In keeping with regulatory filings, Jane Road Group disclosed passive stakes in a number of public bitcoin miners on Oct. 23 and Oct. 24, 2025, sending a ripple by means of mining shares. Experiences have disclosed holdings of about 5.4% in Bitfarms Ltd., 5.0% in Cipher Mining Inc., and 5.0% in Hut 8 Corp, all proven on Schedule 13G types that sign non-activist positions.

Jane Road Discloses Stakes

The filings record Jane Road as a passive investor reasonably than an activist proprietor. Primarily based on studies, the group’s transfer is being learn as a vote of confidence within the miners as public corporations, not essentially a plan to run them. The precise greenback worth of the stakes was not within the submitting summaries made public, however the proportion holdings have been clear.

Market Strikes After The Filings

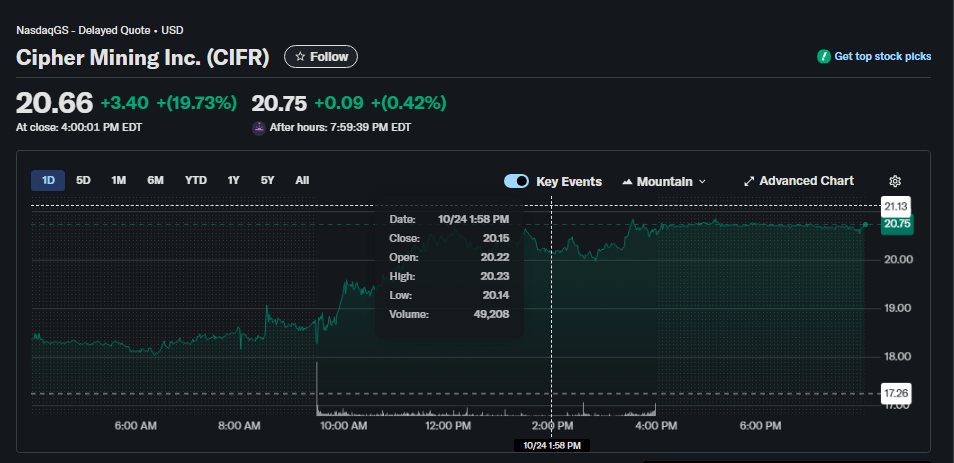

Inventory merchants reacted quick. Cipher Mining climbed roughly 13% on the day of the filings, whereas different miners additionally noticed good points as traders priced within the information.

Shares jumped as a result of market individuals typically view large, seen positions by giant buying and selling corporations as a sign that the asset is value a more in-depth look.

Supply: Yahoo Finance

Quantity within the miners’ names elevated as nicely, with many extra shares altering arms than on a mean buying and selling day.

Institutional Context And Exercise

Jane Road has been energetic in digital property buying and selling for a number of years and has taken roles that embody offering liquidity and dealing with ETF issuers.

Experiences present the agency’s crypto buying and selling grew considerably lately, with figures round $110 billion in buying and selling exercise in 2023 talked about in business protection.

The agency has additionally acted as a certified participant for some spot bitcoin ETF processes, which suggests it’s concerned within the markets that join funds to underlying bitcoin publicity.

What This Means For Miners

For the mining corporations, seen institutional stakes can deliver each advantages and scrutiny. On one hand, extra curiosity from large corporations can open doorways to capital and improved market credibility.

Alternatively, mining stays tied to the value of bitcoin, energy prices, and regulatory selections about power use and internet hosting. Experiences have warned that some market watchers assume the positions could also be a part of broader buying and selling methods reasonably than easy long-term bets.

Analysts and market commentators stated the filings are value watching, however in addition they suggested warning. Mining shares are unstable; they’ll transfer sharply when bitcoin strikes, when power offers are introduced, or when {hardware} shifts happen.

Featured picture from Vecteezy, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.