As Ethereum (ETH) steadily approaches its all-time excessive (ATH), some trade leaders imagine that the second-largest cryptocurrency by market capitalization is just not completely benefiting from natural demand. Moderately, it’s being “propped up” by Korean buyers trying to make a fast buck.

Ethereum Being Held Up By Korean Buyers?

In an X submit earlier at present, crypto entrepreneur Samson Mow made some fascinating observations on ETH’s present value trajectory. The crypto govt attributed ETH’s present heightened value to Korean retail buyers.

Particularly, Mow acknowledged that roughly $6 billion value of Korean retail capital is supporting Ethereum costs. Mow blamed ETH influencers who’re reportedly touring to South Korea to market the digital asset to retail buyers.

As well as, the founding father of AQUA Pockets stated ETH buyers aren’t totally conscious of the ETH/BTC chart, and are beneath the misunderstanding that they’re shopping for the “subsequent Technique.” He cautioned that it’ll not finish nicely for ETH buyers.

To recall, Technique is the main public firm in relation to the quantity of Bitcoin (BTC) held on its stability sheet. In response to information from Coingecko, Technique at the moment holds 640,031 BTC, value greater than $48 billion at prevailing market costs.

In the case of Ethereum-based treasury corporations, BitMine leads the pack, holding greater than 2.5 million ETH value roughly $12.4 billion. Different corporations like SharpLink Gaming (838,728 ETH), Coinbase ((136,782 ETH), Bit Digital (120,306 ETH), and ETHZilla (102,246 ETH) spherical up the highest 5 within the record.

There are a number of indicators that the Ethereum buying and selling market in South Korea could also be reaching overbought ranges. As an illustration, the ETH “Kimchi premium” surged to 1.93 on October 5, a big surge from -2.06 noticed in July 2025 when the cryptocurrency traded beneath $3,000.

For the uninitiated, the Kimchi premium refers back to the value distinction the place cryptocurrencies commerce at larger costs on South Korean exchanges in comparison with world markets. This premium arises from sturdy native demand, restricted capital circulation out of Korea, and regulatory obstacles that stop straightforward arbitrage between Korean and worldwide exchanges.

On-Chain Knowledge Counsel Sturdy Demand For ETH

In distinction to Mow’s opinion, on-chain information reveals that each institutional and retail demand for ETH is just not exhibiting any indicators of slowing down. BitMine continues to stack ETH regardless of it buying and selling near its ATH territory.

On the similar time, ETH-based exchange-traded funds (ETFs) proceed to draw an rising quantity of inflows. Just lately, US-based spot ETH ETFs attracted report inflows value $547 million. At press time, ETH trades at $4,701, up 4.4% previously 24 hours.

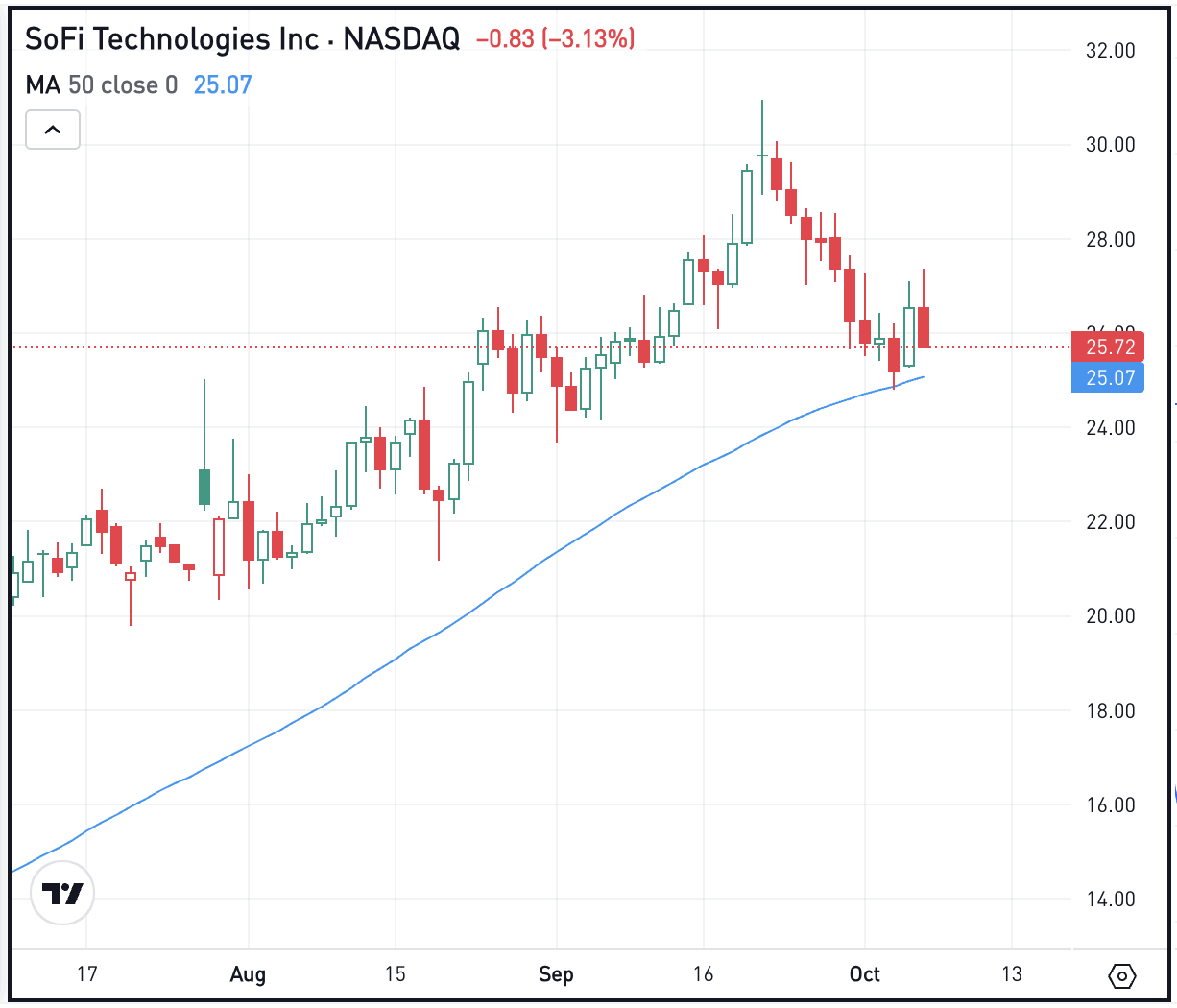

Featured picture from Unsplash.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.