Bitcoin treasury firm Technique has continued its routine of weekly BTC buys with a recent acquisition price $43.4 million.

Technique Has Added One other 390 BTC To Its Bitcoin Reserves

As introduced by Technique co-founder and chairman Michael Saylor in an X put up, the treasury firm has made one other growth to its reserves. The newest buy concerned 390 BTC, acquired at a median value of $111,053 per token. In complete, the purchase value the agency $43.4 million.

The acquisition follows in the future after Saylor made the standard Sunday put up with Technique’s Bitcoin portfolio tracker. This time, the chairman used the caption, “It’s Orange Dot Day.”

In line with the submitting with the US Securities and Trade Fee (SEC), the corporate funded the most recent buy utilizing gross sales of its STRK and STRD at-the-market (ATM) inventory choices.

Following the purchase, the Bitcoin treasury agency now holds 640,808 BTC with a price foundation of $47.44 billion. On the present change price, these holdings are price $73.93 billion, placing the corporate in a revenue of about 55.8%

Final week, Technique made an acquisition price simply $18.8 million, so this week’s purchase is definitely a step up, however when in comparison with purchases from earlier within the 12 months, it’s nonetheless not too vital.

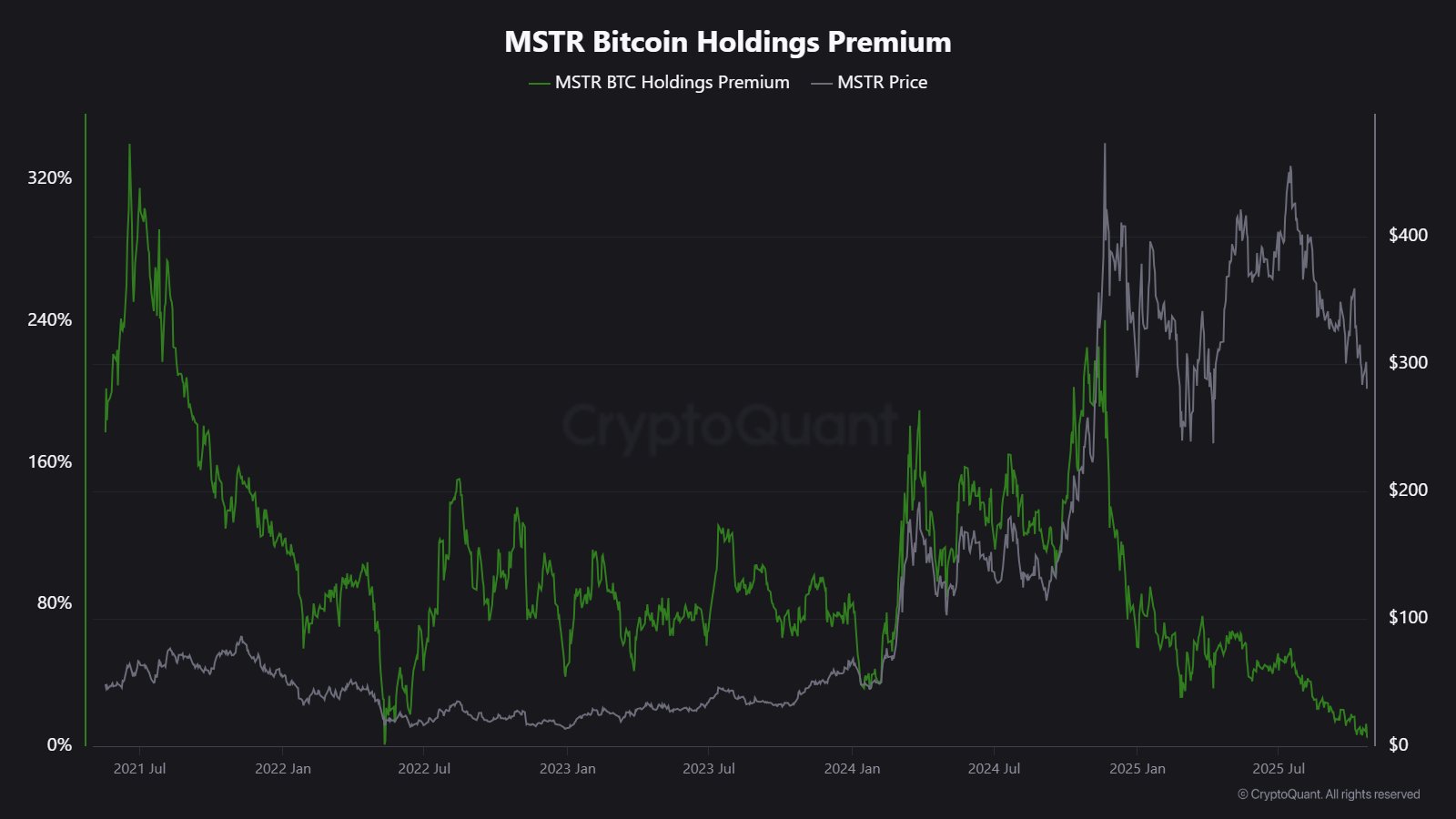

CryptoQuant neighborhood analyst Maartunn has mentioned in an X thread why Technique’s accumulation has slowed down not too long ago. Maartunn has famous that capital is changing into more durable to lift for the corporate, as its fairness issuance premiums have dropped from 208% to only 4%.

The development within the BTC holdings premium of Technique over time | Supply: @JA_Maartun on X

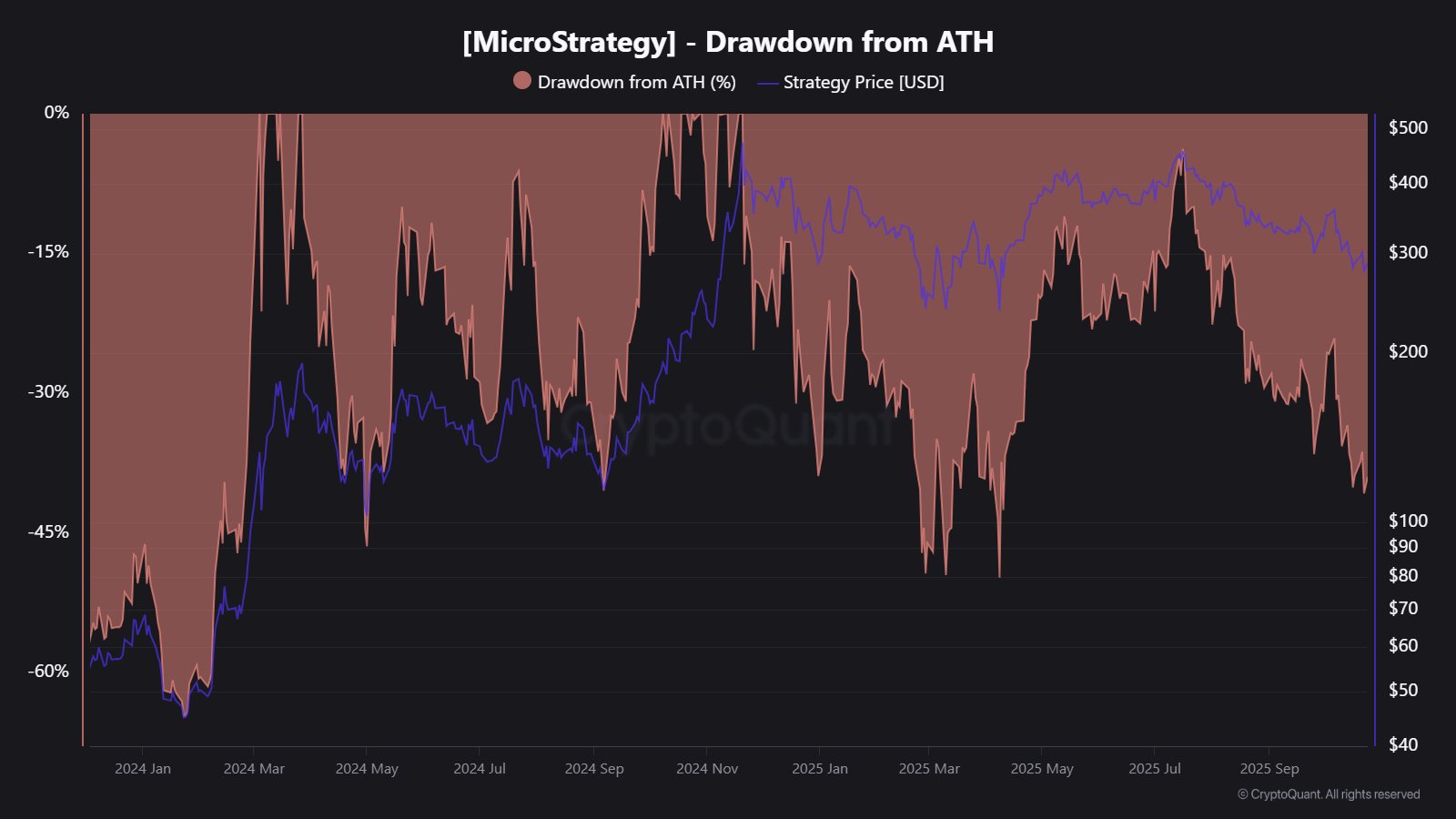

The agency’s inventory value can also be 50% down in comparison with its all-time excessive (ATH). Bitcoin itself can also be buying and selling beneath its ATH, however in its case, the drawdown is at present nowhere close to as vital.

How down the Technique value is in comparison with its ATH | Supply: @JA_Maartun on X

Though Technique’s shopping for has seen a slowdown by way of scale not too long ago, it has nonetheless been commonly accumulating, cementing its place as by far the biggest company Bitcoin holder on this planet.

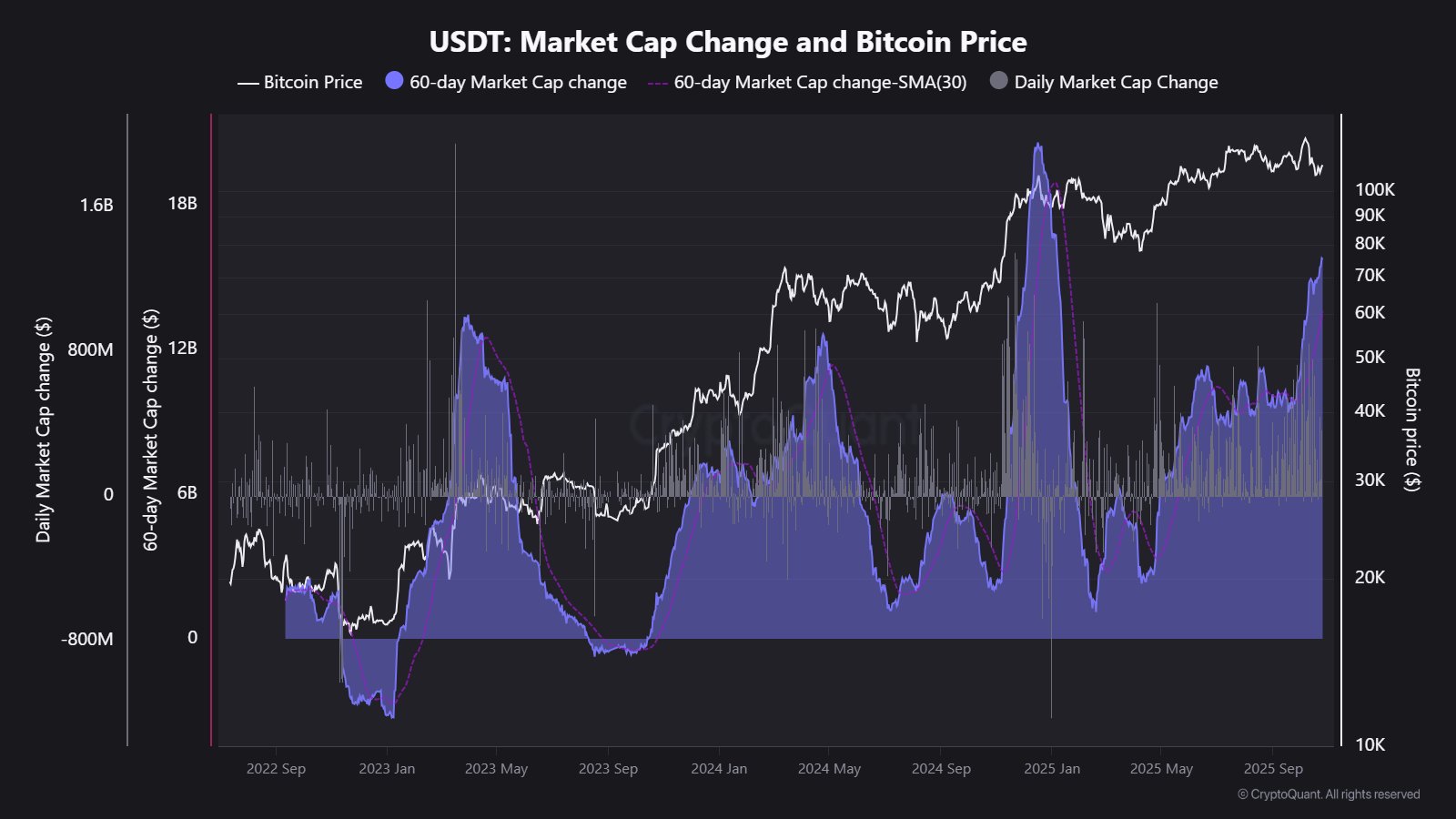

In another information, the provision of the biggest stablecoin on this planet, USDT, has been witnessing some sharp progress, as Maartunn has identified in one other X put up.

The information for the 60-day change within the USDT market cap | Supply: JA_Maartun on X

From the above chart, it’s seen that USDT’s market cap has witnessed a extremely optimistic 60-day change, indicating a considerable amount of capital has flowed into the stablecoin over the past two months. The expansion has been sharp sufficient to be notably above the 30-day easy shifting common (SMA). The analyst has famous that this sort of development is “traditionally linked to short-term BTC upside.”

BTC Worth

Bitcoin has loved a restoration surge over the past couple of days as its value has returned to the $115,500 stage.

Seems to be like the worth of the coin has been on the way in which up | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.