Think about you’re holding a wrench. With just a bit stress on the finish of its lengthy deal with, you’ll be able to twist a bolt that will in any other case take much more pressure to budge. That is the concept of torque — a pressure multiplier.

Now, change the wrench with monetary capital, and the bolt with Bitcoin.

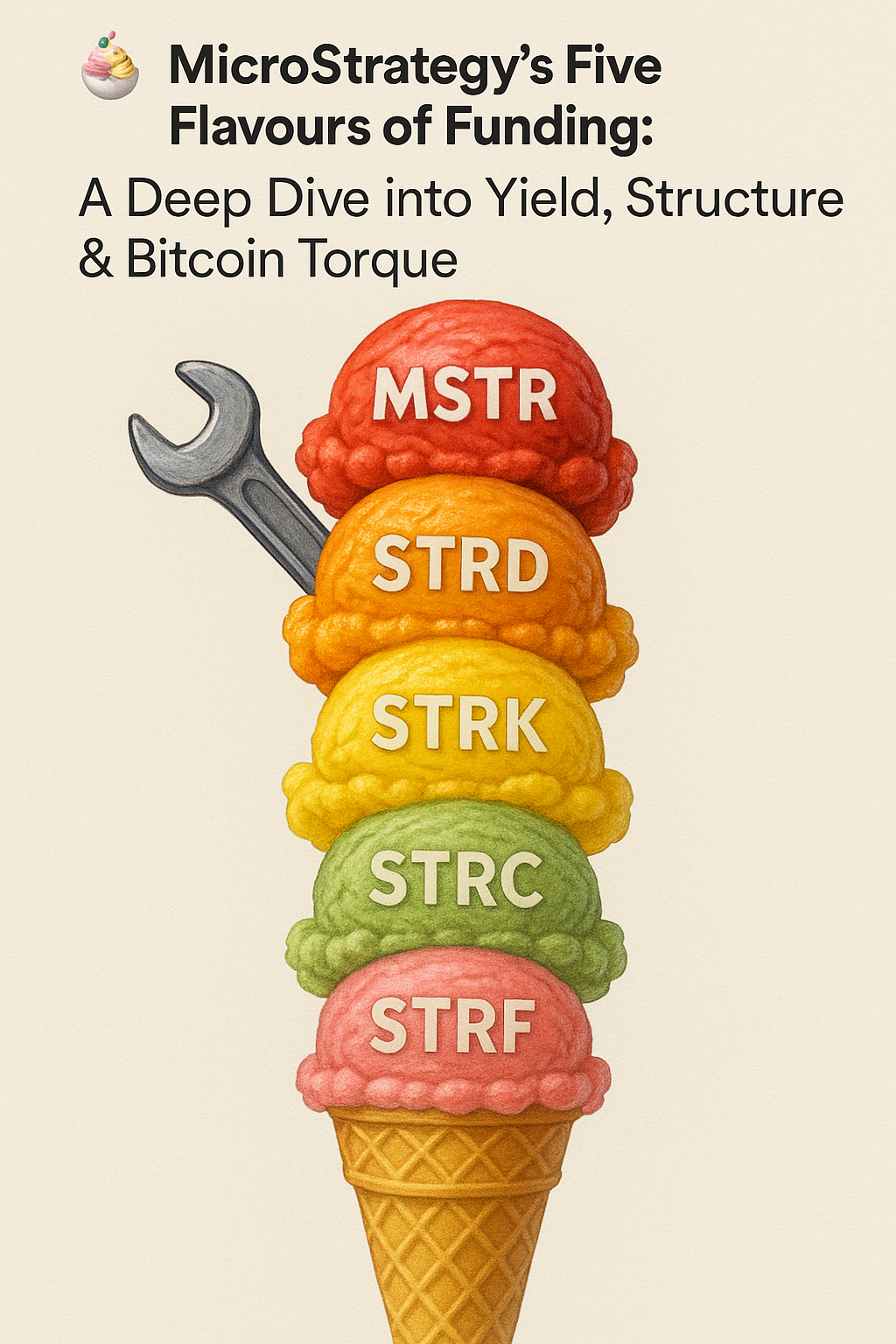

That is the world of Bitcoin Torque, an idea that’s as a lot about strategic foresight as it’s about capital mechanics. It’s a narrative of how one public firm — MicroStrategy — has constructed a monetary machine that turns each greenback it raises into a number of {dollars}’ price of Bitcoin publicity. Not via magic, not via sleight of hand, however via intelligent engineering of convertible debt, most well-liked shares, and the physics of market psychology.

On this essay, we’ll journey from the common-or-garden beginnings of MicroStrategy’s crypto awakening to the hovering mechanics behind its newest instrument, STRC. Alongside the way in which, we’ll unpack what Bitcoin Torque actually means, the way it works, why it issues, and what it reveals in regards to the evolving structure of economic programs within the digital age.

When you’ve ever puzzled how firms can turn out to be vessels of financial transformation, or how monetary instruments as soon as reserved for debt and fairness are actually steering the way forward for Bitcoin adoption — this exploration is for you.

At its easiest, Bitcoin Torque measures how a lot Bitcoin an organization can management per greenback of capital it raises. The upper the torque, the extra “Bitcoin firepower” is generated from every real-world greenback.

Consider it this fashion:

If an organization raises $1 million and finally ends up controlling $7 million price of Bitcoin because of the way it buildings that elevate — that’s 7x torque.The idea mirrors mechanical torque: utilizing leverage (on this case, monetary) to realize a outcome bigger than the enter effort.

However in follow, Bitcoin Torque is greater than only a neat ratio. It’s a lens for understanding how firms like MicroStrategy use Wall Road’s toolset to multiply their publicity to the toughest cash within the digital age — Bitcoin.