On-chain information exhibits Bitcoin short-term holders have transferred a considerable amount of BTC at a loss to exchanges, an indication of one other capitulation wave on the community.

Bitcoin Brief-Time period Holders Are Depositing To Exchanges At Loss

As defined by CryptoQuant neighborhood analyst Maartunn in a brand new submit on X, short-term holders (STHs) have simply made one other wave of underwater change deposits.

The STHs seek advice from the traders who bought their Bitcoin throughout the previous 155 days. This cohort is mostly thought-about to incorporate the weak palms of the market, who simply promote on the sight of market volatility.

Not too long ago, the market has been witnessing a bearish shift, which is strictly the kind of occasion that STHs can be anticipated to react to. There are a number of methods to trace the strikes being made by these traders, with one such being the information of their change influx transactions.

Normally, the STHs switch their cash to centralized exchanges once they want to promote, so a spike in change deposits from the group could be a signal of a selloff.

Throughout downtrends, loss promoting is the most typical kind of distribution from the STHs as a consequence of the truth that their price foundation is at current costs, which are typically greater in bearish phases.

Now, right here is the chart shared by Maartunn that exhibits the pattern within the 24-hour loss change inflows made by the STHs over the previous month:

As displayed within the above graph, the Bitcoin STHs made a considerable amount of loss deposits to exchanges when the cryptocurrency’s worth crashed to $94,000 final week. The identical seems to have adopted throughout the newest downward transfer within the asset.

In complete, STHs have despatched 65,200 underwater tokens to the exchanges over the past 24 hours. On the present change charge, this quantity is value a whopping $6.08 billion.

This new wave of capitulation wave within the STHs got here as BTC dropped towards $89,000. Curiously, what has adopted this FUD from the STHs has to date been a rebound for the asset.

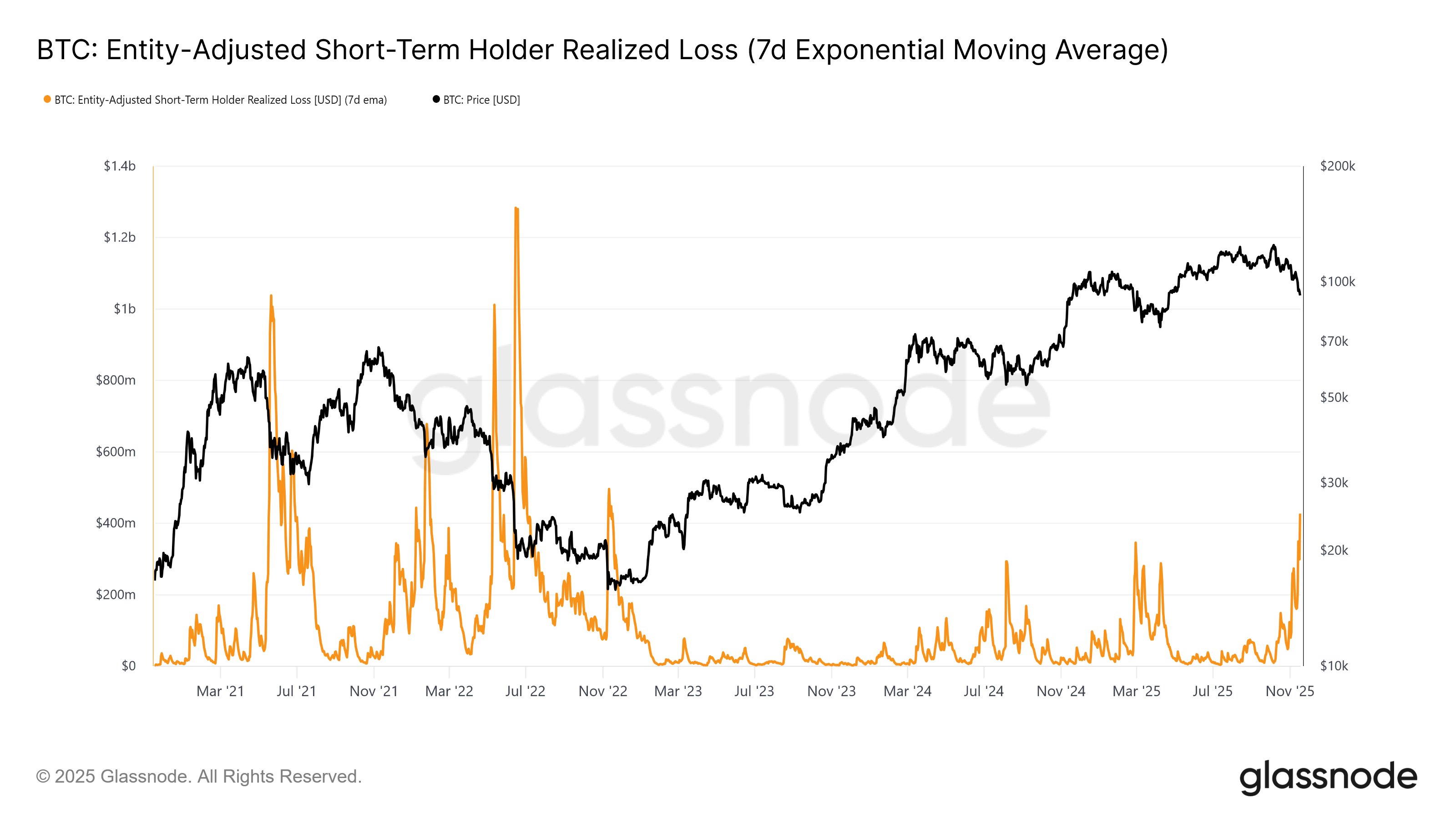

On-chain analytics agency Glassnode has additionally shared information associated to the STH capitulation in a brand new X submit.

Glassnode’s chart is for the quantity of loss that the STHs as an entire are realizing by way of their transactions throughout the community. The 7-day exponential shifting common (EMA) worth of this metric is at present sitting at $427 million, which is the best that it has been since November 2022, when the final bear market bottomed out.

“Panic promoting is elevated & clearly rising, now exceeding the loss ranges seen on the final two main lows of this cycle,” famous the analytics agency.

BTC Worth

Bitcoin witnessed a bounce again to $92,800 throughout the previous day.