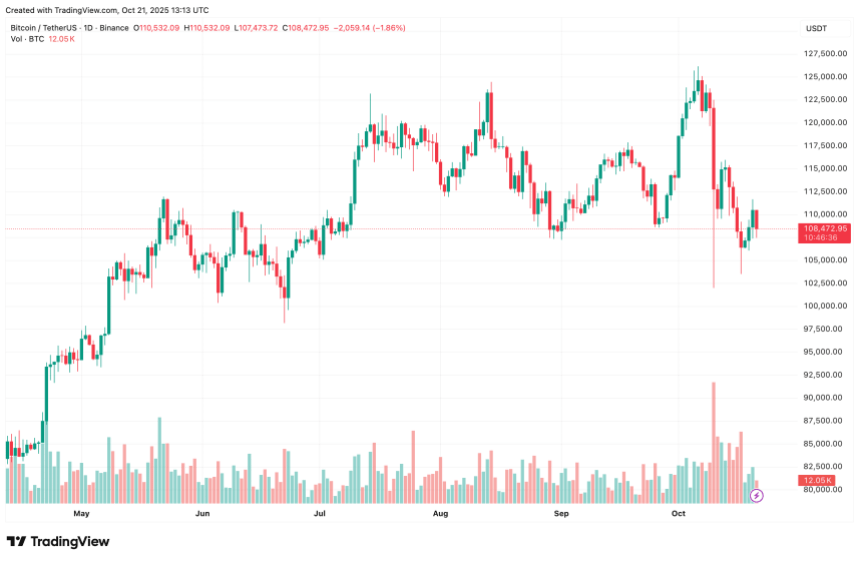

Whereas Bitcoin (BTC) has declined greater than 13% from its contemporary all-time excessive (ATH) of $126,199 recorded earlier this month on October 6, CryptoQuant contributor PelinayPA is assured that there’s a 55% likelihood that the BTC high for this market cycle will not be in but.

Bitcoin Prime Not In But – Extra Upside Forward?

In line with a CryptoQuant Quicktake submit by contributor PelinayPA, there’s a 55% chance that the Bitcoin high for the continuing market cycle will not be in but. The analyst highlighted BTC’s latest on-chain flows to help their declare.

Associated Studying

Of their evaluation, PelinayPA famous that though BTC’s value has tumbled from greater than $126,000 to round $109,000 within the second half of 2025, there was a noticeable improve in 0-1 day BTC inflows to exchanges.

An increase in 0-1 days BTC inflows to trade sometimes has two implications – short-term merchants are taking earnings, and there’s a momentary part of repositioning of liquidity as merchants switch their holdings to exchanges, anticipating value volatility.

The analyst added that BTC held for greater than six months is basically inactive, indicating that long-term holders are seemingly not promoting regardless of the latest market crash. This indicators market confidence amongst long-term holders, minimizing the potential of one other main sell-off within the close to time period.

PelinayPA remarked that such habits sometimes happens within the mid or maturing phases of a bull cycle, the place any dip in value is seen as a possibility to build up as a substitute of a development reversal.

At present, the Bitcoin market is in a pure consolidation part inside an ongoing uptrend. The analyst added:

Within the brief time period, Bitcoin may revisit the $102K area as brief time period merchants proceed to take earnings. Nevertheless, since this promoting strain originates primarily from newer holders, it’s unlikely to disrupt the broader bullish construction. These dips could supply engaging entry alternatives.

Concluding, Pelinay commented that the shortage of promoting exercise amongst BTC holders within the 6-months to 10-year time-band vary exhibits that there’s a 55% chance that the bull market high has not but fashioned.

BTC May Dip To $102,000

The CryptoQuant contributor famous that, though it’s seemingly that the BTC bull market high will not be in but, it doesn’t imply that the highest cryptocurrency wouldn’t see additional momentary decline. If promoting persists, BTC may as soon as once more take a look at the $102,000 help degree.

Associated Studying

Equally, crypto analyst Elliot Waves Academy remarked that BTC has seemingly completed the bullish leg of the continuing market cycle. The analyst added that BTC is prone to consolidate round its present ranges.

That stated, a fellow CryptoQuant contributor famous that BTC has entered the ‘disbelief part,’ and will take the bears unexpectedly with a pointy surge in value. At press time, BTC trades at $108,472, down 2% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com