A Bitcoin whale from 2011 has all of the sudden come alive, shifting 3,962 BTC. Right here’s how a lot revenue the OG made on their historic stack.

Bitcoin Whale Has Proven Motion After 14.5 Years Of Silence

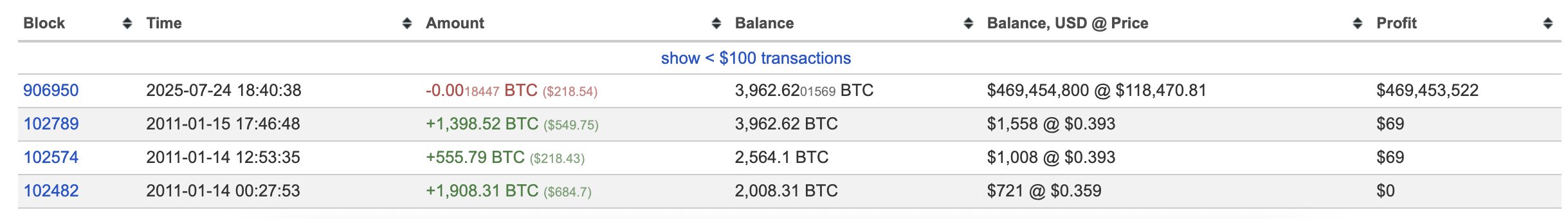

In a publish on X, on-chain sleuth Lookonchain identified how a Bitcoin whale pockets silent since 14.5 years in the past lastly broke its dormancy immediately. The pockets in query acquired 3,962 BTC again in January 2011.

On the time, the cryptocurrency was buying and selling round $0.37, so this quantity would have solely been price about $1,460. After amassing this sum, the investor’s tackle went utterly chilly.

It’s doable that the pockets turned misplaced, both by having its existence forgotten or keys misplaced. That is usually the probably motive behind wallets going dormant for lengthy durations. The much less possible clarification might be that the silence corresponded to willful HODLing by the investor.

Regardless of the case be, the pockets lastly confirmed exercise earlier immediately and made a take a look at transaction of 0.0018 BTC.

The switch historical past of the whale | Supply: @lookonchain on X

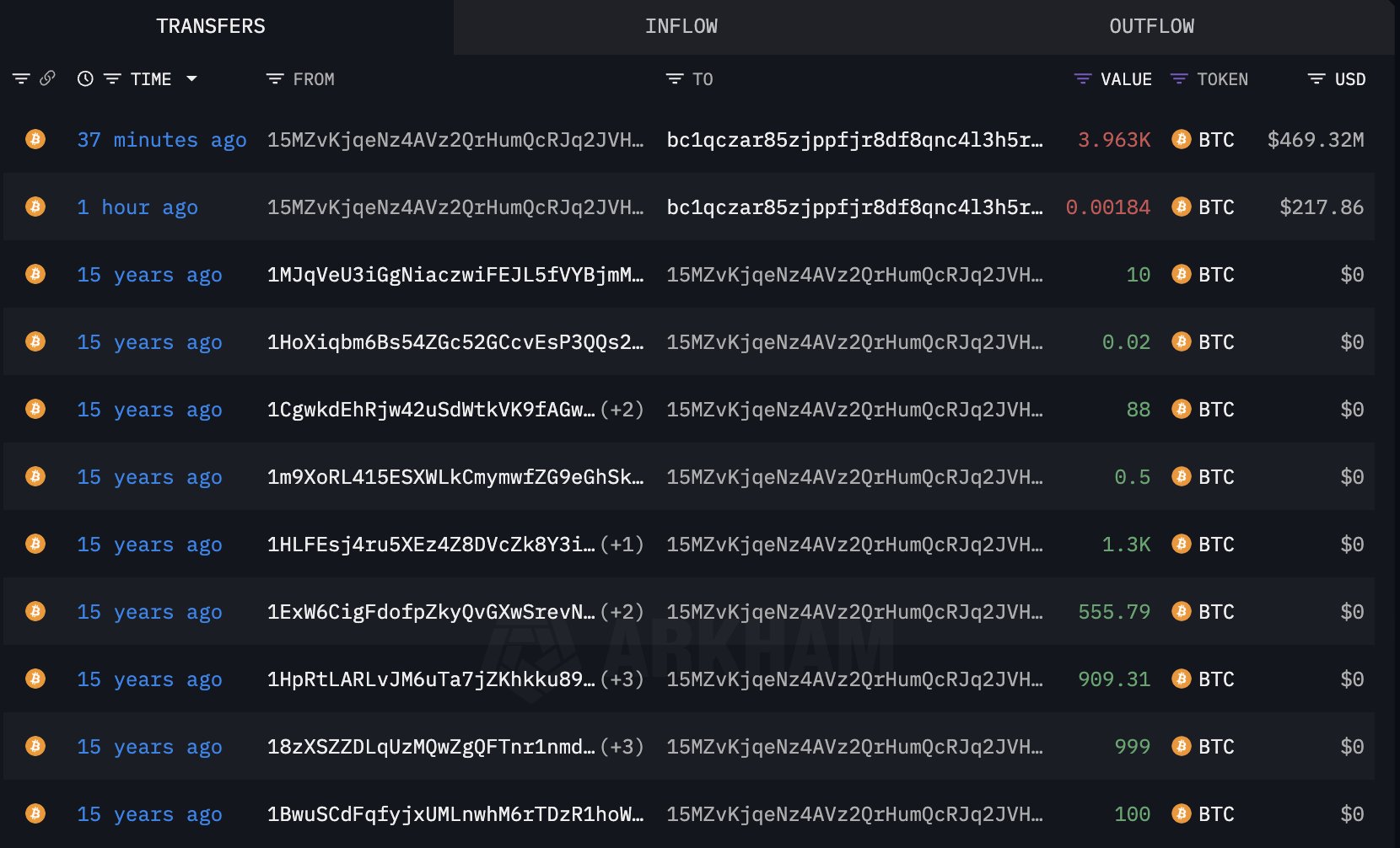

And now, it has utterly emptied itself out, shifting cash to a brand new pockets.

The most recent transaction made by the traditional investor | Supply: @lookonchain on X

On the time of this new transaction, the pockets’s 3,962 BTC stack was price a whopping $469 million. Provided that the preliminary funding was of simply round $1,460, this humongous quantity is virtually all revenue.

Typically, when dormant wallets transfer their cash, it’s an indication that they’re planning to promote. If that is so for the present tackle, the query could also be: why now of all instances, 14.5 years later? Assuming that the pockets was certainly misplaced, it’s doable that it has simply now been rediscovered. Thus, it could have merely been unimaginable to shift these cash till now.

However within the situation that the Bitcoin pockets was rediscovered earlier or the investor by no means really misplaced entry to it, then the rationale could also be that the present bull run highs have simply seemed like a handy window for lastly cashing in.

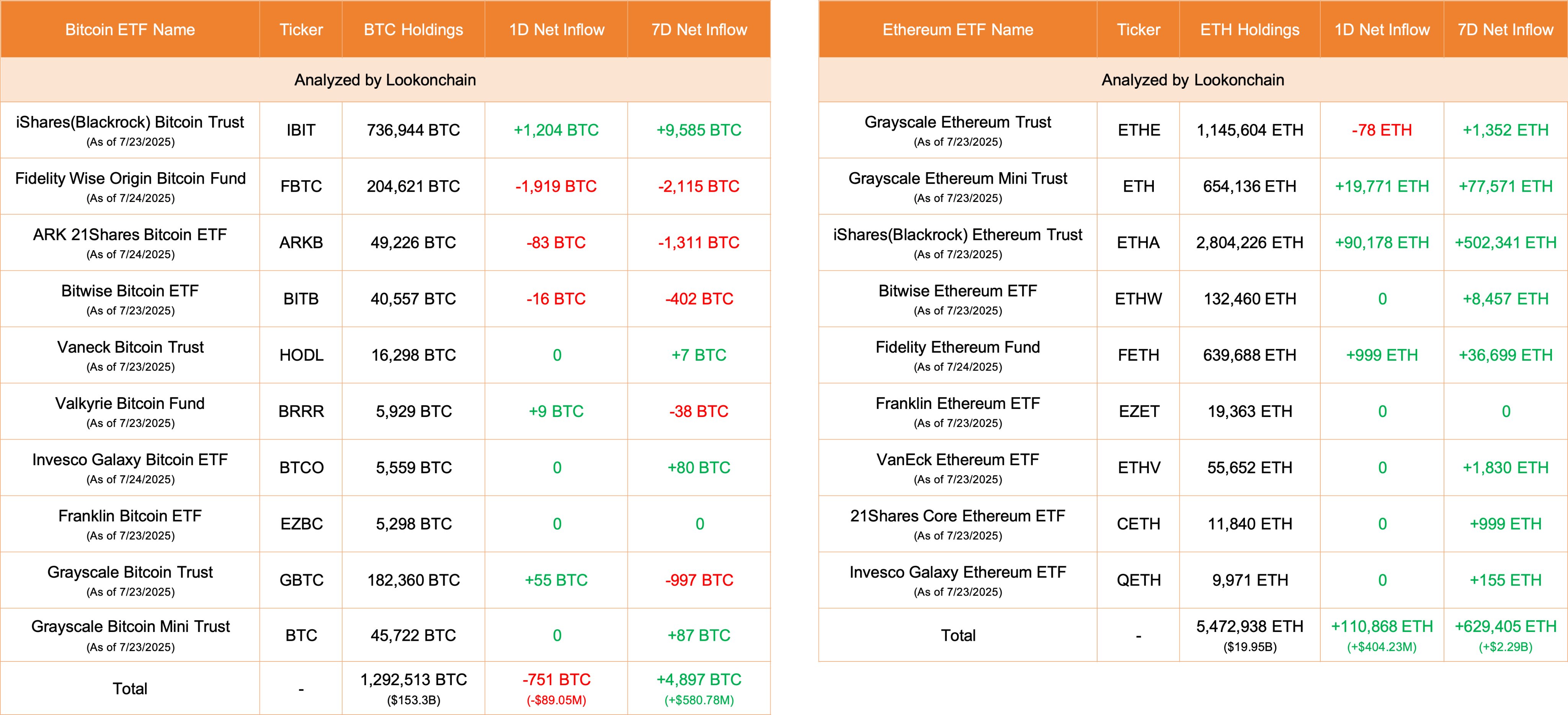

In one other X publish, Lookonchain shared the newest influx/outflow knowledge for the Bitcoin and Ethereum exchange-traded funds (ETFs).

Appears just like the primary cryptocurrency noticed ETF web outflows on July twenty fourth | Supply: @lookonchain on X

As is seen above, the 7-day ETF netflow presently stands at constructive for each Bitcoin and Ethereum, however the each day netflow has printed a damaging worth for the previous. In whole, 751 BTC ($89 million) has left the ETFs over the previous day. Constancy’s FBTC has led the outflows, with 1,919 BTC ($227 million) exiting the fund.

In distinction, ETH ETFs have seen a big influx of 110,868 ($404 million) tokens in the identical window.

BTC Value

On the time of writing, Bitcoin is floating round $118,900, unchanged from one week in the past.

The pattern within the BTC worth over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.