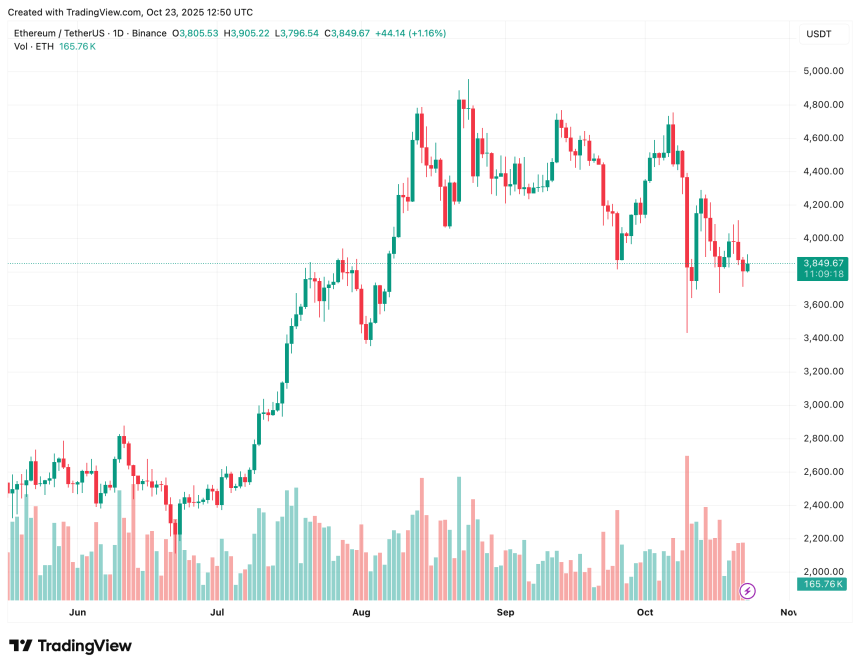

Ethereum (ETH), the second-largest cryptocurrency by market cap, continues to commerce barely under the psychologically necessary $4,000 value stage, following the brutal drawdown on October 9, which noticed the digital forex check the assist at round $3,435.

Ethereum Stays Above Realized Worth – Bullish Momentum Quickly?

Based on a CryptoQuant Quicktake publish by contributor TeddyVision, Ethereum is buying and selling above its Realized Worth at roughly $2,300. Dubbing the worth stage a “elementary assist zone,” the analyst mentioned that traditionally, any dips under this stage have marked a capitulation section.

Associated Studying

For the uninitiated, Realized Worth represents the common value foundation of all ETH holders, calculated by dividing the entire worth of all ETH on the time they final moved on-chain by the present circulating provide.

Realized Worth successfully reveals the “true” common value buyers paid, serving as a key indicator of whether or not the market is in revenue or loss. So long as ETH trades above Realized Worth, the market construction is more likely to stay bullish.

The analyst additionally highlighted Ethereum’s Market Worth to Realized Worth (MVRV) ratio. Notably, ETH holders are presently, on common, at 67% revenue relative to their value foundation. This metric offers two main hints concerning the present market.

First, it reveals that though the market is worthwhile, it’s nonetheless removed from “overheated” ranges. Second, it signifies that market individuals are assured concerning the market’s upward momentum, however not fairly euphoric.

To clarify, the MVRV ratio compares the market worth of an asset to its realized worth. A better MVRV signifies holders are sitting on bigger unrealized earnings – usually signaling potential overvaluation – whereas a decrease MVRV suggests undervaluation or market worry.

Additional, TeddyVision famous Ethereum’s response from the Higher Realized Worth Band, which is presently situated round $5,300. The analyst remarked:

Worth pulled again earlier than reaching the “Overheating Zone. This isn’t a reversal – it’s a consolidation section after distribution, a wholesome cooldown with out structural injury.

Lastly, spot inflows of ETH to crypto exchanges are additionally slowing down, hinting that the subsequent leg up for the digital asset will doubtless rely upon recent liquidity, and never leverage. To sum it up, Ethereum is slowly transferring from the distribution section to the consolidation section.

Is It A Good Time To Purchase ETH?

Whereas offering dependable future predictions within the crypto market stays a difficult job, recent on-chain and change knowledge level towards ETH regaining its bullish momentum. As an example, Binance funding charges just lately hinted that ETH may surge to $6,800.

Associated Studying

Equally, ETH reserves on exchanges proceed to fall at a fast tempo. Earlier this month, ETH provide on exchanges hit a multi-year low, rising the chance of a possible “provide crunch” that may dramatically enhance ETH’s value.

That mentioned, crypto analyst Nik Patel just lately cautioned that ETH’s value correction could not but be totally over. At press time, ETH trades at $3,849, up 0.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com