In keeping with experiences, Evernorth — a Ripple-backed treasury agency — has agreed to merge with Armada Acquisition Corp II and plans to listing below the XRPN ticker.

The SPAC deal goals to boost $1 billion to construct what Evernorth calls a big XRP treasury. Ripple and co-founder Chris Larsen contributed XRP to the venture.

9 days after the SPAC announcement, experiences mentioned Evernorth had already acquired $1 billion value of XRP. The merger is focused to shut in Q1 2026.

On Contributions & Money Shopping for

As a result of the early inputs had been paid in XRP quite than money, fast upward stress on trade order books didn’t occur.

Market purchases require fiat or money to be positioned into public markets. SBI’s introduced $300 million money pledge is one instance of cash that could possibly be used to purchase XRP outright.

However up to now many of the headline quantities are XRP moved right into a treasury, not contemporary money hitting exchanges.

It’s my understanding the brand new @evernorthxrp enterprise will increase $1BN via XRP direct funding, as introduced and as we’ve seen on the chain.

So that you considering “how will that have an effect on open market XRP?”. Let me clarify.

There subsequent plan is to IPO on inventory trade. This can increase…

— Vincent Van Code (@vincent_vancode) October 27, 2025

Analyst Alerts Incoming ‘Shock’

Vincent Van Code, a software program engineer and energetic voice within the XRP neighborhood, advised followers on X that the larger occasion should be forward.

He mentioned the IPO itself may convey billions in new money. If these funds are later used to purchase XRP on the open market, he warned, current provide may tighten and a “provide shock” may comply with.

Van Code didn’t provide a hard and fast timetable. Different commentators, together with a market voice generally known as Nietzbux, have already framed the event as strongly bullish for XRP.

Why The Timing Issues

Primarily based on experiences, the sequence is what may change costs: money raised first, then purchases on public markets. If that order is reversed — money arrives and huge buys comply with rapidly — liquidity could possibly be examined.

Exchanges have various depth. A single giant purchaser can transfer costs extra in skinny markets than in thick ones. That’s easy market mechanics. It’s also why some neighborhood members are watching the SPAC schedule intently.

There’ll come a time the place XRP and XRPL is simply the place you retain most of your wealth. That is known as Treasury.

Trace trace.

— Vincent Van Code (@vincent_vancode) October 17, 2025

XRP’s Function And The Broader Narrative

Numerous builders and analysts now communicate of XRP not solely as a cost bridge but additionally as a treasury asset contained in the XRPL ecosystem.

Van Code prompt {that a} time might come when individuals maintain a giant share of their wealth in XRP and on the XRP Ledger.

Ripple’s CTO David Schwartz has emphasised comparable concepts about self-custody and on-ledger utility. These themes are being reused as a part of the argument for long-term demand.

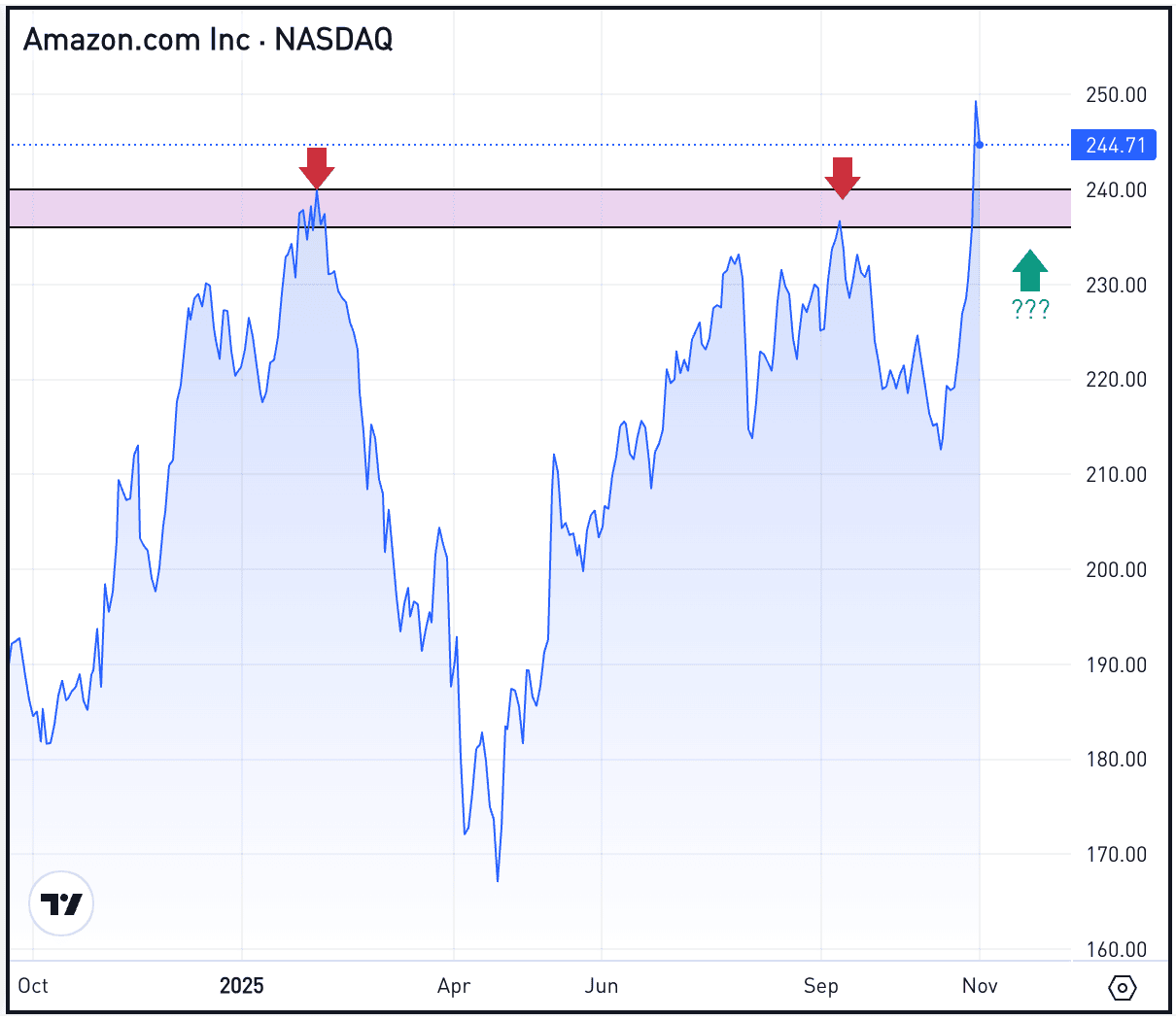

Featured picture from Gemini, chart from TradingView