Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

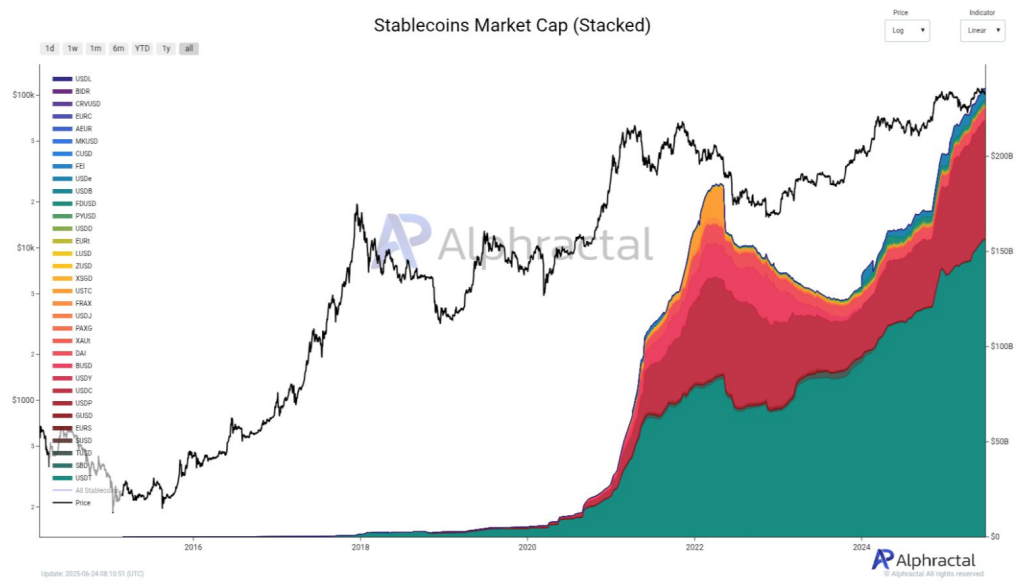

Primarily based on studies, stablecoin issuance has saved climbing for the previous 90 days, with billions of {dollars} flowing in every week. Buyers look like ready for a transparent signal earlier than shifting capital.

Proper now, USDT holds over 66% of that market, whereas USDC and DAI share the remaining. In complete, stablecoins account for about $250 billion, or virtually 8% of all crypto belongings.

Associated Studying

Stablecoin Provide Hitting New Highs

Demand for a trusted greenback peg is driving this progress. Tether leads by a large margin as a result of many merchants belief its stability. Stablecoin reserves have swelled, at the same time as different segments keep quiet. This factors to loads of money on the sidelines.

🔥Billions in Stablecoins are issued weekly, and the 90-day change for all Stablecoins exhibits a considerable amount of liquidity out there out there.

Tether (USDT) stands out, representing 66.2% of the complete Stablecoin market.

Presently, the Stablecoin market cap is near $250B… pic.twitter.com/DugpqDiEPl

— Alphractal (@Alphractal) June 24, 2025

Bitcoin And Stablecoin Dominance

Bitcoin and stablecoins collectively make up roughly 74% of the whole crypto market. That’s an enormous quantity. In previous cycles, as soon as these balances peak, cash typically strikes into smaller tokens. Proper now, Bitcoin’s value is steadying after current swings. Stablecoin balances continue to grow.

I can’t promise something, however there’s a robust likelihood {that a} highly effective Altcoin Season will take maintain within the third quarter of 2025.

I had already talked about this in some posts earlier than, about June and July, and I nonetheless stand by that evaluation.

The primary causes are the massive quantity of… https://t.co/TjRyxBxSKs

— Joao Wedson (@joao_wedson) June 24, 2025

Altcoin Season On The Horizon

Primarily based on forecasts from analyst Joao Wedson, altcoins might see a elevate in Q3 2025. He factors to the large quantity of stablecoin liquidity and chronic doubt amongst retail and massive gamers. That stage of doubt has come earlier than in different cycles, and it often marks a turning level. When confidence returns, altcoins are likely to surge.

Buyers Poised On The Sidelines

Many holders appear able to hit purchase. They’re holding onto stablecoins till charts, on-chain knowledge or macro information clear up. A lift in stablecoin flows to exchanges might be one early trace that rotation is beginning. Giant strikes by whale wallets into low-cap tokens might comply with.

In current weeks, inflows of stablecoins into buying and selling platforms have ticked increased. That’s a key sign to observe. If weekly inflows rise sharply—say above $5 billion—it could present critical urge for food constructing. Previous cycles noticed comparable spikes simply earlier than altcoin rallies started.

Market observers can even be monitoring Bitcoin’s consolidation vary intently. If it stays above current lows for a couple of weeks, that may give confidence a lift in all places. Then we might see smaller cryptocurrencies transfer increased on new liquidity.

Primarily based on these indicators, it seems to be like we’re in a ready sport. Stablecoin provides are at report ranges, Bitcoin is settling, and altcoin sentiment stays low. When all that strains up good, funds are more likely to rotate. Then the altcoin sector might see new life.

Featured picture from Imagen, chart from TradingView