The Bitcoin value has considerably slowed down in its restoration since reclaiming the $91,000 stage over the previous week. In accordance with the most recent on-chain knowledge, the flagship cryptocurrency appears to be getting into a essential zone, which might see its value rebound with extra momentum within the close to future.

On-Chain Information Suggests Bitcoin Value Might See Rebound Quickly

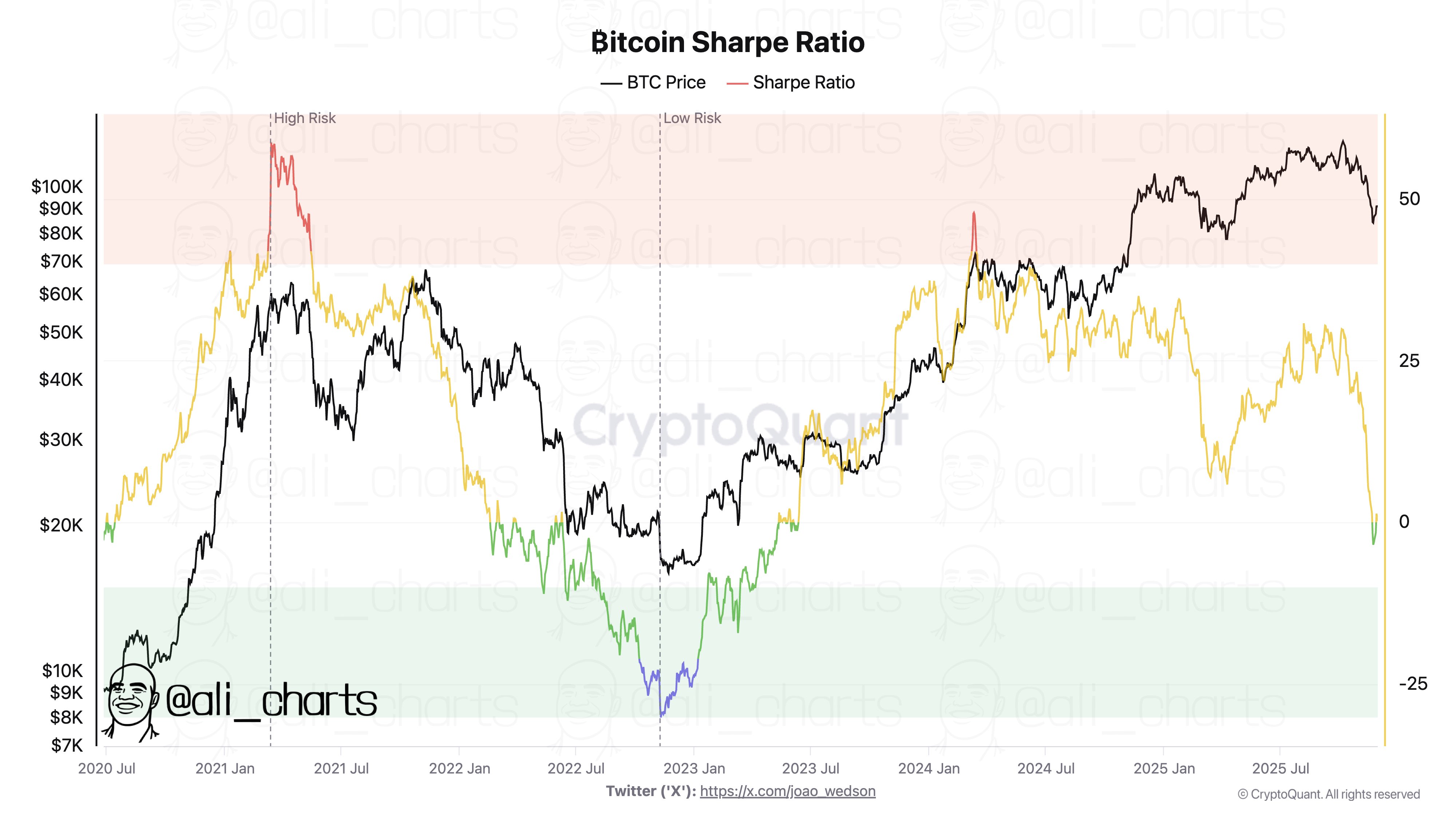

In a November 29 publish on the social media platform X, crypto analyst Ali Martinez revealed that the Bitcoin value may be getting into a “low-risk” zone. In accordance with the market pundit, this low-risk space has usually supplied strong potential shopping for alternatives for traders.

This analysis revolves across the Sharpe Ratio, an on-chain indicator that assesses the risk-adjusted returns of a selected crypto asset (Bitcoin, on this case). This metric principally evaluates the quantity of revenue an funding affords per unit of threat (contemplating threat is measured by volatility).

Sometimes, a rising Sharpe Ratio signifies the next risk-adjusted efficiency, which means the asset generates better returns in comparison with the chance undertaken. Alternatively, when this metric is in a downward development, it implies that the coin is in a “lower-risk zone” and the returns have gotten much less important.

Supply: @ali_charts on X

As proven within the chart above, the Bitcoin Sharpe Ratio has been on a pointy downturn, approaching the low-risk area (the inexperienced space). Inside this space, the market chief tends to supply decrease returns and is commonly much less prone to sudden volatility-driven value actions.

Traditionally, the low-risk zone has been the place long-term traders “purchase the dip,” as they appear to make much less dangerous choices available in the market. Furthermore, as noticed within the highlighted chart, the Bitcoin value bottomed out (as seen in late 2022) when the Sharpe Ratio entered the low-risk zone.

In essence, the Bitcoin value could possibly be getting ready for a market rebound because the Sharpe Ratio hovers round and under the zero threshold.

Bitcoin Coinbase Premium Hole Flashes Inexperienced Once more

One other on-chain metric that provides additional credence to the Bitcoin value rebound speculation is the Coinbase Premium Hole. This indicator measures the distinction between the BTC value on the US-based Coinbase trade (USD pair) and the worldwide Binance trade (USDT pair).

Supply: @JA_Maartunn on X

When the Coinbase Premium Hole is constructive, prefer it at present is, the metric implies that US-based traders are shopping for Bitcoin aggressively. In the end, this demand strain from American traders might present the buoy that the Bitcoin value at present wants.

As of this writing, the worth of BTC stands at round $90,940, reflecting a mere 0.4% soar previously 24 hours.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

_id_c0ada7b0-18f7-48ab-9a54-50f27b579857_size900.jpg)