The US Treasury Division has re-designated

Moscow-based cryptocurrency alternate Garantex and sanctioned its successor,

Grinex, together with three executives and 6 related corporations in Russia and

the Kyrgyz Republic.

Officers say Garantex processed greater than $100

million in illicit transactions since 2019, together with funds tied to ransomware

assaults and darknet markets.

“Digital property play an important position in world innovation and

financial improvement, and america is not going to tolerate abuse of this

trade to help cybercrime and sanctions evasion. Exploiting cryptocurrency exchanges to

launder cash and facilitate ransomware assaults not solely threatens our nationwide

safety, but additionally tarnishes the reputations of reputable digital asset

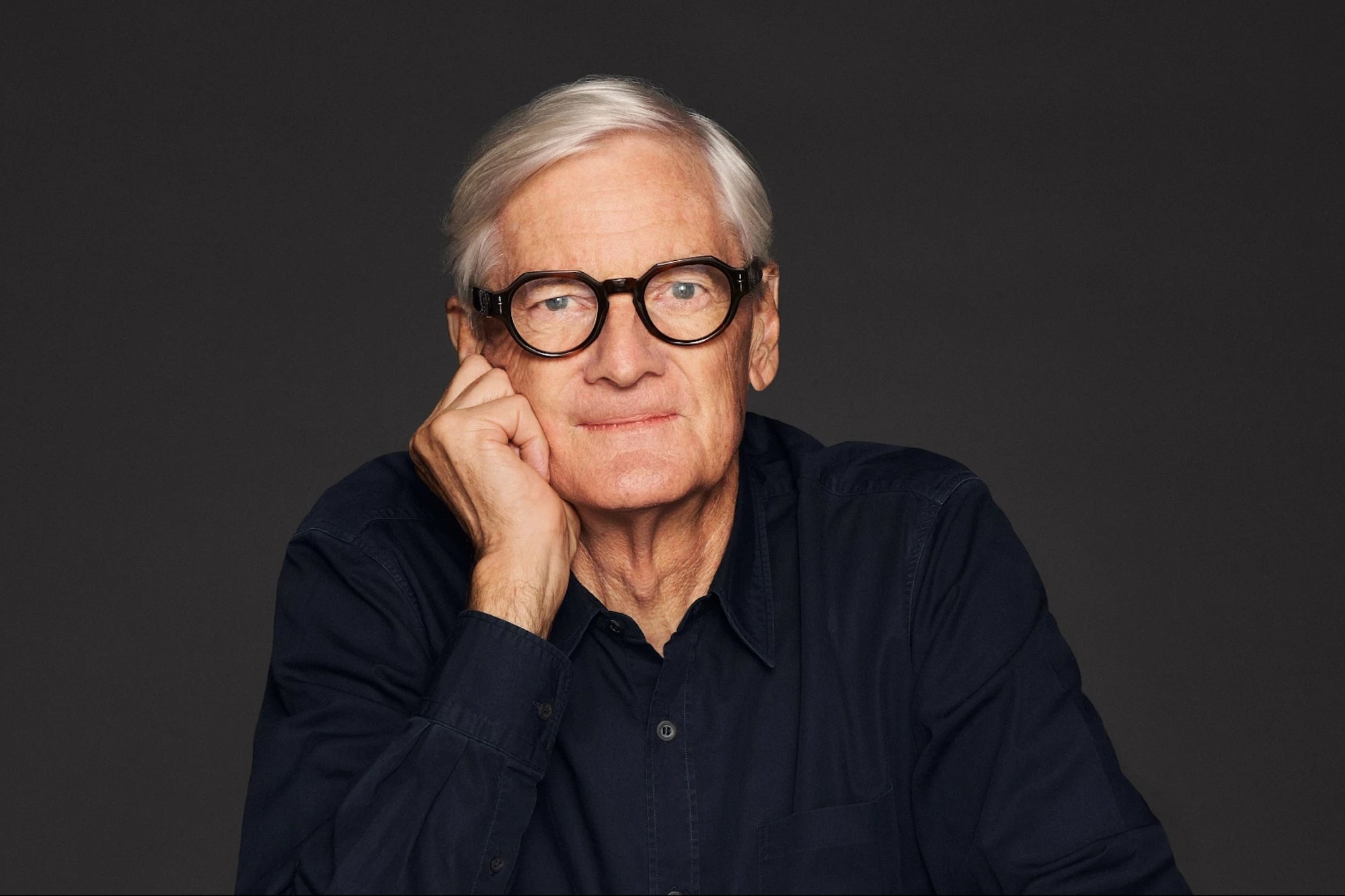

service suppliers,” John Hurley, the Underneath Secretary of the Treasury for Terrorism and

Monetary Intelligence, mentioned.

Coordinated Legislation Enforcement Operation

The motion adopted a March 6, 2025, operation by the

US Secret Service with German and Finnish authorities, which seized Garantex’s

net area and froze over $26 million in cryptocurrency.

The subsequent day, the Justice Division unsealed

indictments towards executives Aleksandr Mira Serda and Aleksej Besciokov.

Besciokov was arrested in India.

In keeping with Treasury, Garantex moved its buyer

base and funds to Grinex after these measures, permitting it to proceed

operations regardless of sanctions. Based in Estonia in 2019, Garantex misplaced its license

in 2022 after regulators cited anti-money laundering failings and hyperlinks to

legal wallets.

Associated: Russia and Stablecoin Use: Ruble-Pegged A7A5 Moved $9B on One Crypto Alternate

US officers say it maintained accounts for lots of

of hundreds of customers and acquired thousands and thousands from ransomware operations, together with

Conti, LockBit, Black Basta, and Ryuk.

Treasury alleges the alternate constructed infrastructure to

conceal pockets possession, enabling it to proceed servicing sanctioned

people and entities.

Creation of Grinex to Evade Sanctions

Grinex was fashioned by Garantex officers following the

March legislation enforcement motion. Treasury says it processed billions in

cryptocurrency transactions and used a ruble-backed A7A5 token, issued by

Kyrgyz agency Outdated Vector, to permit Garantex prospects to get well frozen funds.

The token was linked to sanctioned Russian and

Moldovan entities accused of facilitating cross-border funds to bypass

sanctions.

Sanctioned people embrace co-founders Sergey

Mendeleev and Pavel Karavatsky, and co-owner Mira Serda. Associate companies InDeFi

Financial institution and Exved have been additionally designated to facilitate illicit transactions and

commerce aimed toward circumventing US sanctions.

The sanctions block all US-linked property belonging to

the designated people and entities. US individuals are prohibited from

participating in transactions with them, and non-U.S. companies danger secondary sanctions

for offering help.

Treasury mentioned the measures are a part of ongoing efforts

to disrupt cryptocurrency platforms used for cybercrime, following earlier

actions towards exchanges resembling Cryptex, SUEX, and Chatex.

The US Treasury Division has re-designated

Moscow-based cryptocurrency alternate Garantex and sanctioned its successor,

Grinex, together with three executives and 6 related corporations in Russia and

the Kyrgyz Republic.

Officers say Garantex processed greater than $100

million in illicit transactions since 2019, together with funds tied to ransomware

assaults and darknet markets.

“Digital property play an important position in world innovation and

financial improvement, and america is not going to tolerate abuse of this

trade to help cybercrime and sanctions evasion. Exploiting cryptocurrency exchanges to

launder cash and facilitate ransomware assaults not solely threatens our nationwide

safety, but additionally tarnishes the reputations of reputable digital asset

service suppliers,” John Hurley, the Underneath Secretary of the Treasury for Terrorism and

Monetary Intelligence, mentioned.

Coordinated Legislation Enforcement Operation

The motion adopted a March 6, 2025, operation by the

US Secret Service with German and Finnish authorities, which seized Garantex’s

net area and froze over $26 million in cryptocurrency.

The subsequent day, the Justice Division unsealed

indictments towards executives Aleksandr Mira Serda and Aleksej Besciokov.

Besciokov was arrested in India.

In keeping with Treasury, Garantex moved its buyer

base and funds to Grinex after these measures, permitting it to proceed

operations regardless of sanctions. Based in Estonia in 2019, Garantex misplaced its license

in 2022 after regulators cited anti-money laundering failings and hyperlinks to

legal wallets.

Associated: Russia and Stablecoin Use: Ruble-Pegged A7A5 Moved $9B on One Crypto Alternate

US officers say it maintained accounts for lots of

of hundreds of customers and acquired thousands and thousands from ransomware operations, together with

Conti, LockBit, Black Basta, and Ryuk.

Treasury alleges the alternate constructed infrastructure to

conceal pockets possession, enabling it to proceed servicing sanctioned

people and entities.

Creation of Grinex to Evade Sanctions

Grinex was fashioned by Garantex officers following the

March legislation enforcement motion. Treasury says it processed billions in

cryptocurrency transactions and used a ruble-backed A7A5 token, issued by

Kyrgyz agency Outdated Vector, to permit Garantex prospects to get well frozen funds.

The token was linked to sanctioned Russian and

Moldovan entities accused of facilitating cross-border funds to bypass

sanctions.

Sanctioned people embrace co-founders Sergey

Mendeleev and Pavel Karavatsky, and co-owner Mira Serda. Associate companies InDeFi

Financial institution and Exved have been additionally designated to facilitate illicit transactions and

commerce aimed toward circumventing US sanctions.

The sanctions block all US-linked property belonging to

the designated people and entities. US individuals are prohibited from

participating in transactions with them, and non-U.S. companies danger secondary sanctions

for offering help.

Treasury mentioned the measures are a part of ongoing efforts

to disrupt cryptocurrency platforms used for cybercrime, following earlier

actions towards exchanges resembling Cryptex, SUEX, and Chatex.