On-chain knowledge reveals XRP retail traders are up 60% even after the market downturn. Right here’s how the determine compares for Bitcoin and Ethereum.

XRP Retail Realized Worth Places Revenue Margin Round 60%

In a brand new put up on X, on-chain analytics agency Glassnode has mentioned how retail profitability compares between the highest belongings within the sector: Bitcoin, Ethereum, and XRP. Retail traders check with the smallest of entities out there, who don’t maintain a big stability on a person stage (usually lower than $1,000). To calculate the profit-loss stability of this cohort, Glassnode has made use of the Realized Worth indicator.

The Realized Worth measures the common value foundation or acquisition stage of a given phase of the community. When the asset’s spot value trades above this stage, it means the group is in a state of web unrealized acquire. Then again, it being underneath the metric implies the dominance of loss among the many cohort members.

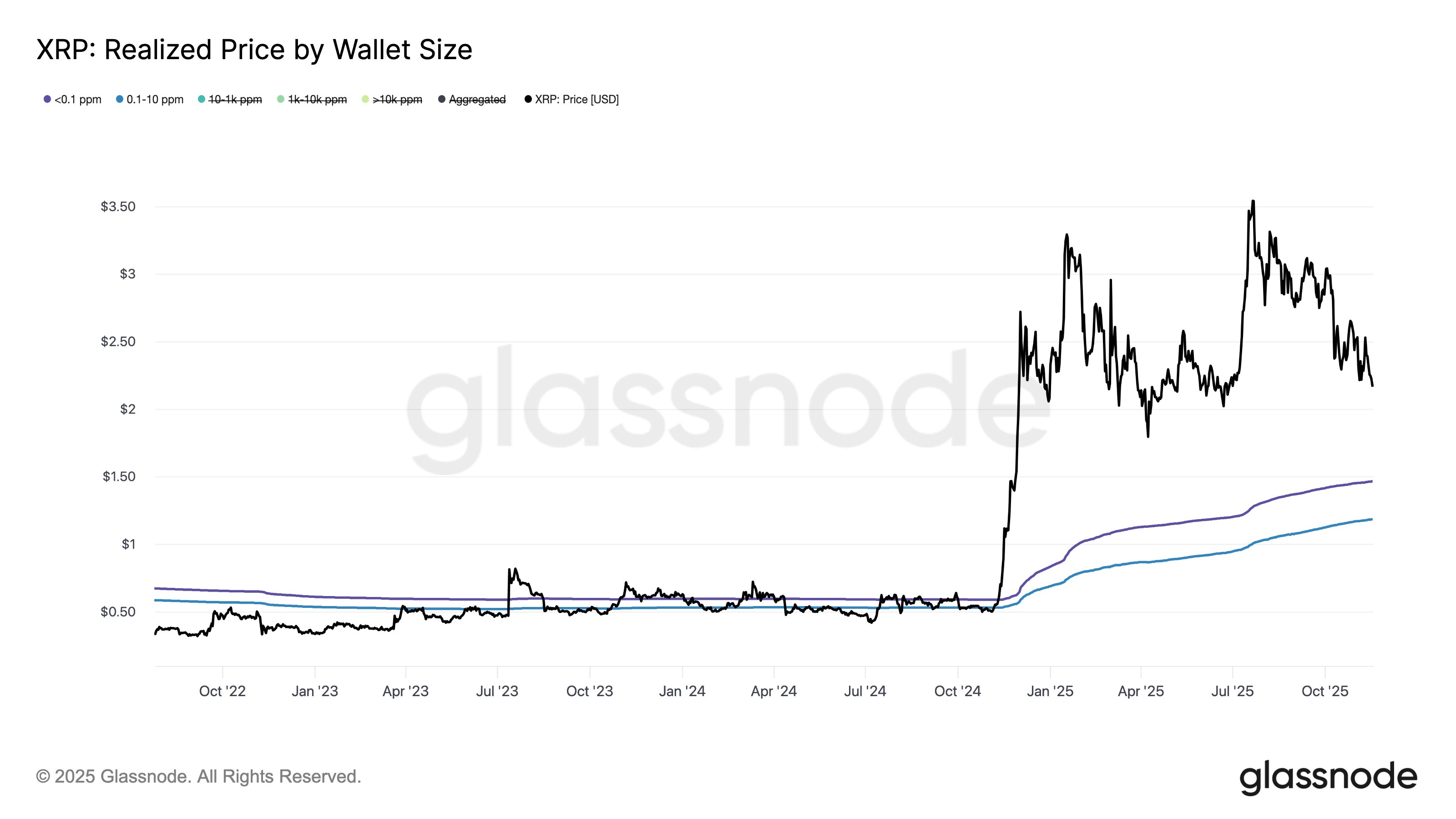

First, here’s a chart that reveals the pattern within the Realized Worth for the retail traders on the XRP community:

The value of the coin presently appears to be buying and selling at a big distance above the indicator | Supply: Glassnode on X

As displayed within the above graph, XRP has witnessed bearish value motion not too long ago, however its value nonetheless has a notable hole over the Realized Worth of the retail entities. Extra particularly, this group is in a mean revenue of 60% proper now. Ethereum retail holders are additionally within the inexperienced, however their profitability isn’t fairly pretty much as good, sitting at 40%.

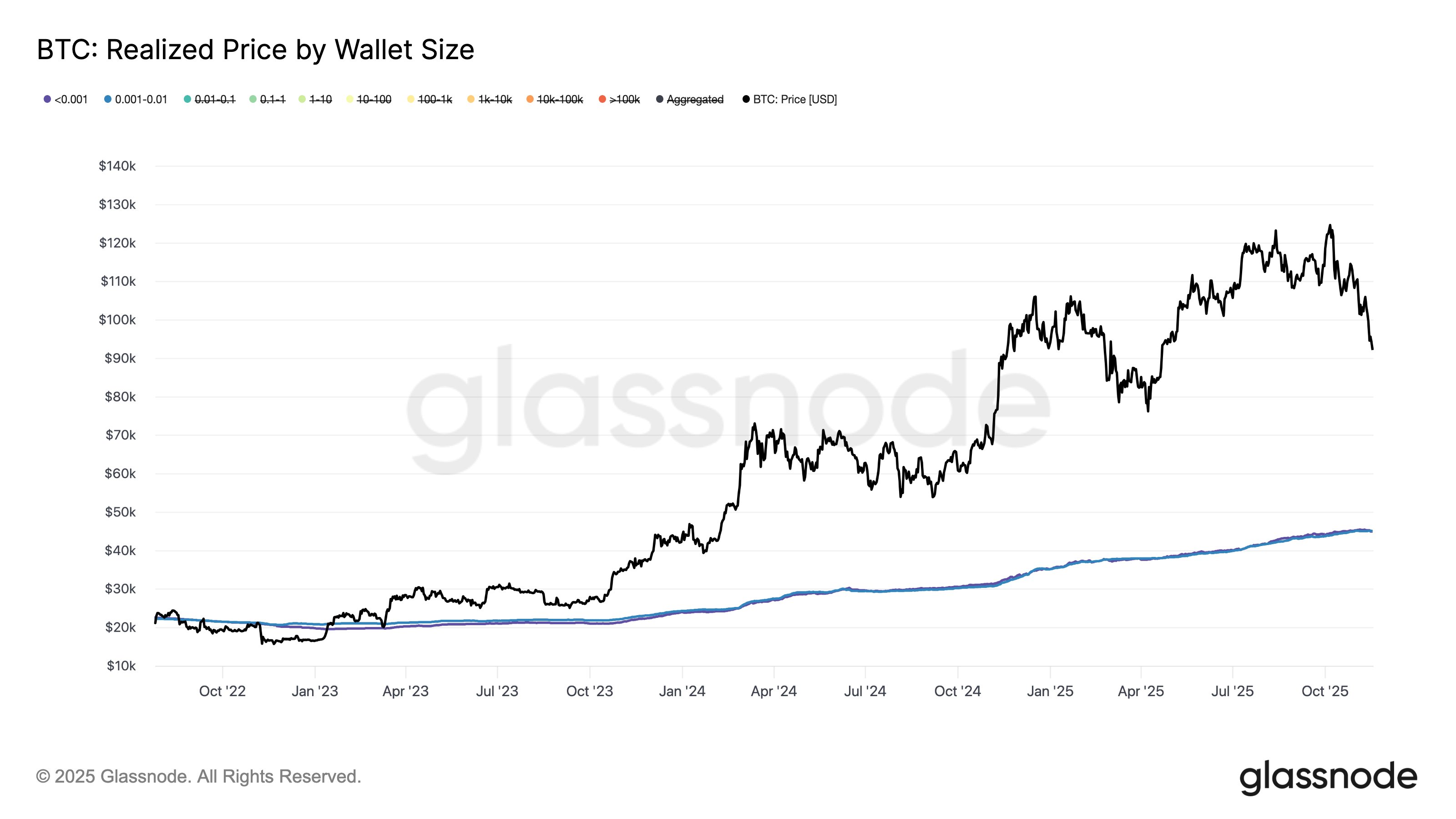

The Realized Worth of the retail-sized ETH wallets | Supply: Glassnode on X

Each XRP and Ethereum, nevertheless, pale compared to Bitcoin. Even after the worth crash, BTC retail addresses are nonetheless in a mean revenue of greater than 100%.

Seems to be just like the Realized Worth of BTC retail traders is sort of low | Supply: Glassnode on X

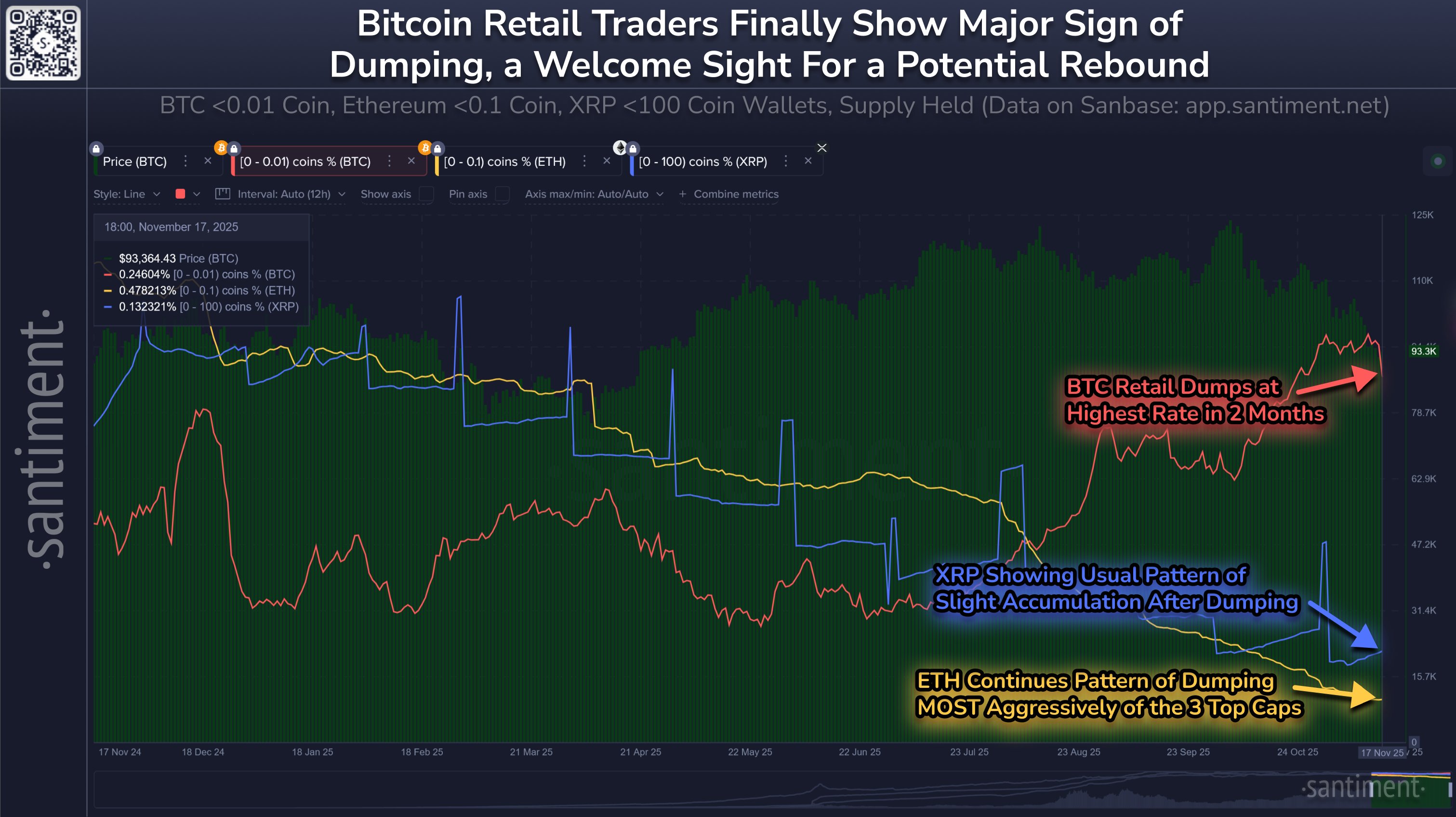

Now, what are retail traders doing with their income? On-chain analytics agency Santiment has make clear the matter in an X put up. Because the chart beneath for the holdings of this cohort reveals, promoting has occurred on all three networks not too long ago.

How the proportion of provide held by retail traders has modified on the XRP, BTC, and ETH blockchains | Supply: Santiment on X

Bitcoin retail was accumulating till the newest value plunge, however this bearish wave has spooked them into promoting 0.36% of their provide over the past 5 days, which is the best fee of distribution in two months. Ethereum retail has been exiting for some time now, and the pattern has solely continued throughout the previous month because the cohort’s holdings have gone down by 0.90%. XRP’s small arms have proven a extra combined conduct, first taking part in a pointy selloff, after which following on with slight accumulation. Total, the group’s provide is down 1.38% for the reason that begin of November.

“Costs transfer the other way of small wallets’ conduct,” famous Santiment. “So we’re keeping track of retail merchants persevering with to panic promote as a optimistic signal for crypto’s restoration.”

XRP Worth

XRP has fallen alongside the remainder of the market as its value has returned to $2.13.

The pattern within the value of the coin over the past month | Supply: XRPUSDT on TradingView

Featured picture from Dall-E, Santiment.web, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.