It has been a difficult few weeks within the markets for traders. From a significant tech sell-off to bitcoin tumbling greater than 30%, current strikes have left many questioning whether or not this ferocious bull market is nearing its finish. There aren’t many traders who wouldn’t chew your hand off for an end-of-year rally, besides possibly Michael Burry. The star investor not too long ago warned in opposition to extreme market euphoria and, with quick positions in Nvidia and Palantir, is clearly betting on headwinds for the AI hype.

Tales like these gas the controversy within the markets, that are at the moment divided between hopes for a rally and considerations about valuations and market bubbles. Burry’s bets have left query marks for traders, and the current sell-off throughout threat belongings has some traders on edge. So, what actually issues proper now? Let’s discover out.

After a risky stretch for threat belongings, traders are hoping for a year-end increase, however valuations are wanting stretched.

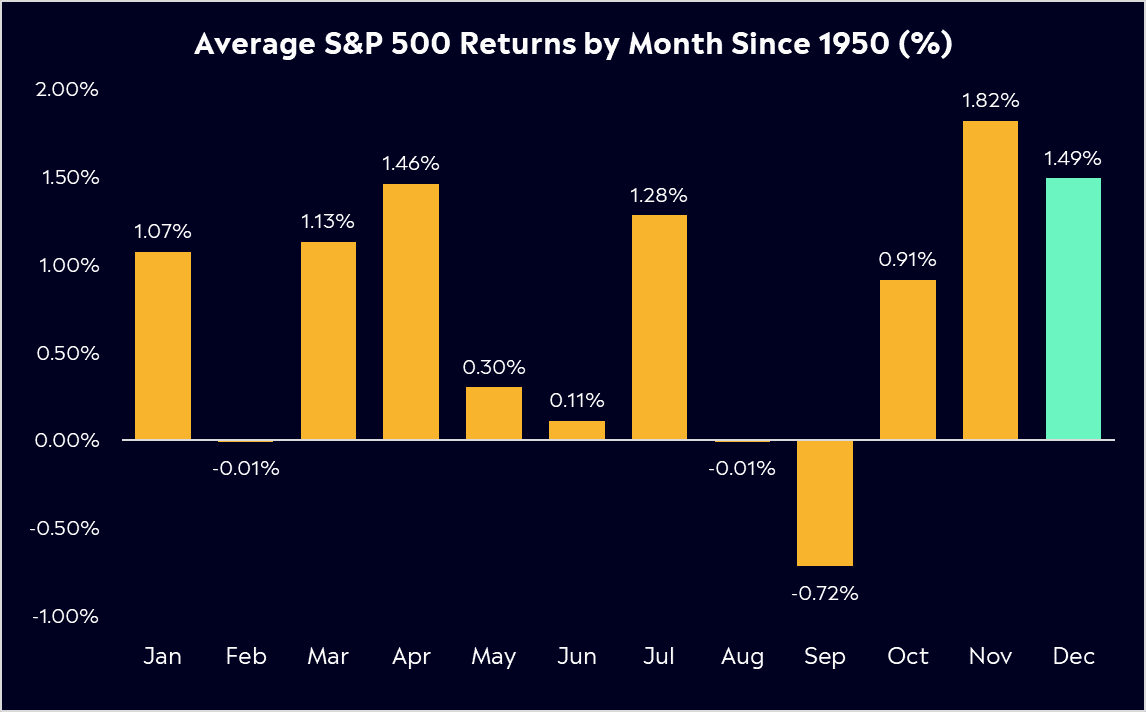

Historic knowledge exhibits an actual Santa Rally exists, with November and December one of the best performing months on common since 1950.

With markets divided between optimism and warning, staying diversified and targeted on high quality is vital heading into 2026.

Investor Psychology

There is no such thing as a doubt that it’s been an ideal yr for markets. On Wall Avenue, the S&P500 is up 15%, whereas the Nasdaq has rallied 20% and in Asia, the Dangle Seng has delivered an enormous 29%. These returns are increased than historic averages, displaying how sturdy 2025 has been. Because the yr attracts to a detailed, investor psychology is now taking centre stage. Hardly anybody desires to promote and doubtlessly miss out on a year-end rally, usually dubbed the ‘Santa Rally’. This might make the market extra emotional and fewer rational. A “purchase the dip” mentality is more likely to prevail, with traders viewing pullbacks as a chance fairly than a warning signal, a development we’ve seen all through this yr.

It’s necessary to keep in mind that pullbacks are regular, and volatility is normal. Since 1974, the S&P 500 has averaged three pullbacks of 5% or extra every year, whereas the typical intra-year pullback is roughly 14%. We’ve seen 5 corrections (10% declines from peak to trough) within the final 9 years, and since 1974, the S&P 500 has returned over 24% on common following a correction.

*Previous efficiency isn’t an indicator of future outcomes

Causes for Optimism: The Bull Case

Regardless of the current noise and cautionary voices, there are stable causes for bullish optimism. Fundamentals, seasonality, and the macroeconomic local weather at the moment recommend a continuation of the rally or at the least steady costs till the top of the yr. Inflation, though nonetheless risky, seems to be largely underneath management, and US tariff coverage has not triggered a brand new surge in inflation. Because of this rates of interest might be minimize additional subsequent yr.

Company earnings have additionally delivered the products. The third-quarter earnings season was broadly sturdy. Within the US, S&P 500 firm income are on observe to rise about 14% from a yr earlier, with a powerful majority of corporations beating expectations. This stable efficiency underpins the market’s beneficial properties with actual earnings progress, not simply hype. Wanting forward, analysts stay optimistic that earnings will proceed to climb into 2026. Forecasts name for double-digit revenue progress subsequent yr, roughly +13% for US corporations, as soon as once more supporting the bull case into subsequent yr.

Seasonality provides additional wind at traders’ backs. The top of the yr is traditionally a robust interval for equities. Since 1950, December has been among the many finest months for the S&P 500, averaging beneficial properties of 1.5%. This seasonal development, usually dubbed the “Santa rally,” bolsters investor confidence, it’s a sample many are wanting to see repeat. The widespread denominator is the repositioning of traders for a brand new yr. Wanting forward 12 months, and when markets are inclined to rise, allocations are normally constructive. This may very well be particularly sturdy this yr.

All these components, from benign inflation, supportive central banks, sturdy earnings, a seasonally good interval, and a respite from unhealthy information, make a compelling case that the rally can proceed or at the least maintain its floor by means of December.

*Previous efficiency isn’t an indicator of future outcomes

Causes for Warning: The Bear Case

On the flip aspect, it could be naive to be blindly complacent and never take into consideration causes to be cautious as we method year-end. Firstly is valuations. The S&P 500 now trades round 23 occasions ahead earnings, a valuation a number of close to its highest stage in a long time, and nicely above the index’s 10-year common of round 18-19. What does that imply in easy phrases? A variety of excellent news is already baked into share costs. When valuations are elevated, markets turn into extra fragile, and traders are fast to react to any disappointment since there’s much less margin for error.

A lot of that excellent news has stemmed from the AI hype. There’s no denying that pleasure round synthetic intelligence has been a large driver of shares, with AI-related shares accounting for a substantial proportion of the S&P 500’s returns since 2022. Tech giants are investing a whole lot of billions of {dollars} to drive the AI revolution. Traders are basically paying up now for the promise of AI riches later. It stays to be seen whether or not these huge AI investments will translate into long-lasting income.

Added to this are political uncertainties. The US authorities shutdown is the longest in historical past and will weigh on market confidence. A fee minimize in December now appears to be like unlikely, with the likelihood now solely round 15%. Markets are strolling a positive line between euphoria and overvaluation. The upper the valuation, the extra delicate traders may very well be to detrimental surprises. Minor pullbacks can be wholesome, however bigger corrections would wish a transparent set off.

Navigating the Dangers

One factor that I at all times remind traders is that uncertainty is a continuing in markets, it by no means actually goes away and accepting that’s a part of the investing mindset.

One key level is that large market volatility normally has catalysts; it doesn’t come out of nowhere. Sharp swings are usually sparked by surprises that catch the group off guard, maybe a sudden earnings miss, an sudden coverage transfer, or an exterior shock like a geopolitical battle. Whereas we are able to’t predict these occasions, we are able to typically put together for them.

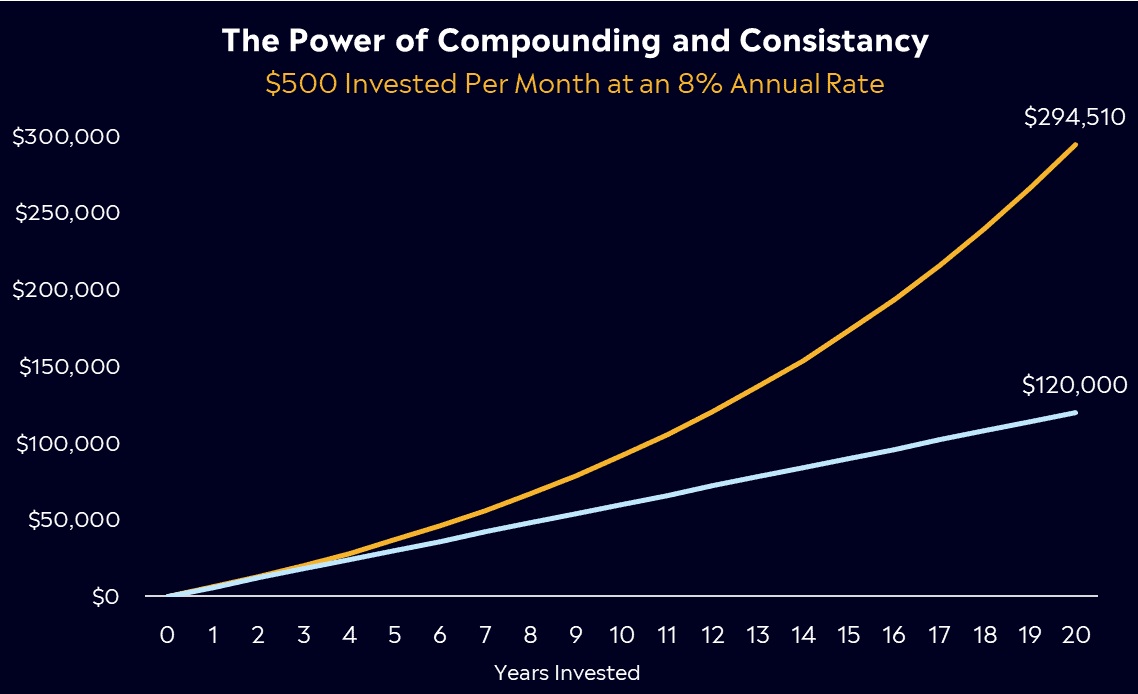

If in case you have a long-term investing plan, keep it up. A plan helps traders follow the great concepts they got here up with throughout calmer occasions. Those that constantly add to their long-term inventory publicity are inclined to do nicely over time. Promoting investments in a panic can lock in losses. Traditionally, markets rebound, and people who keep invested usually profit from the restoration.

The present volatility highlights the significance of diversification in an funding portfolio. By spreading investments throughout a wide range of belongings, diversification reduces the impression of any single asset’s poor efficiency. In occasions of market turbulence, not all sectors or particular person shares react the identical manner; some could even see beneficial properties, which may help offset losses in different areas. This technique smooths out the volatility in a portfolio, offering a steadier return over time and main to higher risk-adjusted returns.

Let’s take an S&P500 ETF for example, reminiscent of SPY, VOO, or IVV. One of these ETF invests within the 500 largest publicly traded corporations within the US, providing broad market publicity. The S&P500 consists of a variety of industries reminiscent of expertise, healthcare, finance, and shopper items, which signifies that the ETF is inherently diversified throughout a number of sectors. Throughout the S&P500, completely different sectors carry out in another way primarily based on varied financial situations. As an example, throughout a pullback within the expertise sector, different sectors like utilities or shopper staples could carry out higher, thereby cushioning the general impression on the ETF.

*Previous efficiency isn’t an indicator of future outcomes

The Backside Line for Traders

Excessive valuations are not any purpose to panic, but it surely’s necessary to notice that they do make markets weak to disappointments or shocks. That’s why I imagine the mantra needs to be certainly one of cautious optimism. Let income run, however it is a good second to critically assessment your holdings. Be sure to’re concentrated in corporations with stable fundamentals, companies which have tangible earnings, sturdy stability sheets, and actual aggressive benefits. Particularly, give attention to corporations that may convert innovation into income. It’s one factor for an organization to have a flashy new expertise or product; it’s one other for that innovation to truly generate sustainable earnings.

Whether or not we in the end get a textbook year-end rally or not is of little consequence to the affected person, long-term investor. If shares proceed to climb by means of December, that’s a welcome bonus. If the rally fizzles or a brief pullback happens, it’s not the top of the world; it may even be a chance to choose up high quality belongings at barely higher costs.

Stay optimistic, however stay vigilant sufficient to guard your self from draw back. Cautiously optimistic is the candy spot. After a yr of sturdy returns, it’s time to calibrate your technique. The year-end rally can be good, and it could very nicely come to fruition. But when it doesn’t, keep in mind that investing is a protracted sport. Those that keep level-headed and targeted on fundamentals would be the actual winners when the mud settles and the following yr begins.

This communication is normal data and schooling functions solely and shouldn’t be taken as monetary product recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary product. It has been ready with out taking your aims, monetary state of affairs or wants under consideration. Any references to previous efficiency and future indications usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.