Victoria d’Este

Printed: November 05, 2025 at 12:46 pm Up to date: November 05, 2025 at 12:46 pm

Edited and fact-checked:

November 05, 2025 at 12:46 pm

In Transient

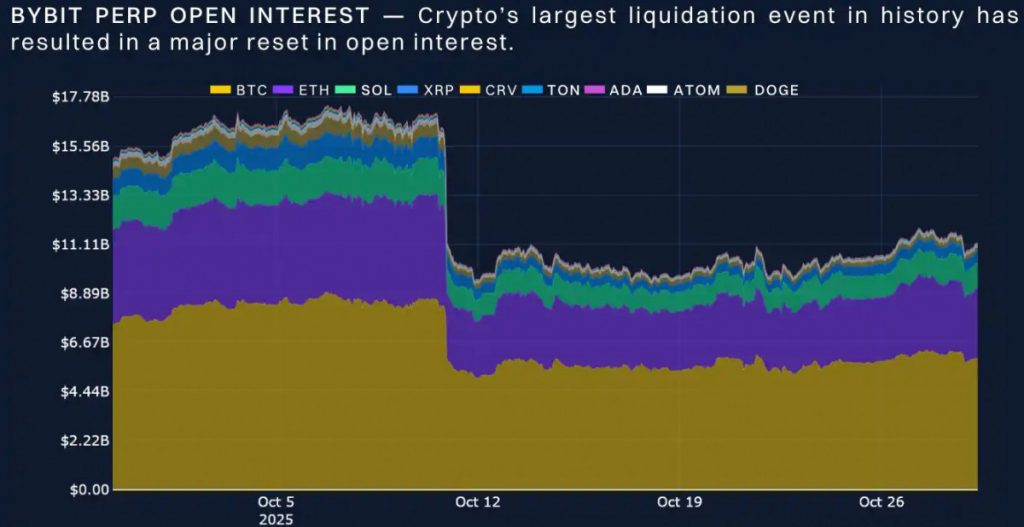

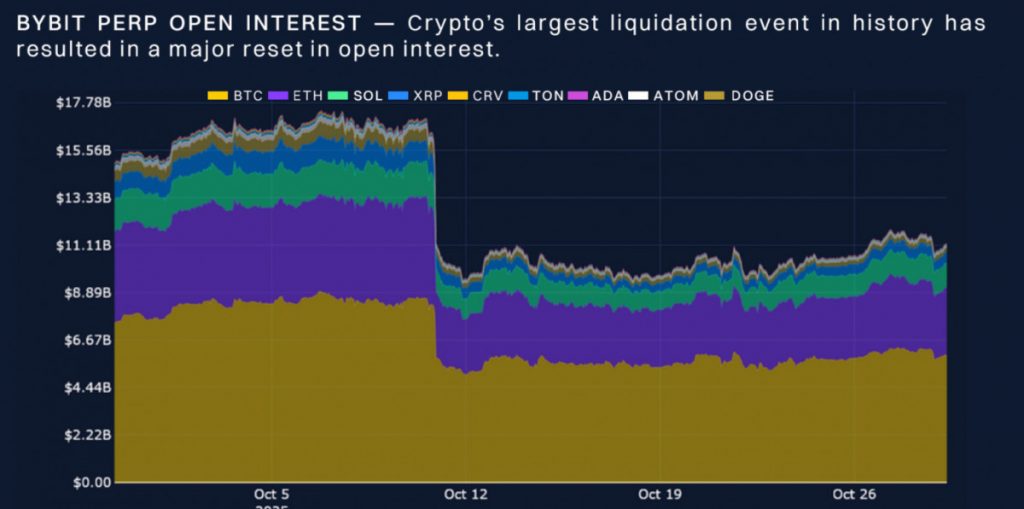

After October’s $6 billion liquidation, Bybit and Block Scholes’ newest report reveals a newly cautious crypto market, with merchants hedging positions and ready for readability amid subdued optimism.

The crypto market has skilled many phases over the previous decade: euphoric, chaotic, unstoppable. Nonetheless, it has not often been cautious. This cautious tone is obvious in Bybit and Block Scholes’ newest Crypto Derivatives Analytics Report, which gives a sober evaluation of digital asset buying and selling following October’s record-breaking $6 billion liquidation. Regardless of the thrill a couple of modest worth rebound, knowledge point out merchants are retreating behind hedges, therapeutic their wounds, and awaiting readability that may not arrive quickly.

The report states that the set off was one other geopolitical incident. U.S.–China commerce tensions escalated when President Trump unexpectedly introduced a 100% tariff enhance on Chinese language items. Inside hours, large liquidations worn out billions in open curiosity, eliminating one of many largest leveraged buildups in crypto historical past.

Although the 2 nations later agreed on a brand new commerce framework, the harm was already achieved. Bitcoin has since traded inside a slim vary of $105,000 to $115,000, the place it stays stubbornly confined. In a market that when thrived on momentum, such stagnation appears nearly unfamiliar.

Perpetuals Caught in Impartial

Bybit’s knowledge signifies that perpetual futures, that are central to crypto derivatives, stay under $10 billion in notional open curiosity, a stage not seen since early 2023. Though document highs in U.S. equities ought to have boosted danger urge for food, the report reveals a rising disconnect between digital property and conventional markets.

Merchants seem hesitant to re-enter with vital positions, nonetheless affected by the fast and large-scale decline in October. What was as soon as a market pushed by leverage now appears to be in a survival mode.

Hedging Over Hype

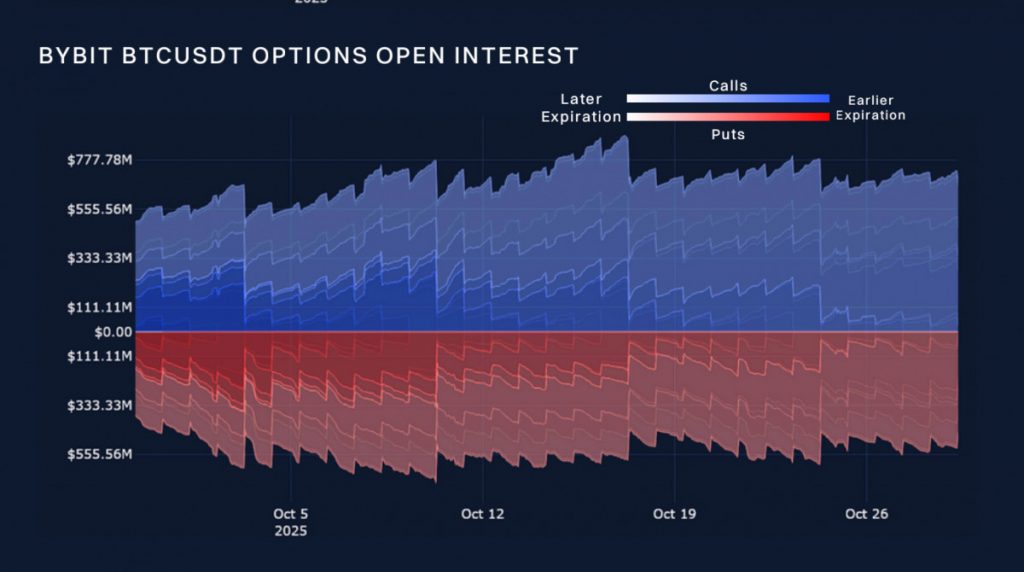

The story is definitely extra nuanced. Though perpetual markets have stalled, choices buying and selling presents a special image. Bybit and Block Scholes observe that Bitcoin choices open curiosity has been steadily growing, indicating that skilled merchants are adopting defensive positions slightly than utterly withdrawing.

The demand for short-term places stays sturdy, and at-the-money implied volatility, an necessary indicator of danger notion, stays excessive throughout totally different maturities. This delicate shift from leverage to choices highlights that crypto’s most refined buyers aren’t leaving, however slightly shopping for time.

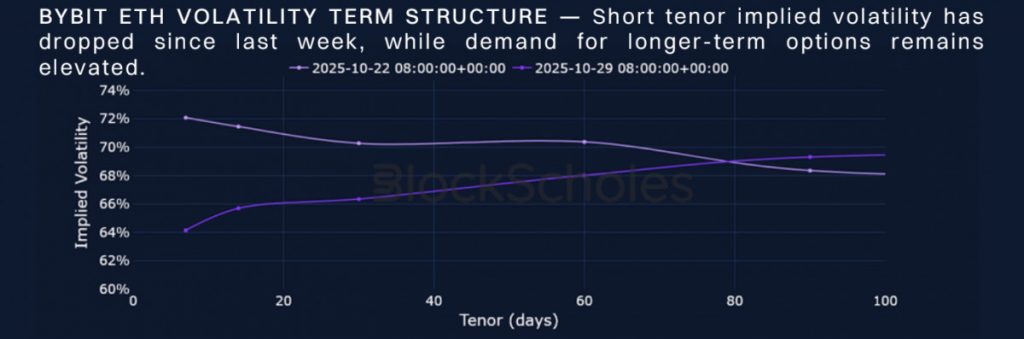

That hesitation is mirrored throughout Ethereum markets, the place volatility quickly shifted to a bullish development earlier than reverting to a cautious stance. Regardless of declining realized volatility, merchants nonetheless pay premiums for insurance coverage.

Block Scholes’ analysts observe that the market struggles to overlook October’s shock, with a collective post-traumatic reflex holding possibility costs elevated even when spot markets are calm. Traditionally, these phases of low worth motion and expensive hedging have typically preceded sudden massive strikes. The problem is that nobody can predict which path this time will favor.

Macro Headwinds and Micro Sparks

Macro forces supply little reassurance. Federal Reserve Chair Jerome Powell’s repeated assertion that future price cuts are unlikely has subdued the cautious optimism after the October coverage assembly. With manufacturing knowledge within the U.S. and Asia weakening and Europe nearing stagnation, the long-held perception that crypto would decouple from international finance appears extra fantasy than truth as soon as once more. When shares hit new highs and Bitcoin stays nearly static, it’s not resilience; it’s disengagement.

Sure areas, particularly in DeFi, nonetheless present indicators of exercise. The World Liberty Monetary protocol, a Trump-supported venture with the governance token WLFI, skilled a 25% rebound in its token worth after an 8.4 million-token airdrop and a buyback-and-burn vote aimed toward boosting costs. This quickly reignited hypothesis about politically affiliated DeFi ecosystems.

Nonetheless, even in these instances, perpetual funding charges stay risky, indicating that merchants are nonetheless hesitant to view the bear market as over. Whereas the WLFI rally is a notable headline, it highlights how divided sentiment has change into: confidence is localized slightly than widespread.

Ready for Conviction

The primary perception from Bybit and Block Scholes’ evaluation is that crypto not strikes as a unified entity. The synchronized rallies of 2021 have been changed by fragmented liquidity and a concentrate on defensive capital rotation. Merchants now prioritize hedging over hypothesis and monitor macro occasions, corresponding to tariffs and Fed speeches, extra rigorously than ever.

This doesn’t imply optimism has disappeared. It’s merely overshadowed by warning. Markets that endure robust durations like October’s typically emerge stronger and extra streamlined. In derivatives, stability following deleveraging can sign progress, however provided that merchants regain belief that liquidity received’t disappear out of the blue. The present pause is likely to be the calm earlier than crypto’s subsequent main narrative shift, be it institutional inflows, financial easing, or renewed retail hypothesis.

Presently, Bybit’s charts and Block Scholes’ sentiment indexes each point out an identical scenario: a market that’s lively but cautious, transferring however alert, awaiting the subsequent sign. After ten years of fluctuating extremes, perhaps restraint itself is the strongest bullish indicator.

Disclaimer

Consistent with the Belief Undertaking tips, please observe that the data offered on this web page will not be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you may afford to lose and to hunt unbiased monetary recommendation when you’ve got any doubts. For additional data, we recommend referring to the phrases and situations in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Creator

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of expertise matters together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.