Aster’s native token, ASTER, surged 1,650% in its first 24 hours of buying and selling and reached $0.528, in line with platform experiences.

Associated Studying

Buying and selling quantity for the token in that window was listed at $345 million, and the launch reportedly drew 330,000 new wallets.

Fast Person Development And Liquidity

Based on on-chain information and platform disclosures, Aster’s complete worth locked jumped from $660 million to $1 billion shortly after launch.

The platform claims complete customers of 1.848 million, with seven-day new person additions hitting 617,379. Experiences present every day figures of 53,332 new customers and $1.50 billion in 24-hour buying and selling quantity.

The debut additionally included a Binance Alpha itemizing inside hours and new perpetual markets launched with as much as 50x publicity throughout 4 belongings. Platform revenue was reported at $466,838 for a day and $49.2 million in complete earnings to this point.

A major first step for $ASTER on BNB Chain.

• $345M traded in 24h• Value reached $0.528 (~1,650%)• 330K new wallets joined• TVL $660M → $1.005B• Platform quantity close to $1.5B

Due to our group for the belief and assist. We’ll preserve specializing in constructing an open… pic.twitter.com/cgPlwb2FVh

— Aster (@Aster_DEX) September 18, 2025

Characteristic Rollouts And Buying and selling Instruments

Primarily based on experiences, Aster moved rapidly to allow spot withdrawals sooner than deliberate, utilizing BNB Chain with a quoted 30-second processing time.

The crew activated ASTER/USDT perpetuals with four-times margin and hourly funding charge settlements. The platform additionally launched a Genesis Stage 2 scoring program that rewards extra than simply uncooked buying and selling quantity, aiming to favor what it calls “sensible merchants.”

Prime customers have been reported to indicate realized positive factors larger than $645,000 in early buying and selling periods.

Technical Options And Safety

Aster has positioned itself as a multi-chain protocol with native assist throughout BNB Chain, Ethereum, Solana, and Arbitrum, eradicating the necessity for handbook bridging for a lot of flows, in line with technical notes.

The protocol makes use of zero-knowledge proofs by itself Aster Chain for commerce validation and faucets Pyth Community oracles for value feeds.

Experiences present the platform makes use of collateral tokens like asBNB and USDF that may be staked to earn yield whereas remaining lively in buying and selling.

Associated Studying

Robust Endorsement

In the meantime, platform information listed $517 trillion in cumulative buying and selling quantity and near $450 million in complete TVL.

A lot of Aster’s surge will be tied to the sturdy backing of former Binance CEO Changpeng Zhao. His public endorsements, the place he in contrast the platform’s liquidity to “Binance stage” and praised the crew’s execution, have performed a serious function in drawing consideration and capital to the challenge.

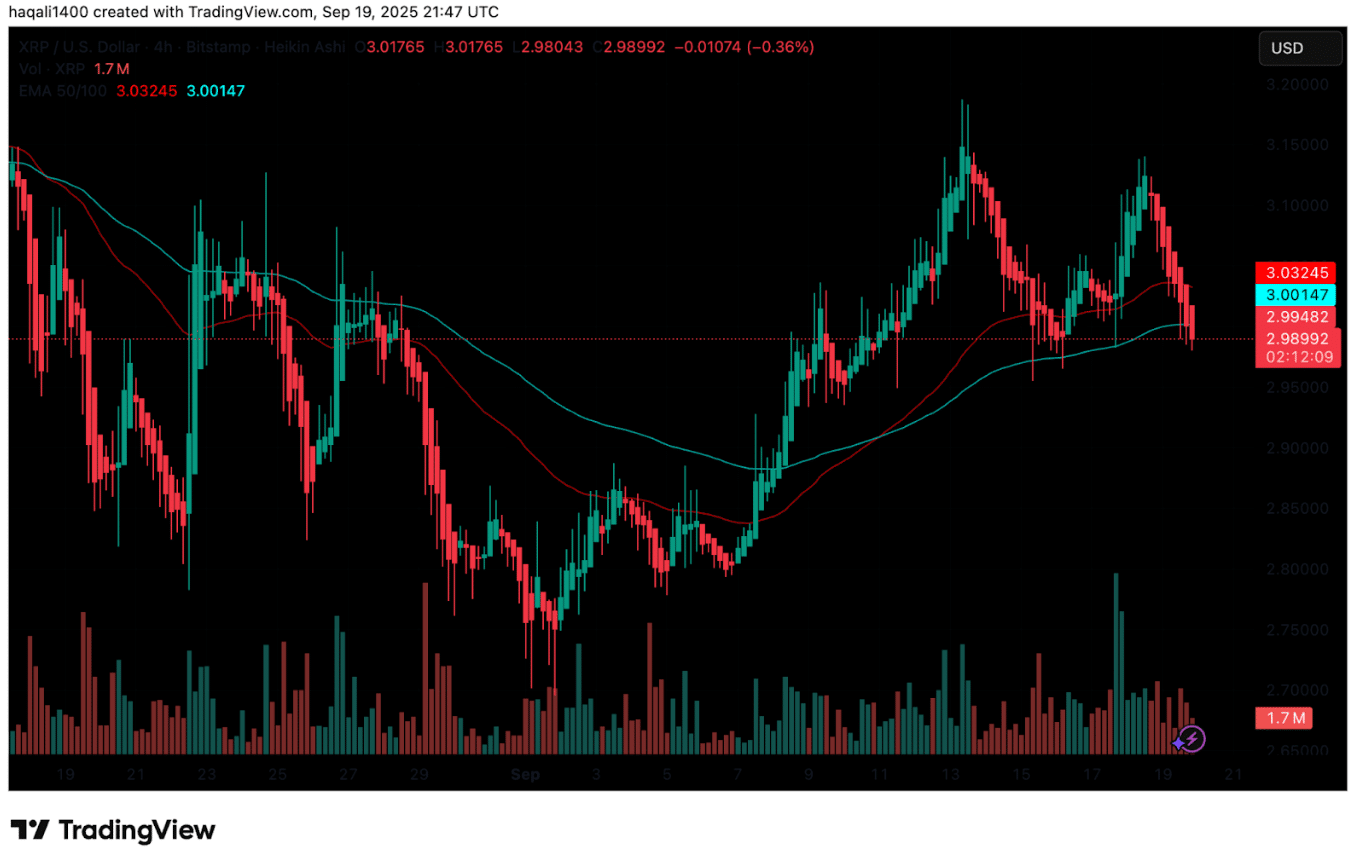

Featured picture from Unsplash, chart from TradingView