The variety of tradable crypto tokens has gone parabolic since 2022, with CoinMarketCap now monitoring roughly 18.9 million digital belongings, in comparison with slightly over 20,000 in 2022.

In January of that yr, roughly 20,000 belongings had been listed throughout main trackers. By mid-2025, that universe swelled to an estimated 18.9 million, an astonishing 945x enhance in simply three and a half years.

The surge isn’t evenly distributed, as three high-throughput networks are chargeable for about 90% of the brand new provide: Solana, Base, and BNB, pushed by low charges, turnkey launchpads, and a tradition of speedy experimentation.

The three kings

Solana is the epicenter. Over the previous yr alone, the chain noticed on the order of 18 million new tokens minted as memecoin factories and no-code issuers lowered the barrier to creation to pennies.

Pump.enjoyable has produced roughly 11.4 million SPL tokens by late July 2025, in response to the Dune dashboard by person oladee, which tracks the app’s on-chain mints. That’s up from roughly 8.7 million in March 2025, including nearly 2.7 million in 4 months, up by 31%.

The rely exceeds the mixed new token rely on Base, BSC, Tron, Polygon, Optimism, Arbitrum, and Ethereum throughout the identical interval.

The result’s a torrent of micro-cap belongings, most launched for enjoyable, virality, or hypothesis, and plenty of by no means progressing past a couple of wallets and a shallow liquidity pool.

Base has emerged because the quickest follower. In exactly a yr, builders and creators deployed greater than 8.4 million fungible tokens on the community.

Creator coin tooling tied to Zora ignited a speedy mint cycle on Coinbase’s L2. A Dune dashboard by person Sealaunch reported over 1.5 million creator cash minted in 2025, because the mannequin unfold, with a lot of this exercise centered on Base following its integration into the Base App.

In late July, Base briefly outpaced Solana by every day token rely as “content material cash” turned social posts into micro-tokens at scale.

Binance Sensible Chain (BSC), which pioneered the cheap-token growth in 2021, continues to considerably contribute to new token launches.

BscScan’s token tracker lists practically 4.7 million BEP-20 token contracts on BNB Chain, the ecosystem that BSC is a part of. This highlights its function as a mass-mint venue for fungible belongings.

Whereas its share of recent issuance has pale relative to Solana and Base, BSC stays a go-to venue for quick, low-cost launches.

Liquidity per token shrinks

The catch to this Cambrian explosion is liquidity. Capital merely hasn’t saved tempo with provide. Common stablecoin liquidity per token has collapsed from round $1.8 million in 2021 to roughly $5,500 in early 2025.

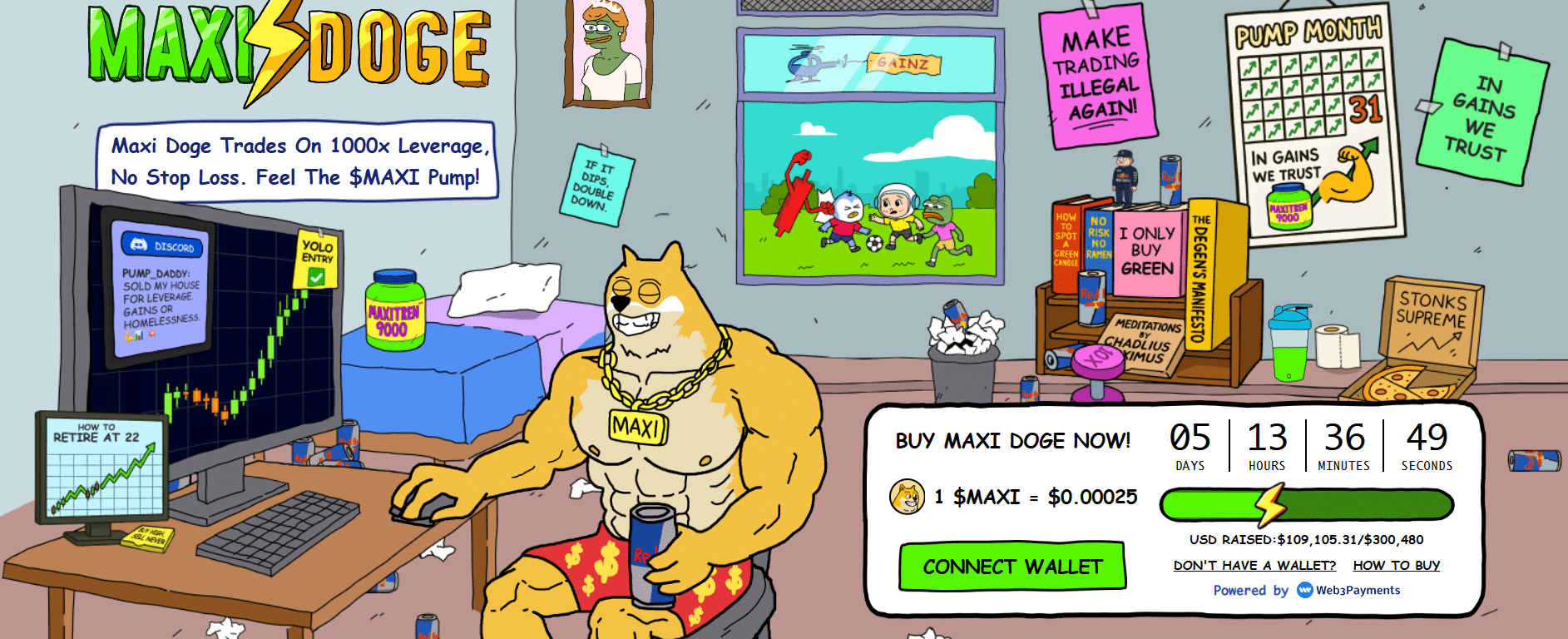

In sensible phrases, a lot of the 18.9 million tokens are illiquid, thinly traded, and extremely prone to manipulation. Costs can rocket or crater on a couple of hundred {dollars} of move, and rug-pulls stay a threat wherever low-effort issuance thrives.

That imbalance is reshaping market construction. Regardless of the proliferation of belongings, worth continues to pay attention in a couple of hundred names, with Bitcoin’s and Ethereum’s dominance climbing as capital consolidates into confirmed networks whereas the lengthy tail languishes.

For groups, the sheer existence of a token now not confers worth. Protocols should show sturdy demand by displaying customers, charges, money flows, or compelling utility to draw liquidity in a saturated subject.

Networks face their very own trade-offs. Excessive throughput and low charges empower permissionless creativity but additionally invite spam and churn.

Talked about on this article