Ethereum is buying and selling at essential value ranges after a pointy 10% decline from the $4,750 mark, reflecting rising uncertainty throughout the broader crypto market. The current correction has pushed ETH towards the $4,300 assist zone, a degree that bulls are actually fiercely defending to forestall a deeper retracement. Regardless of the pullback, on-chain information suggests that giant holders stay assured, signaling that this dip could also be a part of a wholesome market reset slightly than the beginning of a downtrend.

Associated Studying

In line with current information, Bitmine continues its aggressive accumulation of ETH, including to its holdings whilst costs fluctuate. This regular influx from institutional gamers highlights sturdy conviction in Ethereum’s long-term fundamentals, notably because the community maintains dominance in DeFi and good contract exercise.

Nonetheless, sentiment amongst retail merchants stays blended. Some concern that sustained weak point beneath $4,300 may set off one other wave of promoting stress, whereas others see this as a possible accumulation alternative earlier than the following main transfer. As Ethereum stabilizes at these ranges, the approaching days might be essential to find out whether or not the market resumes its bullish momentum or enters a protracted consolidation part amid heightened volatility.

Ethereum Accumulation Continues As Bitmine Strengthens Its Place

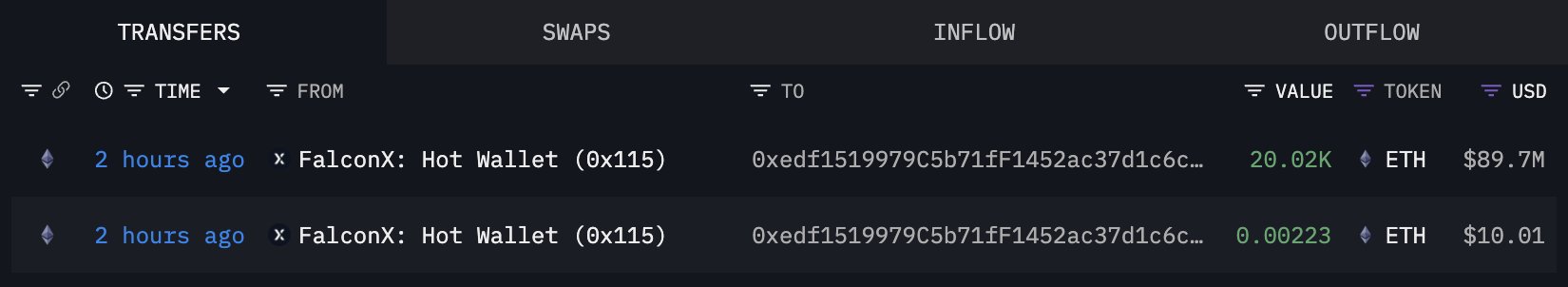

In line with information shared by Lookonchain, institutional accumulation round Ethereum stays sturdy regardless of current market volatility. Only a few hours in the past, Bitmine obtained one other 23,823 ETH (value $103.68 million) from BitGo, marking yet one more vital influx of capital. This transfer comes solely two days after Bitmine acquired 20,020 ETH ($89.7 million) by way of FalconX, underscoring their constant technique of constructing publicity throughout value dips slightly than chasing rallies.

Such accumulation patterns are sometimes seen as an indication of confidence in Ethereum’s long-term fundamentals, notably from institutional buyers who view ETH as a core asset inside the broader digital financial system. Whereas short-term sentiment stays cautious after the current correction, these inflows counsel that good cash continues to see worth round present costs.

The approaching days might be essential for Ethereum’s technical construction. Bulls should defend the $4,300 assist zone to take care of momentum and arrange a possible restoration towards the $4,600–$4,750 resistance space. A powerful protection right here may pave the best way for a brand new all-time excessive, confirming renewed investor confidence and establishing $4,300 as a key accumulation degree.

Associated Studying

Bulls Defend $4,300 Assist

Ethereum (ETH) is at the moment buying and selling close to $4,325, exhibiting indicators of consolidation after a ten% decline from its current excessive of $4,750. The 12-hour chart reveals that ETH has fallen beneath the 50-day shifting common (blue line), signaling short-term weak point, whereas the 100-day (inexperienced) and 200-day (purple) shifting averages are nonetheless trending upward — an indication that the broader uptrend stays intact.

The $4,300 degree now acts as a key assist zone, with bulls trying to ascertain a base and forestall additional draw back stress. If this degree holds, the following goal could be a retest of $4,500–$4,600, the place sellers are prone to reappear. Nonetheless, a break beneath $4,250 may expose Ethereum to a deeper pullback towards the $4,000 psychological degree, an space that beforehand served as a powerful accumulation zone in late September.

Associated Studying

Momentum indicators counsel that promoting stress is easing, aligning with the current on-chain information exhibiting continued accumulation from massive entities corresponding to Bitmine. This reinforces the concept that institutional confidence stays sturdy, even amid volatility. For now, holding above $4,300 is essential — a profitable protection may mark the inspiration for Ethereum’s subsequent push towards new highs.

Featured picture from ChatGPT, chart from TradingView.com