Bitcoin trades close to $92K amid blended alerts from ETFs and tech markets.

Hoskinson and Saylor predict a powerful BTC rebound regardless of latest losses.

ETF outflows and macro dangers may, nevertheless, push BTC towards $85K help.

Whereas Bitcoin value has recovered from the low of $88,540 hit on November 19, the query is whether or not it’ll hit the next excessive than the $93,403 registered on November 18.

Some analysts consider BTC is getting ready for a deeper slide, whereas others insist a strong rebound is already forming beneath the floor.

At press time, BTC value was round $92,237 and already displaying indicators of exhaustion, which might spell doom because it fashioned a decrease low on November 19, which is a bearish signal.

Bullish calls develop regardless of the slide

At $92,237, Bitcoin (BTC) is reeling from a bruising stretch that has erased greater than $33,000 from its worth in underneath two months.

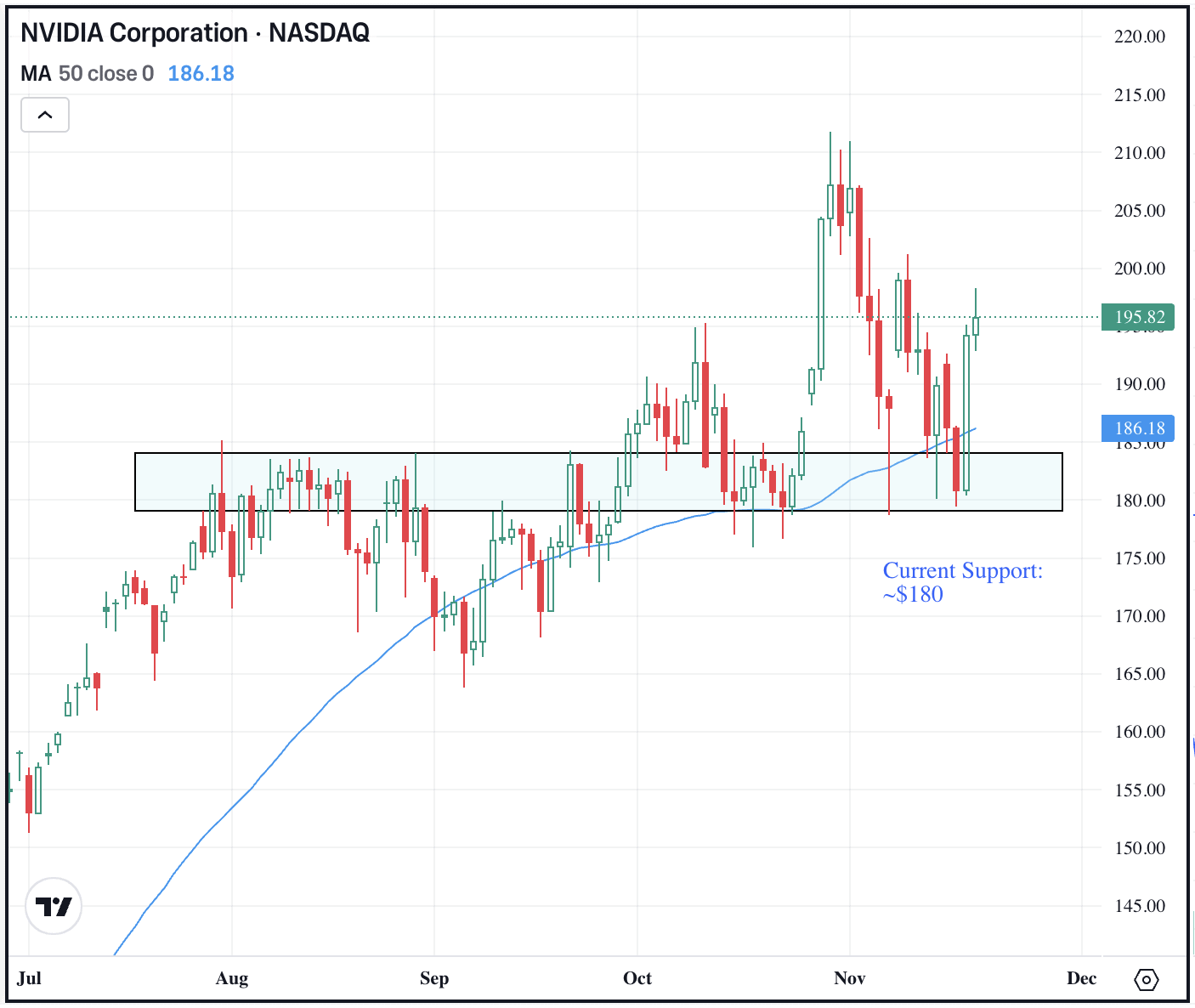

Notably, right this moment’s uptick follows a pause in ETF outflows and a rebound in tech shares, pushed by Nvidia’s stronger-than-expected earnings.

Whereas the market stays on edge as macro uncertainty and shifting liquidity situations proceed to stress danger belongings, Cardano founder Charles Hoskinson stays one of many strongest voices calling for a significant rebound.

Throughout CNBC’s Squawk Field present on Tuesday, Hoskinson argued that Bitcoin’s latest losses mirror broader macro distortions, together with tariff tensions, recession dangers, and uneven regulatory alerts.

Hoskinson believes these forces will ease within the coming months.

He expects BTC to recuperate sharply and doubtlessly hit $250,000 inside the subsequent yr, projecting that institutional adoption and large-scale tokenisation will redefine market cycles.

Michael Saylor shares an analogous degree of confidence, viewing the present downturn as typical of Bitcoin’s long-term behaviour.

The MicroStrategy govt says the corporate is constructed to face up to excessive drawdowns, calling his place “indestructible” in a latest interview with Fox Enterprise.

₿etter than Ever. In the present day I used to be the warm-up act for @natbrunell as we each talked Bitcoin with @cvpayne. You’ll need to hear what she needed to say. pic.twitter.com/vDaFceyeza

— Michael Saylor (@saylor) November 18, 2025

Notably, Saylor has continued to purchase BTC at the same time as volatility will increase, reinforcing his view that deep corrections are a part of the broader path towards increased valuations.

ETF exercise has additionally grow to be a pivotal issue.

The BlackRock Bitcoin ETF posted a document $523 million every day loss on November 18 following a streak of outflows throughout the spot Bitcoin ETF panorama.

The Bitcoin ETFs outflow appears to have stabilised, with IBIT seeing $60M price of inflows on November 19.

Analysts warn that sustained inflows shall be important if Bitcoin hopes to keep away from a retest of this week’s lows.

Bearish dangers nonetheless loom

Not all alerts level upward. Some merchants see an actual probability BTC may break under key help ranges close to $90,000.

If the market fails to carry this help, prediction platforms point out rising expectations of a drop towards $87,000.

ETF outflows totalling greater than $3 billion this month spotlight lingering warning, and lots of retail contributors stay hesitant after weeks of drawdowns.

Macro situations stay sophisticated.

Expectations of Federal Reserve fee cuts have pale, whereas recession considerations are resurfacing because of weak jobs information and ongoing commerce friction.

These pressures have restricted upside momentum at the same time as Nvidia’s tech rally briefly boosted danger urge for food.

Regardless of the uncertainty, Bitcoin continues to commerce like a high-beta asset tied intently to broader market sentiment, and the following few days might decide whether or not consumers regain management or whether or not sellers will take a look at new lows.