Grupo Murano, a $1 billion actual property agency primarily based in Mexico, is pioneering a daring technique to combine bitcoin into its operations, with CEO Elías Sacal arguing that bitcoin is “demonetizing” the actual property trade. By shifting from conventional asset-heavy fashions to a bitcoin-centric treasury, the publicly traded firm goals to optimize its funds and capitalize on bitcoin’s potential appreciation, providing a mannequin for companies navigating risky rates of interest and currencies.

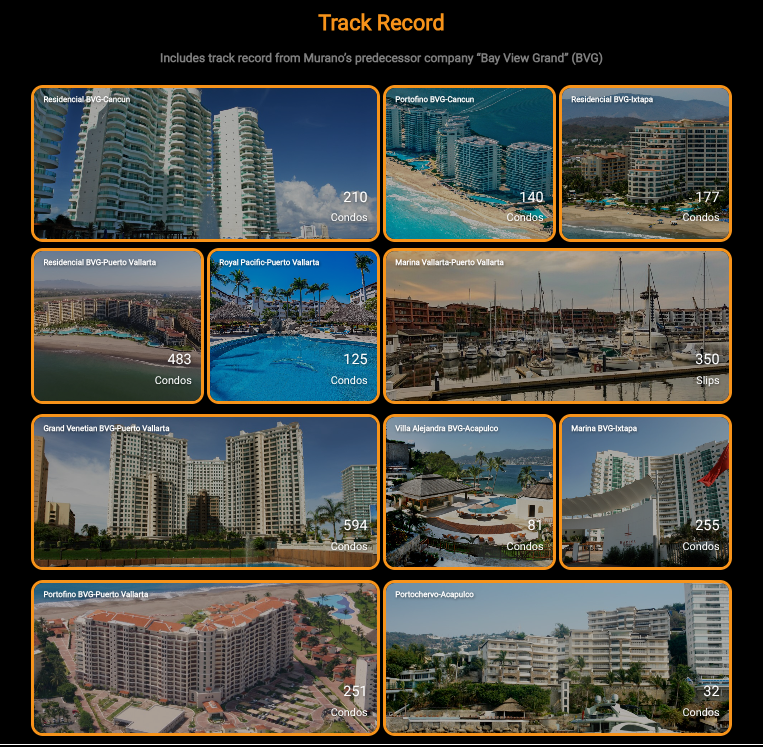

In an unique interview on the Bitcoin for Firms present, Sacal, a 30-year veteran of actual property growth, outlined Grupo Murano’s imaginative and prescient. The agency, which manages lodges beneath manufacturers like Hyatt and Mondrian in addition to residential and industrial properties in cities like Cancun and Mexico Metropolis, plans to transform property into bitcoin by way of refinancing and sale-leasebacks. This strategy reduces debt and fairness on its steadiness sheet whereas sustaining operational management. “As an alternative of buildings ready for small appreciation, we imagine bitcoin will respect extra,” Sacal stated, predicting a possible 300% value improve inside 5 years.

Sacal’s technique addresses the actual property trade’s reliance on debt financing, which has been disrupted by rising rates of interest — leaping from 4% to 9% in some circumstances. “Actual property must be unbiased of the speed of tomatoes or Walmart inflation,” he famous, emphasizing Bitcoin’s stability for transactions like sourcing supplies globally or accepting resort funds. By eliminating middlemen comparable to hedge funds and portfolio managers, bitcoin reduces prices from commissions and alternate charges. A $100 fee, Sacal defined, typically shrinks to $85 after charges, however bitcoin makes these funds extra environment friendly.

Grupo Murano can also be educating stakeholders — workers, traders and friends — about Bitcoin’s advantages. The agency plans to deploy Bitcoin ATMs in its properties and is finalizing a partnership with a significant fee platform to allow seamless transactions, notably for American-oriented resort friends in Cancun and Mexico Metropolis. This aligns with Murano’s bold purpose to construct a $10 billion bitcoin treasury inside 5 years, impressed by Technique’s $100 billion valuation, acquired primarily by way of adopting bitcoin. Murano can also be trying to settle for bitcoin funds all through its portfolio and shall be exploring alternatives to host Bitcoin conferences at its areas.

The corporate’s focus stays on high-margin growth tasks, allocating 20-30% of its enterprise to actual property and 70-80% to bitcoin holdings. Sacal dismissed different cryptocurrencies, calling bitcoin “the champion, like Method One or the NFL.” He sees Latin America, led by pioneers like El Salvador, as a fertile floor for Bitcoin adoption, although political dangers stay. Bitcoin may unify regional economies, decreasing dependence on tourism or remittances.

For Bitcoin Journal’s viewers, Grupo Murano’s pivot highlights Bitcoin’s potential to remodel capital-intensive industries. By prioritizing growth over possession and leveraging Bitcoin’s appreciation, Murano affords a playbook for companies searching for resilience towards financial volatility. As Sacal places it, “Finally, actual property globally shall be dominated by Bitcoin transactions,” signaling a shift towards a extra steady, decentralized future.

Bitcoin for Firms is an initiative owned by BTC Inc., the mum or dad firm of Bitcoin Journal. BTC Inc. operates varied subsidiaries centered on the digital property trade and has a enterprise relationship with Group Murano.