Ripple chief expertise officer David “JoelKatz” Schwartz moved to elucidate the hole between Ripple’s oft-touted roster of financial institution relationships and the still-modest on-chain exercise on the XRP Ledger (XRPL), responding at size on July 30 to a extensively shared thread of questions from investor and YouTuber Andrei Jikh. In a sequence of posts on X, Schwartz pointed to compliance realities, institutional conduct, and product roadmap objects—most notably a forthcoming “permissioned domains” mannequin—as key causes that institutional flows stay largely off-chain in the present day.

300+ Financial institution Offers, Little Quantity? Ripple CTO Solutions

Jikh’s immediate captured long-standing critiques: after greater than a decade and “300+ financial institution partnerships,” why isn’t the XRPL clearing “billions in day by day on-chain quantity,” why would payers select a unstable asset like XRP over stablecoins, and—in a world saturated with fiat-linked tokens—do bridge belongings nonetheless matter? He additionally raised questions on tokenization technique, together with why a agency equivalent to BlackRock would choose XRPL fairly than function a captive chain, and about geopolitical danger for non-US customers.

Schwartz’s central rationalization for sluggish on-chain settlement was blunt concerning the constraints going through regulated entities that can’t unknowingly transact in opposition to illicit counterparties on public DEX liquidity: “Even Ripple can’t use the XRPL DEX for funds but as a result of we are able to’t be certain a terrorist gained’t present the liquidity for cost. Options like permissioned domains will tackle this.” The put up acknowledged “it has been very sluggish” to shift institutional flows on chain, at the same time as he argued that establishments are “beginning to see the advantages.”

Pressed by one other consumer on whether or not the identical counterparty-risk drawback exists on different L1s, Schwartz mentioned that, relying on how options are used, “usually decentralized exchanges on public layer 1’s don’t provide you with any management or data of who your counterparties are.” The purpose was procedural fairly than ethical—“laws aren’t at all times completely logical,” he added—underscoring why regulated cost flows have struggled to route via open liquidity.

Schwartz framed “permissioned domains” as a design supposed to maintain the ledger’s openness whereas giving compliance-bound members a venue with rule-enforced counterparties. In follow-ups, he described a construction during which “retail is welcome within the permissioned components supplied they’ll show they’re not sanctioned,” and mentioned the “internet impact” must be that liquidity in these domains stays akin to the open aspect due to market-making between the 2.

XRP Vs. Stablecoins

On the stablecoin query, Schwartz rejected the concept that XRP’s volatility routinely disqualifies it for funds. He argued there are use instances the place volatility “isn’t a minus, or is even a plus,” and—individually—contended {that a} functioning bridge requires stock: “A bridge forex solely works if somebody is holding it so as to get it exactly once you want it.” He added that if customers don’t know which asset they may want subsequent, they might rationally maintain the “dominant bridge” as a result of it’s cheaper to pivot from a liquid hub asset into no matter comes subsequent.

Schwartz additionally addressed whether or not bridge belongings nonetheless matter if stablecoins more and more cowl most buying and selling pairs. He allowed that “if one stablecoin wins,” it might act because the bridge, however mentioned he doesn’t suppose a single stablecoin can win as a result of every is “solely…secure relative to 1 explicit fiat forex” and anchored to jurisdictions. That multi-stablecoin actuality, he argued, leaves room for a impartial bridge to attach a “lengthy tail” of tokenized belongings.

Requested why a heavyweight like BlackRock wouldn’t merely construct its personal chain for tokenization—particularly as some brokerages do—Schwartz downplayed the significance of chain homogeneity in a world of interoperability and portability. He urged skeptics to “ask the identical query about Circle—why don’t they launch USDC solely on their very own blockchain?” implying the plain reply: ubiquity and liquidity come from assembly customers the place they’re, throughout many networks.

On geopolitics, he drew a line between XRPL, which he described as impartial infrastructure, and Ripple’s enterprise merchandise, that are segmented by jurisdiction. “In the event you’re asking about XRPL, it’s not likely US based mostly,” he wrote, including that the ledger “has by no means discriminated in opposition to any explicit participant,” and conceding that, for Ripple’s personal merchandise, licensing realities apply and a few corridors—“North Korea or Cuba any time quickly”—are out of bounds.

Schwartz additional argued that XRP’s position inside Ripple’s funds stack stays materials even when a lot of it isn’t seen on public ledgers. “I don’t have the numbers in entrance of me,” he wrote, “however I’m fairly certain XRP’s use as a bridge in Ripple Funds dwarfs each different asset.” In a associated level on XRPL design, he reminded readers that “XRP has a privileged place on the XRP Ledger.”

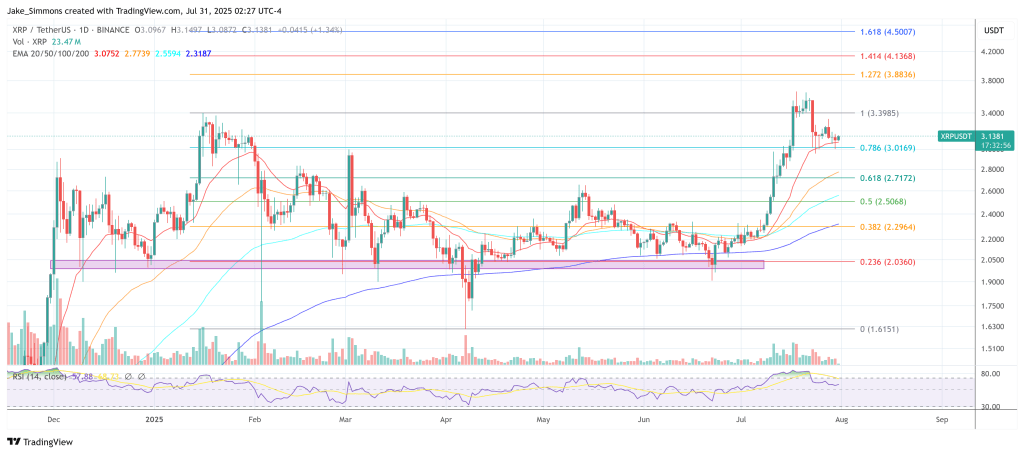

At press time, XRP traded at $3.13.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.