Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

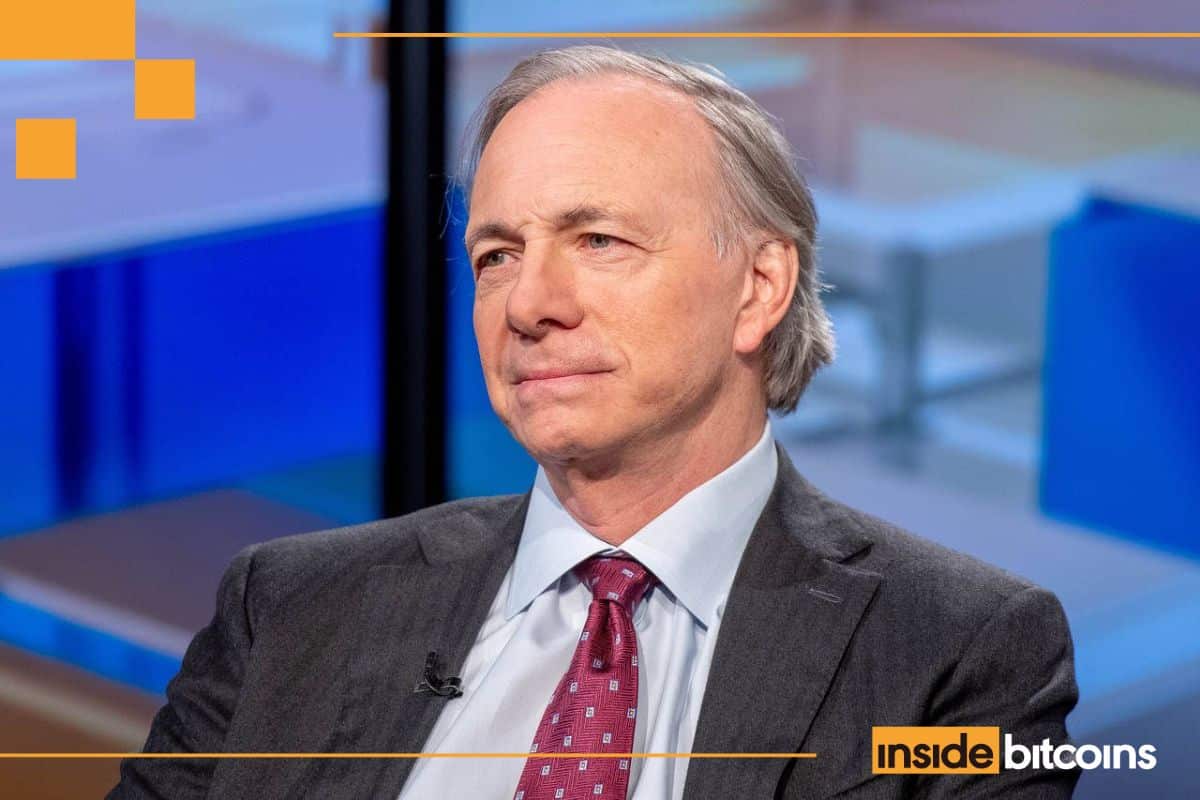

Crypto sits on the coronary heart of Ray Dalio’s new message. On September 3, 2025, the Bridgewater Associates founder printed a point-by-point rebuttal to what he known as the Monetary Instances’ “mischaracterizations,” releasing the complete written Q&A he says he supplied to the paper. The trade restates his “Large Debt Cycle” framework and argues that rising US debt burdens, dangers to Federal Reserve independence, and mounting geopolitical fractures are eroding the greenback’s position as a retailer of wealth—situations that he says are boosting gold and crypto.

Why Crypto Is An “An Enticing Different”

Dalio frames the US fiscal place as late-cycle and dangerously self-reinforcing. “The good excesses that are actually projected on account of the brand new finances will possible trigger a debt-induced heart-attack within the comparatively close to future—I’d say three years, give or take a 12 months or two,” he wrote. He quantified the near-term squeeze in stark phrases, citing “about $1 trillion a 12 months in curiosity” and “about $9 trillion wanted to roll over the debt,” alongside roughly “$7 trillion” in spending versus “$5 trillion” in revenues, requiring “an extra roughly $2 trillion in debt.” That increasing provide, he argued, collides with weakening demand when buyers query whether or not bonds “are good storeholds of wealth.”

Associated Studying

The fulcrum, in Dalio’s telling, is now the Federal Reserve. If political strain undermines the central financial institution’s independence, he warned, “we’ll see an unhealthy decline within the worth of cash.” Ought to a “politically weakened Fed” enable inflation to “run sizzling,” the consequence could be that “bonds and the greenback [go] down in worth” and, if not remedied, changing into “an ineffective storehold of wealth and the breaking down of the financial order as we all know it.” He linked this to a broader late-cycle sample: international holders “decreasing their holdings of US bonds and rising their holdings of gold attributable to geopolitical worries,” which he known as “classically symptomatic” of the endgame.

Dalio linked the macro and political strands to a extra interventionist coverage backdrop, referencing actions “to take management of what companies do” and likening the present part to the 1928–1938 interval. He didn’t pin the dynamic on a single administration—“this case has been occurring for a very long time beneath presidents from each events”—however mentioned post-2008 and particularly post-2020 insurance policies accelerated it. “The interplay of those 5 forces will result in big and unimaginable adjustments over the following 5 years,” he added, itemizing debt, home politics, geopolitics, acts of nature, and expertise (with AI most essential) because the drivers.

Inside that late-cycle schema, Dalio positioned crypto squarely within the “exhausting forex” bucket. “Crypto is now another forex that has its provide restricted,” he wrote. “If the provision of greenback cash rises and/or the demand for it falls, that may possible make crypto a sexy different forex.” He tied the current “rises in gold and cryptocurrency costs” to “reserve forex governments’ unhealthy debt conditions,” and reiterated his long-running concentrate on “storeholds of wealth.”

Associated Studying

On whether or not crypto might “meaningfully substitute the greenback,” he emphasised mechanics over labels, noting that “most fiat currencies, particularly these with giant money owed, could have issues being efficient storeholds of wealth and can go down in worth relative to exhausting currencies,” a sample he mentioned echoed the 1930–1940 and 1970–1980 episodes.

Dalio addressed crypto stablecoin danger in that context, separating asset worth drawdowns from systemic fragility: “I don’t suppose so,” he mentioned when requested if stablecoins’ Treasury publicity is a systemic danger, including that “a fall in the true buying energy of Treasuries” is the true hazard—mitigated “if they’re well-regulated.” He additionally rejected the notion that deregulation alone threatens the greenback’s reserve standing: “No,” he mentioned, pointing once more to debt dynamics as the first vulnerability.

Dalio’s newest remarks match inside a decade-long evolution of his public stance on Bitcoin and crypto quite than a whiplash reversal. Early on, he emphasised gold because the superior “storehold of wealth” and warned that if Bitcoin ever turned too profitable, governments may limit it—tempering enthusiasm with regulatory danger.

By 2020–2021 he started calling Bitcoin “one hell of an invention,” acknowledged proudly owning a small quantity, and more and more framed it as a portfolio diversifier that rhymes with digital gold, whereas nonetheless stressing its volatility and coverage sensitivities. Along with his newest remarks, Dalio places all the crypto market contained in the financial hierarchy he makes use of to investigate late-cycle dynamics.

At press time, the entire crypto market cap stood at $3.79 trillion.

Featured picture created with DALL.E, chart from TradingView.com