Traditionally, bitcoin’s value peaks roughly 20 months after a Bitcoin halving. The final Bitcoin halving occurred in April 2024, which implies we might see a cycle prime by December of this 12 months.

The chances of this are more and more probably as Fed Chair Powell reduce charges by 25 bps right this moment, giving the roughly $7.4 trillion sitting in cash market funds a purpose to return off the sidelines and transfer into a tough asset like bitcoin, particularly now that it’s simpler to acquire publicity to bitcoin by way of spot bitcoin ETFs and proxies like bitcoin treasury firms.

Powell additionally signaled right this moment that two extra fee cuts might be on the best way earlier than the 12 months is out, which might solely additional scale back returns in cash market funds, doubtlessly pushing traders into arduous property like bitcoin and gold in addition to riskier property like tech and AI-related shares.

This might catalyze the ultimate leg of a “melt-up” corresponding to what we noticed with tech shares on the finish of 1999 earlier than the dot com bubble burst.

Additionally, very like the likes of Henrik Zeberg and David Hunter, I consider the stage is being set for the ultimate parabolic leg of a bull run that started in late 2022.

Utilizing a standard monetary index as a reference level, Zeberg sees the S&P 500 exceeding 7,000 earlier than the 12 months is out, whereas Hunter sees it rising to eight,000 (or increased) throughout the similar time-frame.

What’s extra, we could also be witnessing the breakdown of a 14-year help degree for the US greenback, based on Macro Strategist Octavio (Tavi) Costa, which implies we might see a markedly weaker greenback within the coming months, one thing else that may help the bull case for arduous and threat property.

What Occurs Come 2026?

Each Zeberg and Hunter consider that, as of early subsequent 12 months, we’ll see the biggest bust throughout all markets that we’ve seen since October 1929, when monetary markets within the US collapsed, spurring the onset of the Nice Despair.

Zeberg’s rationale for this contains the true financial system grinding to a halt, partially evidenced by the quantity of houses in the marketplace.

Hunter believes that we’re on the finish of a half century lengthy secular debt-fueled cycle that can finish with a leverage unwind not like something we’ve seen in fashionable historical past, as per what he shared on Coin Tales.

Different indicators like mortgage fee delinquencies additionally level to the concept that the true financial system is screeching to a halt, which can inevitably impact the monetary financial system.

The Bitcoin Downturn Isn’t Assured, however It’s Possible

Even when we aren’t headed towards a worldwide macro bust, bitcoin’s value will take a success in 2026 if historical past repeats itself.

That’s, bitcoin’s value dropped from nearly $69,000 on the finish of 2021 to roughly $15,500 by the tip of 2022 and from nearly $20,000 on the finish of 2017 to only over $3,000 on the finish of 2018.

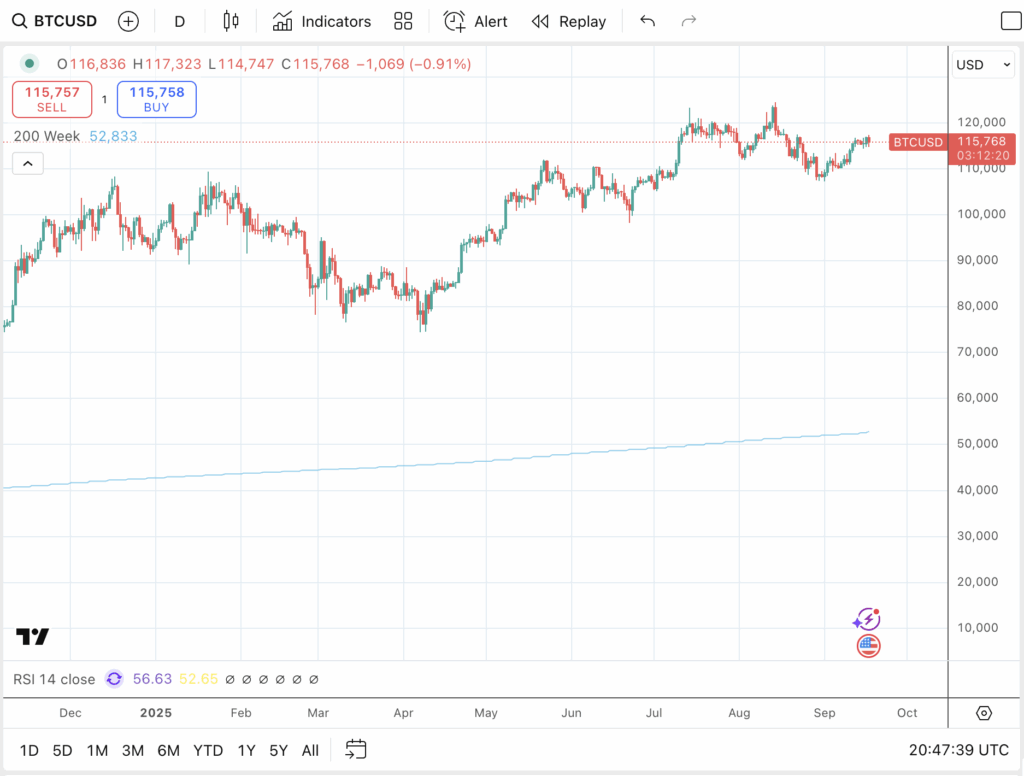

In each circumstances, bitcoin’s value both tapped or dipped beneath its 200-week commonplace shifting common (SMA), the sunshine blue line on the charts beneath.

At the moment, bitcoin’s 200-week SMA is sitting at about $52,000. If we see a parabolic rise in bitcoin’s value within the coming months, it might rise as excessive as $65,000, earlier than bitcoin’s value drops to such a value level or decrease a while in 2026.

If we do see the kind of bust that Zeberg and Hunter are forecasting, bitcoin’s value might additionally drop nicely beneath that threshold.

With all of that mentioned, nobody is aware of what the long run holds, and please don’t interpret something on this article as monetary recommendation.

On the similar time, you could need to take into account that whereas historical past doesn’t essentially repeat itself, it usually rhymes.