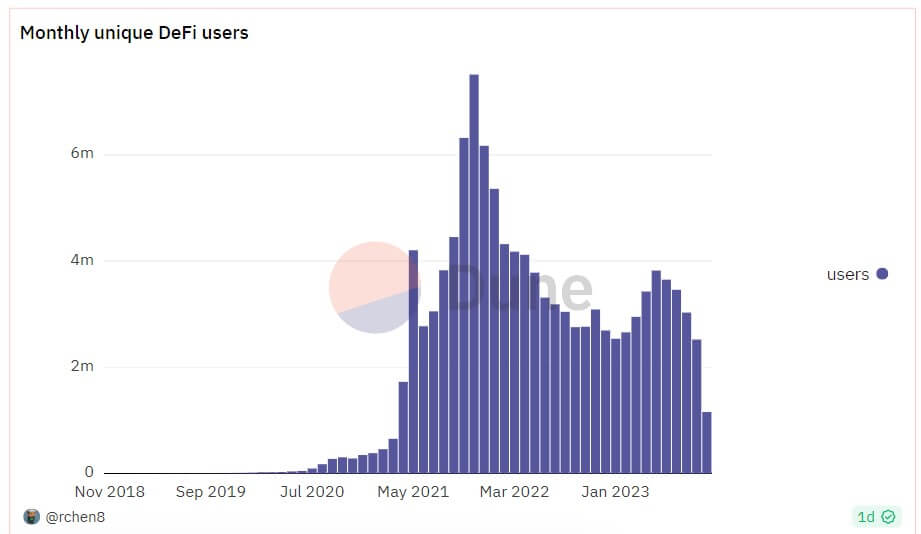

DeFi tasks misplaced 2.5M month-to-month customers.

Because the TVL has flatlined, DeFi tasks have encountered one other problem: a lower of roughly 2.5 million energetic month-to-month customers all year long, Altindex reported, citing a Dune Analytics dashboard by rchen8. Per the report, the decline commenced in Might and has maintained a downward pattern.

In Might, the DeFi sector boasted over 3.8 million month-to-month customers, however by October, this determine had dwindled to round 1.15 million, in comparison with the two.7 million customers reported the earlier October. General, month-to-month distinctive customers have dropped by 66% from the all-time excessive of seven.51 million recorded in November 2021.