On-chain knowledge reveals the Bitcoin Market Worth to Realized Worth (MVRV) Ratio is at present nonetheless beneath historic market peaks.

Bitcoin MVRV Ratio Could Not Be That Overheated But

In a brand new submit on X, the institutional DeFi options supplier Sentora (beforehand IntoTheBlock) has mentioned in regards to the newest pattern within the MVRV Ratio of Bitcoin. The “MVRV Ratio” refers to a well-liked on-chain indicator that compares the BTC Market cap and Realized cap.

The Realized Cap is an on-chain capitalization mannequin for the asset that calculates its complete valuation by assuming the worth of every particular person token in circulation is the same as the worth at which it was final moved on the community. That is totally different from the standard Market Cap, which simply takes the present spot value as the worth for all cash.

The earlier transaction of any token is prone to signify the final time that it modified fingers, so the worth at its time may very well be thought-about as its present value foundation. Thus, the Realized Cap is basically the sum of the acquisition values of all cash.

One method to interpret the mannequin is as a measure of the quantity of capital that buyers as a complete initially put into the cryptocurrency. In distinction, the Market Cap represents the worth that they’re holding proper now.

Because the MVRV Ratio takes the ratio of the 2 fashions, its worth mainly tells us whether or not the buyers are holding greater than they put in. In different phrases, the indicator incorporates details about the profit-loss stability of your complete community.

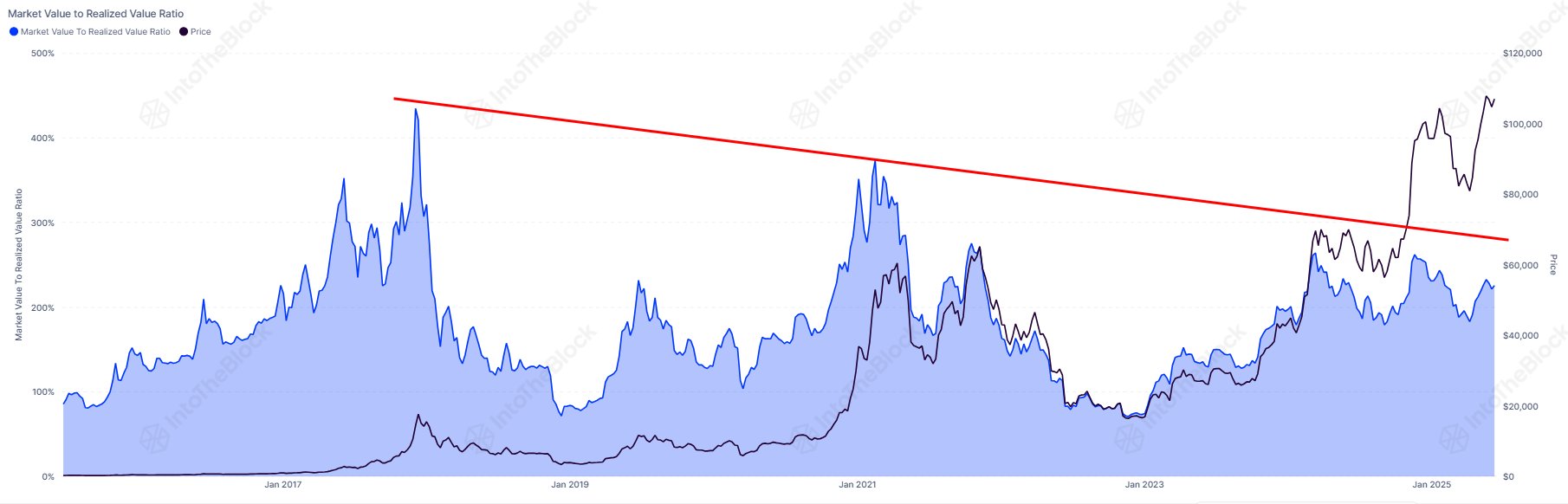

Now, right here is the chart shared by Sentora that reveals a long-term view of the Bitcoin MVRV Ratio:

The pattern within the BTC MVRV Ratio over the previous ten years | Supply: Sentora on X

As is seen within the above graph, an excessive peak within the Bitcoin MVRV Ratio has traditionally coincided with tops within the asset’s value. The reason behind the sample lies in the truth that buyers grow to be extra tempted to take their positive aspects the bigger that they develop.

At a excessive worth of the MVRV Ratio, the Market Cap considerably exceeds the Realized Cap, so the common investor may be assumed to be holding onto a notable revenue. This usually results in holders taking part in mass selloffs to comprehend their positive aspects, however the bull run retains going so long as sufficient demand continues to stream in to soak up the promoting strain.

From the chart, it’s obvious that this stability appears to have been reaching a turning level earlier with every cycle, showcasing that as Bitcoin matures as an asset, its returns have gotten smaller. At current, the MVRV Ratio is sitting at a price of two.25, which suggests the Market Cap is greater than double the Realized Cap. Nevertheless, even after taking into consideration for shrinking positive aspects, this worth is notably decrease than earlier cyclical tops.

“This means the market nonetheless isn’t as overheated because it was throughout earlier peaks,” notes the analytics agency. It now stays to be seen how the remainder of the cycle will play out, and whether or not BTC will make use of this potential room or not.

BTC Worth

Bitcoin has erased its current restoration as its value has come again all the way down to the $104,200 mark.

Appears to be like like the worth of the coin has plunged over the last couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.