You don’t have to grasp each chart sample or predict each transfer to achieve crypto buying and selling. What you do want is a method that matches your targets, threat tolerance, and out there time. The cryptocurrency market is quick, unstable, and in contrast to some other asset class—so your strategy have to be particular, not normal. This information provides you a transparent, structured have a look at each passive and energetic cryptocurrency buying and selling methods, so you’ll be able to select, adapt, and check the best technique for long-term success.

Why It Is Necessary To Have a Cryptocurrency Buying and selling Technique

The cryptocurrency market strikes quick. Costs shift inside minutes, typically with out clear trigger. Should you commerce with out a technique, you’re reacting to noise, not information. That results in inconsistent outcomes and preventable losses.

A method defines when to enter, exit, and sit out. As a substitute of guessing, you’ll be following a technique. That is important in a market the place value actions are sharp and frequent. Methods additionally offer you one thing to measure. With out a system, you’ll be able to’t inform whether or not your beneficial properties come from ability or luck. With one, you’ll be able to consider and enhance primarily based on precise efficiency.

Monetary markets reward consistency. In crypto, that consistency will depend on a transparent buying and selling strategy.

Learn extra: Crypto Buying and selling 101.

Passive Methods for Lengthy-Time period Crypto Holders

Passive methods work nicely within the unstable crypto market. You’re not making an attempt to time each transfer: as a substitute, you deal with long-term development and cut back the influence market sentiment has in your choices. Profitable merchants typically mix passive strategies with disciplined threat administration. These approaches are easy in idea however require endurance and consistency to carry out nicely over time.

HODLing (Maintain On for Expensive Life)

HODLing (Holding On for Expensive Life) is the act of shopping for and holding a cryptocurrency over a protracted interval, no matter market volatility. The purpose is to learn from long-term appreciation of the underlying asset, assuming that its fundamentals will strengthen over time. However this technique isn’t simply to “purchase and overlook.” It entails particular resolution factors.

You usually enter a HODL place after researching an asset’s fundamentals like community exercise, token provide limits, growth progress, or institutional curiosity. For instance, merchants might purchase Bitcoin after main protocol upgrades or accumulation by public corporations, fairly than merely shopping for throughout hype-driven rallies.

As soon as a place is opened, it’s typically saved in a safe chilly pockets (like Ledger or Trezor) to keep away from alternate threat and discourage impulsive promoting. Common portfolio critiques are restricted (typically a couple of times a 12 months) so that you don’t react to short-term crypto market volatility. Some merchants set profit-taking guidelines to promote parts at key value milestones or when portfolio weight exceeds a set restrict, however others maintain till a broader macro sign or private monetary purpose is reached.

Learn extra: The Greatest Chilly Crypto Wallets.

HODLing is efficient for many who lack the time or don’t wish to monitor markets each day. It fits merchants who consider within the long-term potential of their crypto belongings, belief the challenge’s trajectory, and settle for excessive drawdowns throughout bear markets as a part of the cycle.

Greenback-Price Averaging (DCA)

Greenback-Price Averaging (DCA) is a technique the place you make investments a hard and fast sum of money right into a digital asset at common intervals, no matter its present value. This spreads your entry factors throughout time, lowering the chance of investing a lump sum at a market peak. It’s particularly helpful within the cryptocurrency market, which is understood for sudden, excessive value actions.

You don’t want automated instruments to make use of DCA successfully. Whereas many exchanges supply recurring purchase options, you’ll be able to handle the method manually with the identical consequence. What issues is consistency and self-discipline. Right here’s how the technique is normally utilized:

Select a number of crypto belongings primarily based on elementary analysis, reminiscent of long-term utility, growth exercise, or token provide fashions.

Determine on a hard and fast funding quantity—reminiscent of $100, €200, or 0.01 BTC—and apply it at constant time intervals (e.g. weekly, bi-weekly, or month-to-month).

Execute trades manually or via scheduled buys on platforms like Binance, Coinbase, or Kraken. Guide execution provides extra management, automation ensures self-discipline.

Observe your common price foundation over time utilizing portfolio instruments or spreadsheets. This allows you to perceive how a lot you’ve really paid for every unit of the asset.

Periodically overview the asset’s fundamentals or your monetary targets, and pause or redirect contributions if situations change.

DCA advantages merchants preferring routine over energetic evaluation. It’s nicely suited to individuals incomes revenue recurrently, who need publicity to crypto belongings with out inserting massive one-time bets. It additionally works as a hedge in opposition to the emotional impulse to time the market: a mistake even skilled merchants make.

To study extra about DCA, learn our devoted article.

Energetic Crypto Buying and selling Methods

Energetic buying and selling entails frequent, hands-on decision-making to benefit from short-term value actions. Not like passive investing, these cryptocurrency buying and selling methods depend on timing, precision, and technical indicators. You could perceive the right way to learn charts, interpret patterns, and execute rapidly, typically throughout a number of trades per day or week.

Day Buying and selling

Day buying and selling is an energetic buying and selling technique the place you open and shut positions throughout the identical day to revenue from short-term value actions. Not like long-term investing, crypto day buying and selling focuses on small fluctuations that happen over minutes or hours. You’ll typically place a number of trades in a single session, and their success will depend on pace, self-discipline, and technical evaluation.

This technique is finest fitted to you for those who can monitor markets intently and act rapidly. Day buying and selling works finest in markets with excessive buying and selling quantity and liquidity, like BTC/USDT or ETH/USD pairs on main exchanges.

To commerce successfully, it is advisable to use technical indicators. These instruments enable you establish entry and exit factors primarily based on chart information. One of the crucial broadly used is Shifting Common Convergence Divergence (MACD). It compares two shifting averages of an asset’s value (normally 12-day and 26-day EMAs) to establish momentum shifts. A typical MACD crossover—when the MACD line crosses above the sign line—can point out a purchase alternative. The reverse suggests an opportunity promote.

Different instruments utilized in day buying and selling embrace:

Candlestick patterns, which present value path and market sentiment

Quantity evaluation, which confirms breakout energy or indicators exhaustion

Help and resistance ranges, which outline potential reversal zones

Learn extra: Chart Patterns Each Crypto Dealer Ought to Know.

Crypto day buying and selling is dangerous. You’re uncovered to slippage, charges, and false indicators, particularly in unstable markets. You additionally want an outlined threat administration plan, normally involving stop-loss orders to restrict draw back per commerce. A typical rule is to threat not more than 1–2% of your buying and selling capital on any single place.

Earlier than you begin, outline your buying and selling type. Will you commerce trending belongings, or deal with volatility spikes? Are you scalping small strikes or holding for multi-hour patterns? Every selection impacts which indicators and setups you’ll use.

Swing Buying and selling

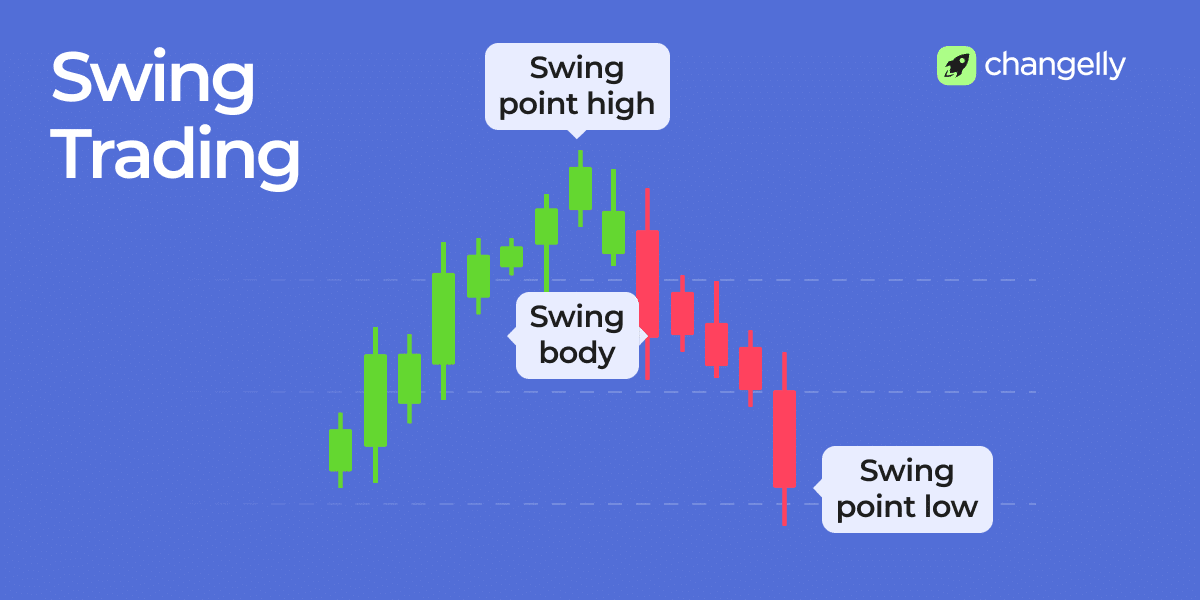

Swing buying and selling captures value strikes that develop over days or perhaps weeks. It sits between day buying and selling and long-term investing. You goal to enter at first of a development and exit earlier than it reverses.

Swing merchants depend on indicators like 50-day and 100-day Easy Shifting Averages (SMA), Fibonacci retracement ranges, and quantity breakouts. A typical setup may embrace shopping for an asset after a confirmed breakout above resistance, then holding it so long as the asset maintains increased highs and better lows. Indicators like MACD crossovers and RSI divergences will help affirm entry or exit indicators.

You normally maintain fewer positions however apply extra thorough evaluation to every. Since trades can final a number of days, swing buying and selling fits you for those who can’t sit at your display screen all day however nonetheless wish to act on short- to mid-term traits. It’s additionally much less delicate to intraday volatility, making threat administration extra predictable.

Scalping

Scalping goals to revenue from very small value adjustments that happen over seconds or minutes. You may enter and exit dozens and even lots of of trades in a single day. Success will depend on tight spreads, quick execution, and low charges.

This technique requires you to observe order e book depth, tick-level value actions, and real-time quantity spikes. Scalpers typically use 1-minute or 5-minute charts, and instruments just like the VWAP (Quantity Weighted Common Value) or Bollinger Bands to establish ultra-short-term imbalances.

You could place trades with precision—typically utilizing market orders for pace—and instantly minimize losses when a setup fails. Because the revenue per commerce is minimal, scalping solely works in case your platform presents excessive liquidity and really low charges. It’s supreme for merchants who thrive in high-speed environments and may make fast choices with out hesitation.

How one can Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero price

Development Buying and selling

Development buying and selling entails figuring out and buying and selling within the path of a sustained market transfer. You don’t attempt to catch tops or bottoms, you goal to journey the center of the development, the place momentum is strongest.

Frequent instruments embrace the 200-day SMA for long-term development affirmation, the ADX (Common Directional Index) to measure development energy, and value channels or trendlines to outline construction. You may go lengthy when value breaks above a downtrend line on sturdy quantity, with affirmation from RSI holding above 50.

Development merchants keep in trades so long as the development stays intact. You exit solely when technical indicators—like decrease highs forming, MACD reversal, or quantity fading—recommend weakening momentum. This technique fits you for those who’re affected person, desire fewer choices, and are comfy holding positions for days or perhaps weeks.

Relative Power Index (RSI)

The RSI is a momentum oscillator that helps you notice overbought or oversold situations. Readings above 70 typically sign that an asset is overbought, whereas readings under 30 recommend it might be oversold.

RSI isn’t only for recognizing reversals. You should use RSI trendlines, divergences (the place value makes new highs however RSI doesn’t), and RSI crossovers (e.g., RSI strikes from under 30 to above) to time entries. Many day and swing merchants mix RSI with MACD or shifting averages to keep away from false indicators.

For instance, if Bitcoin’s RSI drops under 30 throughout a robust uptrend after which reverses again above 30, it may sign a short-term shopping for alternative. RSI is beginner-friendly, however efficient sufficient for extra superior setups, particularly when filtered with different indicators.

Arbitrage

Arbitrage takes benefit of value variations throughout exchanges. For instance, if ETH is buying and selling at $3,050 on Coinbase and $3,080 on Binance, you might purchase on the cheaper platform and promote immediately on the opposite for a close to risk-free revenue—assuming low sufficient charges and quick transfers.

There are a number of varieties of arbitrage:

Spatial arbitrage: Between completely different exchanges

Triangular arbitrage: Between buying and selling pairs on the identical alternate

Statistical arbitrage: Utilizing algorithms to identify value inefficiencies

To make use of this technique, you want entry to a number of exchanges, quick execution, and ideally automated buying and selling instruments or bots. Spreads are sometimes small, and income per commerce are low, so you have to execute with excessive quantity and pace. Blockchain transaction occasions, charges, and withdrawal limits can cut back income, making execution probably the most important half.

Arbitrage isn’t for everybody—it fits technically expert merchants who can construct or function bots, monitor latency, and react rapidly. However in periods of excessive crypto market volatility, worthwhile value gaps can seem often, particularly on smaller exchanges or illiquid belongings.

How one can Select the Proper Buying and selling Technique

The crypto market strikes sooner than conventional monetary markets, and never each technique suits each dealer. Selecting the best one means understanding how a lot time, threat, and evaluation you’re ready to deal with. It’s not (no less than, not all the time) about choosing probably the most worthwhile technique. It’s about selecting the one you’ll be able to execute persistently.

Assess Your Time Availability

How typically are you able to commerce? Should you can’t monitor markets all through the day, overlook day buying and selling. Crypto strikes quick, and lacking even just a few hours can break a setup.

With restricted time, passive strategies like DCA or weekly swing buying and selling are extra life like. They deal with broader value actions, not short-term indicators.

Contemplate Your Threat Tolerance

Not everyone seems to be constructed for high-risk buying and selling. Scalping and leverage-based methods don’t simply supply fast rewards, however faster losses, too. If volatility makes you second-guess each resolution, lean towards longer-term methods tied to elementary evaluation. Select setups the place time, not timing, works in your favor.

Are You Extra Analytical or Intuitive?

Your decision-making type shapes what sort of crypto technique you’ll be able to persist with.

Should you’re analytical, you’ll doubtless desire structured, rule-based programs. Methods that depend on technical evaluation—like day buying and selling, scalping, or development buying and selling—will really feel extra pure. You’ll base trades on indicators like MACD, RSI, and value patterns, not subjective opinions.

Should you’re extra intuitive, you’re most likely drawn to momentum shifts, narratives, and macro traits. You may reply sooner to constructive information, social sentiment, or adjustments in market tone. In that case, methods like HODLing, swing buying and selling, or event-driven trades might swimsuit you higher.

Combining Passive and Energetic Methods

You don’t must commit to 1 technique. You may, for instance, maintain a long-term portfolio (BTC, ETH) and actively commerce altcoins on the facet. This hybrid strategy provides flexibility. It permits you to handle threat via passive holdings whereas nonetheless utilizing technical evaluation to behave on short-term alternatives when time permits.

Crypto Buying and selling Technique Suggestions

Even with a stable crypto buying and selling technique, small execution errors can spoil your outcomes. The cryptocurrency market is quick, sentiment-driven, and infrequently irrational. The following pointers deal with often-overlooked however sensible changes that may enable you make higher buying and selling choices and keep away from frequent traps.

Keep away from buying and selling instantly after main token unlocks or vesting occasions: they typically set off unpredictable value strikes that don’t align with chart patterns. Monitor unlock schedules through instruments like TokenUnlocks or challenge docs.

Use buying and selling quantity as affirmation, not simply value: a breakout with out rising quantity normally lacks energy. Actual strikes in crypto are sometimes pushed by coordinated shopping for.

Keep out of low-liquidity pairs, even when the chart appears good: slippage can flip a successful setup right into a loss. Liquidity issues extra in crypto than in lots of conventional markets.

Observe funding charges on perpetual futures: extraordinarily constructive or unfavorable charges reveal crowd positioning. This offers you beneficial insights into investor sentiment earlier than making buying and selling choices.

Backtest your setups throughout completely different market situations: a method that works in a bull cycle may break down in sideways or bear markets. Backtesting with historic information retains you sincere.

Use alerts as a substitute of screen-watching: instruments like TradingView allow you to set customized alerts for particular value ranges or indicator crossovers, so that you react solely when wanted.

All the time outline invalidation earlier than entry: know precisely what situation would show your commerce thought improper. That’s your cease—not a guess primarily based on how a lot you’re keen to lose.

Attempt the “moonbag” technique: take income after vital beneficial properties whereas leaving a smaller portion of your funds in a “moonbag” (in your pockets) for an opportunity of benefiting from any potential future rallies.

Closing Phrases

No technique works on a regular basis, however the best one for you’ll doubtless work more often than not. Whether or not you’re monitoring small value actions or constructing a portfolio for the lengthy haul, consistency and self-awareness matter greater than making an attempt to outsmart the market.

The cryptocurrency market rewards readability and punishes guesswork. By understanding your buying and selling type, setting limits, and committing to a number of well-defined cryptocurrency buying and selling methods, you’re not simply reacting to volatility, you’re managing it. That’s the actual edge on this asset class.

FAQ

Which crypto buying and selling technique is the most effective for learners?

Greenback-Price Averaging (DCA) is probably the most beginner-friendly as a result of it avoids the necessity to time small value actions. It means that you can construct a place steadily with out reacting to short-term investor habits.

How a lot cash do I would like to begin buying and selling crypto?

You can begin with as little as $10–$50 on most exchanges, however no less than $100–$500 is extra sensible for making use of actual cryptocurrency buying and selling methods and masking charges whereas managing threat correctly.

What instruments or indicators ought to I study first for technical evaluation?

Begin with Relative Power Index (RSI) and Shifting Averages, as they’re easy however efficient for figuring out traits and momentum. These instruments enable you perceive frequent setups behind frequent beneficial properties and losses.

What number of methods are there in crypto buying and selling?

There are no less than 6–8 core methods, together with day buying and selling, swing buying and selling, scalping, development buying and selling, arbitrage, DCA, and HODLing. Every one displays completely different targets, timeframes, and investor habits.

Disclaimer: Please observe that the contents of this text are usually not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.