When Bitcoin first emerged in 2009, it provided a daring imaginative and prescient: a decentralized various to banks, governments, and the standard monetary system. It was borderless, peer-to-peer, and constructed on the promise of transparency and particular person management. Early adopters noticed crypto as greater than an asset; they noticed it as a motion to upend centralized energy and problem the established order.

Quick ahead to 2025, and the crypto house seems to be more and more acquainted. Alternate-traded funds (ETFs) for Bitcoin and Ethereum are gaining traction. Staking-as-a-service platforms mirror conventional interest-bearing accounts. Advanced yield merchandise and structured monetary instruments are bringing Wall Road’s playbook onchain.

This raises a key query: Are these developments indicators of crypto maturing and going mainstream, or are they undermining the very ideas that made crypto revolutionary? In different phrases, is crypto progressing or simply conforming? This text probes that pressure.

Crypto’s Journey: From the Wild West to Wall Road

In its early years, crypto was the monetary Wild West. Buyers needed to navigate self-custody wallets, peer-to-peer trades, and unregulated exchanges. The ethos was clear: decentralization, private accountability, and open experimentation. Many early adopters took on the dangers for the promise of full management and the chance to construct exterior the standard system. The early debate of DeFi vs TradFi wasn’t simply philosophical; it formed how folks invested, constructed instruments, and seen monetary sovereignty.

Nevertheless, because the house matured and billions of {dollars} flowed in, crypto started to undertake buildings acquainted to conventional finance. Regulated custodians, centralized exchanges with compliance groups, and institutional-grade merchandise like ETFs and staking-as-a-service turned extra frequent. Danger profiles shifted, and authorized readability attracted banks, hedge funds, and household places of work.

For a lot of, this evolution is welcome. TradFi-style merchandise supply better stability, clear regulatory frameworks, and simpler entry for on a regular basis traders. These modifications decrease the barrier to entry and convey crypto to a broader viewers. However as crypto turns into safer and extra regulated, does it lose a few of its unique edge?

Are Index Funds and Staking Instruments a Step Ahead or Backwards?

As crypto adopts conventional monetary instruments, let’s discover their advantages and downsides to grasp whether or not they mark progress or a quiet retreat within the ongoing debate of DeFi vs TradFi.

Professionals of Conventional Monetary Instruments for Crypto

Accessibility

Crypto index funds and staking platforms decrease the barrier to entry for on a regular basis customers. As a substitute of navigating dozens of tokens or managing complicated DeFi protocols, newcomers can get broad market publicity or earn yield with just some clicks.

For instance, Spot ETFs give conventional traders crypto publicity via acquainted brokerage accounts. This accelerates adoption amongst risk-averse or time-constrained traders.

Simplicity

Passive investing instruments simplify crypto participation. Index merchandise like Bitwise or staking-as-a-service on platforms reminiscent of Coinbase eradicate the necessity to analysis, rebalance, or handle non-public keys actively.

And similar to in conventional finance, customers typically surprise, “do index funds pay dividends?” Within the crypto world, this may be seen in staking rewards or protocol incentives constructed into these merchandise.

For customers who don’t need or can’t afford to spend hours finding out DeFi mechanics, these instruments present a streamlined expertise that carefully resembles conventional asset administration. Fashionable staking instruments like Lido or Rocket Pool permit customers to earn passive earnings with out operating validator nodes.

Broader Adoption

By mimicking legacy finance, these instruments assist crypto combine into pension plans, ETFs, and institutional portfolios. In consequence, extra capital flows into the ecosystem, enhancing liquidity and market stability.

A number of high index funds in 2025 have gained recognition, bridging the hole between Web3 innovation and conventional investing methods . Merchandise like yield-bearing stablecoins (USDe or Ethena’s sUSDe) even supply predictable returns that entice customers who beforehand noticed crypto as too risky or speculative.

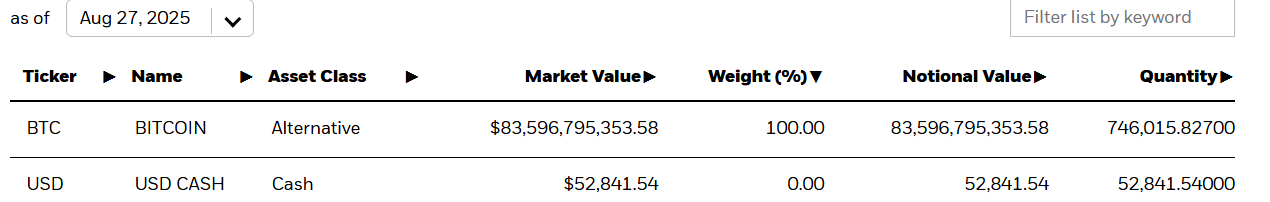

Onboarding By means of Acquainted Channels

These instruments introduce crypto via interfaces and providers that legacy traders already belief. For instance, BlackRock’s iShares Bitcoin Belief (IBIT) turned one of many high index funds of 2025 by way of web inflows and has crossed $80 billion in notional worth in 2025.

This pattern suggests conventional traders are extra keen to interact with crypto when it’s wrapped in typical packaging.

Cons of Conventional Monetary Instruments for Crypto

Much less Particular person Management

Whereas these instruments are handy, they arrive at the price of private autonomy. Buyers typically depend on custodians or asset managers to carry their funds, reintroducing the identical counterparty danger that crypto aimed to eradicate.

With staking-as-a-service, customers normally don’t management the validators their tokens help, which reduces transparency and private oversight.

Reliance on Intermediaries

The rising dominance of intermediaries, like ETF issuers and centralized exchanges, reshapes crypto’s infrastructure. These entities management large quantities of staked and tradable property, concentrating energy in ways in which threaten decentralization.

This dependency introduces systemic dangers, together with custodial failures and lack of transparency, making crypto behave extra like conventional finance than a decentralized various.

Lowered Participation in Governance

Delegating tokens for staking via centralized platforms typically strips customers of governance rights. As a substitute of voting on protocol upgrades or collaborating in DAO choices, most passive traders change into sidelined.

When customers delegate via custodial staking instruments, they typically give up voting rights and governance affect, lowering the participatory nature that defines decentralized networks. Over time, this might focus decision-making energy in fewer fingers, weakening community-driven improvement and accountability.

Liquidity and Exit Dangers

Many staking instruments implement lock-up durations or withdrawal delays. As an example, customers staking ETH via centralized exchanges could face delays throughout high-demand durations or depend on liquidity derivatives like Lido’s stETH, whose peg can decouple throughout market stress.

Danger of Conformity: What Crypto May Lose

Because the crypto trade leans towards mainstream enchantment, it could be shedding sight of its foundational targets: decentralization, censorship resistance, and open innovation.

Lack of Decentralization and Censorship Resistance

Crypto was constructed to eradicate centralized gatekeepers, giving customers direct management over their property. However with custodial platforms and monetary merchandise run by legacy establishments on the rise, that promise is fading.

When customers depend on ETFs or centralized exchanges, they cease interacting with blockchains instantly and change into purchasers in programs weak to censorship, account restrictions, and regulatory overreach.

Incentives Misalignment: From Members to Shoppers

Decentralized networks depend on lively participation, customers validating transactions, voting on proposals, and contributing to code or the group. However passive merchandise like index funds and staking-as-a-service are turning customers into spectators.

The shift from lively engagement to “set-it-and-forget-it” fashions can weaken networks, as fewer people take accountability for governance, safety, or innovation. Crypto’s power lies in its bottom-up vitality, however that vitality fades when customers disengage.

Regulatory Consolation vs. Ideological Compromise

It’s tempting to view regulatory readability as progress, and in some ways, it’s. Merchandise like spot ETFs and compliant stablecoins assist bridge the hole between crypto and conventional markets. Nevertheless, that consolation typically comes at the price of ideological purity.

Tasks could water down their decentralized buildings, restrict privateness options, or construct in controls that align with regulator preferences slightly than group pursuits. Within the race to realize legitimacy, crypto could dilute the very freedoms it was constructed to guard.

Can Accessibility and Innovation Coexist?

One of many greatest challenges in crypto right this moment is balancing user-friendly design with the preservation of core ideas like decentralization, transparency, and particular person management.

As extra newcomers enter the house, the demand for intuitive, seamless experiences grows. However can crypto change into extra accessible with out shedding what makes it completely different?

The Case for Layered Design

Layered structure gives a strong resolution. This strategy builds easy, intuitive consumer interfaces on high of deeply decentralized infrastructure.

As an example, a consumer would possibly work together with a clear cell app that hides complicated pockets administration, however behind the scenes, they nonetheless retain full custody of their property, work together instantly with good contracts, and luxuriate in the advantages of a trustless system.

This separation of floor simplicity from backend transparency permits innovation in consumer expertise with out compromising the protocol’s integrity.

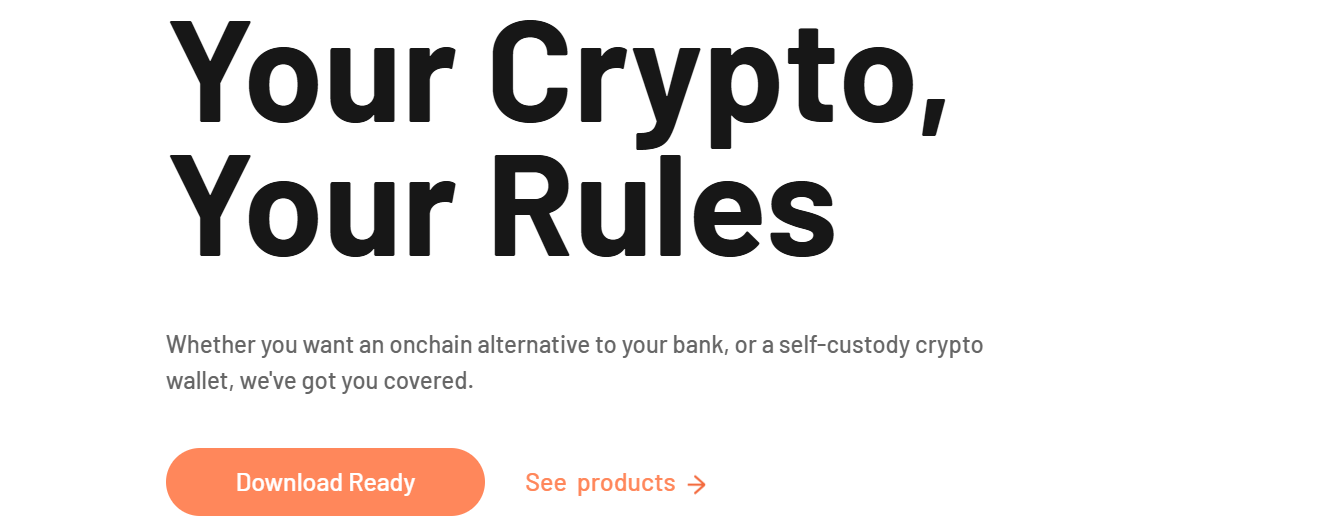

Constructing Instruments That Protect Consumer Sovereignty

Preserving consumer sovereignty means designing instruments that all the time preserve particular person management over their property and information.

Non-custodial wallets with social restoration options, decentralized id programs, and permissionless protocols are examples of expertise that empowers customers with out requiring technical mastery.

When builders prioritize sovereignty of their design, giving customers alternative, privateness, and management, crypto can evolve to fulfill mainstream wants with out abandoning its roots.

Examples of Tasks Getting It Proper

A number of tasks are efficiently combining accessibility with decentralization. Prepared Pockets gives a user-friendly interface with built-in good contract safety and no seed phrases, but customers retain full management over their funds.

Uniswap continues to enhance its front-end expertise whereas remaining a completely decentralized protocol. Equally, Nouns DAO and Farcaster have launched modern governance and social instruments that stay open, composable, and community-driven.

These examples present that accessibility and decentralization aren’t mutually unique; they’re complementary when thoughtfully designed.RELATED: DeFi is Consuming TradFi

Closing Ideas

What makes crypto highly effective isn’t simply its means to generate returns; it’s the liberty it gives. At its core, crypto challenges centralized management, empowers people to personal their property, and permits borderless participation in open programs. That edge shouldn’t be forgotten because the house matures.

The true problem now could be scaling with out shedding soul. As crypto integrates with conventional monetary fashions and prioritizes consumer expertise, there’s a danger of drifting towards conformity. However progress doesn’t should imply compromise, if guided by intention, crypto can stay each accessible and principled.

To builders and customers alike: usability issues, however not at the price of core values. Construct and help instruments that simplify crypto with out stripping it of self-custody, transparency, or decentralization. Innovation ought to serve folks, not simply markets.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”