Each period of investing has its “new, new factor”: railroads within the 1800s, the Nifty Fifty within the Nineteen Seventies, dot-coms within the Nineties. At this time, it’s synthetic intelligence. Like its predecessors, AI is genuinely transformative, however that doesn’t exempt its beneficiaries from the fundamental arithmetic of investing: worth is decided by incomes energy, whereas worth is formed by the temper of the market. The hole between the 2 is the place each alternative and hazard reside. Every shift has carried the promise of structural change, but in addition the chance of inflated expectations. AI is not any exception.

The sharp rally in AI-related shares has been adopted by a current pullback, sparking the inevitable query: are we witnessing the beginning of a bubble? The reply, I consider, requires extra nuance than a easy sure or no. Valuations are elevated, optimism is considerable, however the hallmarks of outright mania, that’s common euphoria or indiscriminate shopping for, usually are not but dominant. What we see as an alternative is a market leaning closely on optimistic assumptions about applied sciences whose long-term economics are nonetheless unsure.

The panorama is various. The vanguard of the rally has been semiconductors. NVIDIA stays the clear frontrunner in AI chips, with demand from hyperscalers and enterprises nonetheless sturdy, whereas AMD is narrowing the hole with its personal accelerator choices. But even with robust earnings, each shares commerce at multiples that assume persistent dominance, a situation hardly ever assured in such a fast-moving business. The platform corporations like Microsoft, Alphabet, Amazon, and Meta are in some ways higher positioned, as they mix AI capabilities with diversified money flows and entrenched buyer bases. Microsoft’s integration of AI into Workplace and Azure is producing measurable income elevate, whereas Alphabet’s search and cloud companies are present process their very own AI-driven evolution. Amazon and Meta, too, are deploying AI each to enhance effectivity and to open new income strains. These corporations could warrant premium valuations, however traders ought to keep in mind that their sheer dimension means incremental development is tougher to realize. Round them, a wider group of corporations has been caught up within the “AI commerce,” usually with restricted direct publicity. That tendency for themes to broaden past fundamentals is a warning signal seen in lots of previous cycles.

The core situation is that present valuations already suggest years, if not many years, of uninterrupted success. That makes future returns extra susceptible to disappointment, whether or not from aggressive shifts, slower adoption, or just the traditional volatility of earnings. The actual problem just isn’t figuring out whether or not AI is vital, it clearly is, however whether or not present valuations go away sufficient margin for error. Historical past means that even extraordinary corporations can disappoint if traders pay an excessive amount of upfront.

How ought to traders reply? First, by distinguishing between real leaders and peripheral beneficiaries. Not each firm with “AI” in its story will maintain long-term profitability. Second, by specializing in stability sheet resilience, cash-flow visibility, and pricing energy: traits that assist endurance if optimism fades. And at last, by remembering that in public markets, even the most effective narratives should clear the hurdle of valuation.

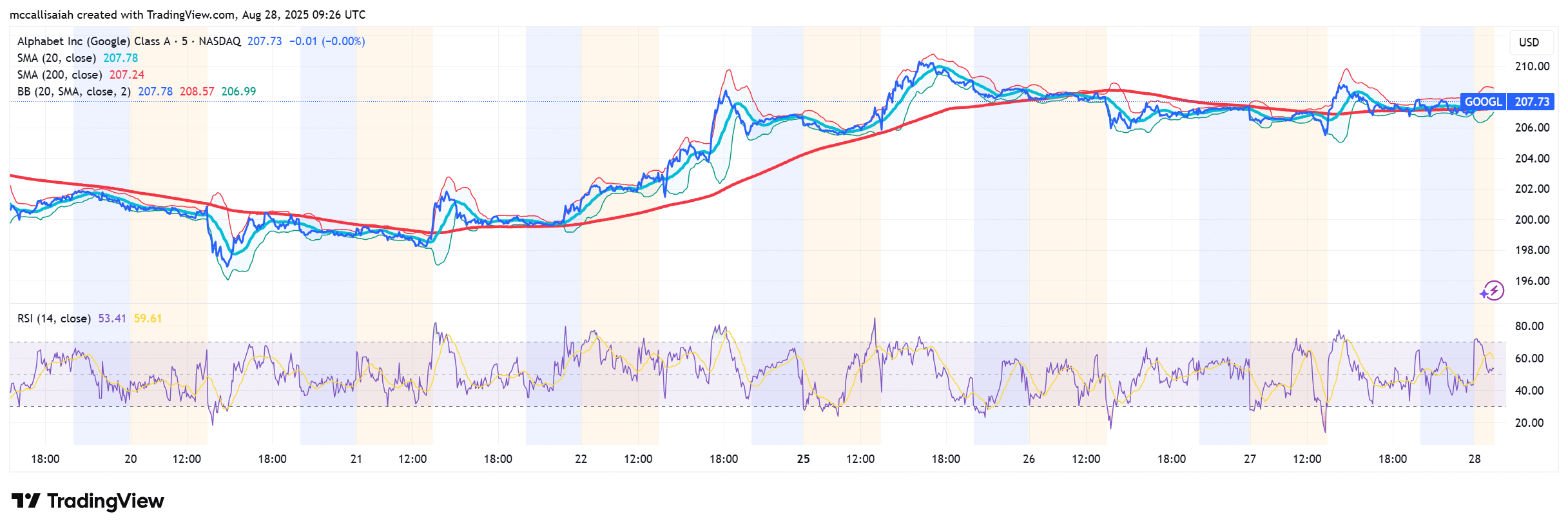

Technical indicators supply a complementary perspective. For probably the most seen names comparable to NVIDIA and AMD, sustained tendencies above the 200-day transferring common counsel continued management, whereas breakdowns by prior assist ranges can point out a shift in sentiment.

AI is undoubtedly transformative. However historical past reminds us that transformative applied sciences and enticing investments usually are not at all times the identical factor. At this time’s costs mirror not simply the way forward for AI, but in addition the optimism of traders. When expectations run far forward of what companies can ship, returns are usually modest and dangers amplified.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

The put up AI Shares: Elevated, Not Euphoric appeared first on eToro.