The POL worth debate is getting into a brand new chapter as analysts query whether or not Polygon’s long-anticipated “stablecoin supercycle” might be the catalyst that reverses its sluggish market efficiency. With stablecoin adoption exploding throughout banks, fintech platforms, sovereign issuers, and commerce networks, Polygon finds itself positioned on the heart of a trillion-dollar transformation.

The query now could be easy: can this supercycle drive sufficient demand, liquidity, and real-world utility to reignite POL’s long-term worth? Early alerts counsel that the reply might rely on how briskly (and the way extensively) international establishments challenge tokenized cash over the next years.

7d

30d

1y

All Time

Is the Stablecoin Supercycle Actual and Why Does It Matter for Polygon?

The “stablecoin supercycle” is now not a fringe concept. Polygon’s World Head of Funds and RWA, Aishwary Gupta, forecasts that over 100,000 stablecoins shall be issued by 2030, not simply by crypto-native corporations but additionally by banks, companies, sovereign governments, and international commerce platforms. This marks a shift from speculative crypto to infrastructure-level digital cash.

LATEST: We’re firstly of a stablecoin "tremendous cycle" that would see over 100,000 completely different stablecoins created inside 5 years, Polygon's international head of funds & RWA, Aishwary Gupta, instructed The Fintech Occasions. pic.twitter.com/EWfWvudELV

— CoinMarketCap (@CoinMarketCap) November 29, 2025

The drivers of this development are highly effective. Banks must cease capital flight into higher-yield on-chain property. Companies need closed-loop currencies that retain shopper worth. Nations goal to strengthen their financial methods by tokenizing their very own secure models. Even shopper apps need to eradicate card-network charges by minting inside digital currencies.

Gupta argues the narrative is misunderstood: stablecoins don’t weaken financial management; they improve it, as USD stablecoins have boosted international greenback demand. Banks will probably challenge their very own deposit tokens, permitting customers to transact on-chain with out transferring funds off-balance sheet. As competitors will increase, hundreds of tokens emerge, and the market fragments – creating a necessity for impartial settlement layers.

Stripe is now rolling out USD-settled stablecoin funds throughout Ethereum, Base, and Polygon pic.twitter.com/7yLghL28vS

— Adam | RWA.xyz (@adamlawrencium) December 7, 2025

That is the place Polygon’s stack shines. With ultra-low charges (underneath $0.002), scalable throughput, and integrations throughout Visa, Stripe, Shopify, and Revolut, Polygon already processes 3M transactions per day and holds over $1.24B in stablecoin provide. If the supercycle turns into actuality, Polygon turns into one of many international highways for tokenized cash.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Can Polygon Seize Sufficient of the Stablecoin Crypto Increase to Rework Its Ecosystem?

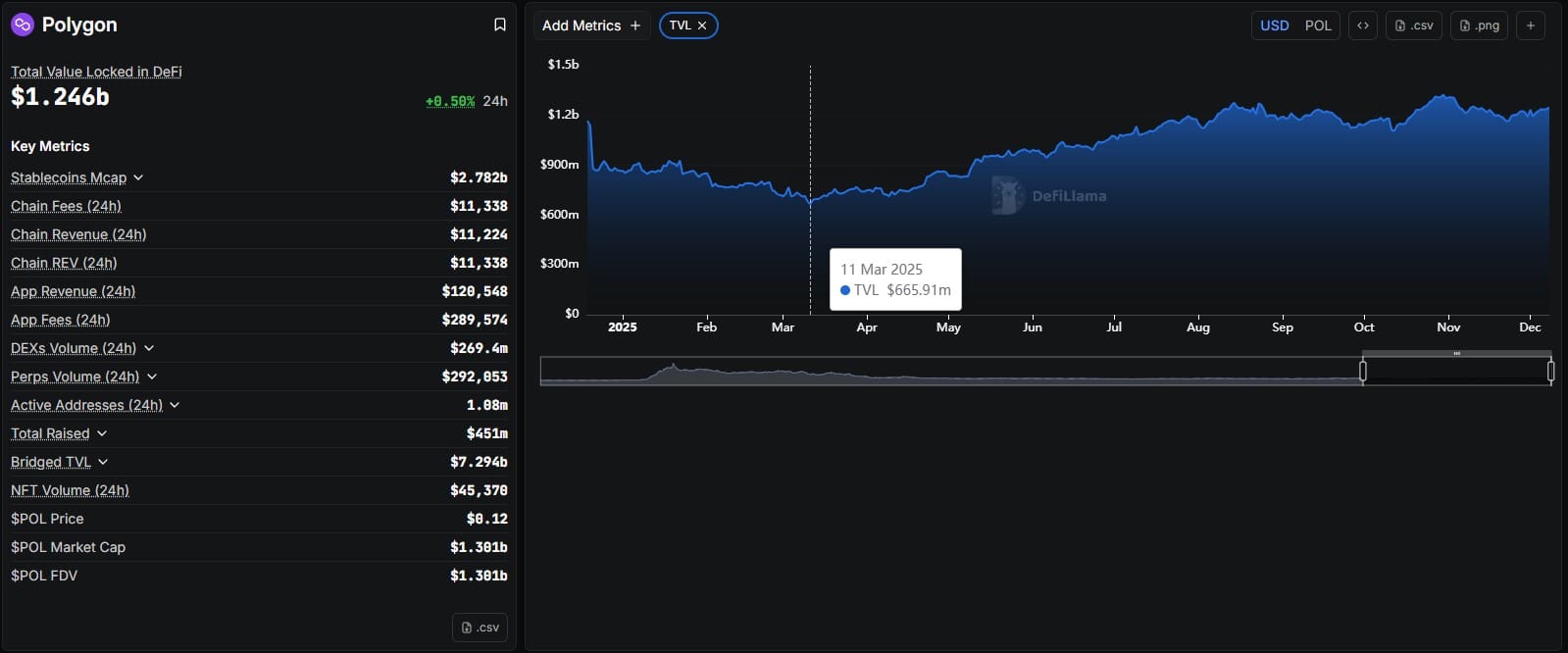

Polygon has quietly turn out to be a spine for real-world funds flows. The community processed $4.3Bn in Q2 2025, instructions 32% of all international USDC P2P transfers, and has added roughly $700M in new TVL this 12 months. With the AggLayer anticipated to unify liquidity throughout chains, Polygon might turn out to be the settlement mesh for hundreds of interoperable stablecoins transferring throughout apps, banks, and markets.

(Supply – DeFiLlama)

This is able to dramatically enhance POL’s financial mannequin. Staking POL secures the community, earns price income, and positions the token because the core asset backing Polygon’s multi-chain structure. A surge in stablecoin velocity would immediately improve charges and community exercise – key components for a sustainable worth restoration.

But market sentiment stays combined. With POL buying and selling close to $0.12, many predictions are bearish or stagnant, citing layer-2 competitors and migration delays. But when the stablecoin supercycle unfolds as Polygon predicts, POL might be one of many largest beneficiaries of the subsequent wave of digital cash.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

POL Worth Prediction: Can Technical and Fundamentals Align?

Regardless of its difficult 12 months, POL worth motion is exhibiting early indicators of stabilization. On the every day timeframe, POL has efficiently defended the $0.12 assist, forming a possible backside and hidden bullish divergence for the reason that October 10 crash.

(Supply – TradingView)

RSI is deep in oversold territory however rising – typically a precursor to energy returning to the market.

The MACD has flipped barely constructive, signaling that sellers are shedding dominance whereas consumers accumulate cautiously. The important thing overhead barrier is the $0.21 stage, which aligns with the 200 EMA and 200 SMA decrease band – a major technical resistance.

(Supply – TradingView)

Zooming into decrease timeframes, POL is compressing tightly beneath a diagonal resistance line, forming a small ascending triangle. This sample typically resolves upward, particularly when paired with oversold momentum and enhancing market circumstances, comparable to BTC reclaiming $90K. A breakout + retest of the $0.21 zone can be the strongest affirmation {that a} sustained rally is underway.

Nonetheless, the quantity stays the lacking ingredient. If the stablecoin narrative accelerates, POL might reclaim greater ranges quicker than many count on.

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Polygon’s World Head of Funds and RWA, Aishwary Gupta, forecasts that over 100,000 stablecoins shall be issued by 2030

Can POL worth reclaim $0.21?

The submit Will Stablecoin Supercycle Save POL Worth Prediction? appeared first on 99Bitcoins.