Crypto exchanges are on-line platforms that provide help to purchase and promote digital property, together with cryptocurrencies and decentralized finance (DeFi) tokens. They perform like conventional inventory exchanges or safety brokers, offering customers with varied instruments to execute crypto trades.

On this article, we’ll run you thru the idea of cryptocurrency exchanges, their varieties, and the way they function. We’ll additionally cowl the outstanding exchanges and the components to think about when selecting a digital asset buying and selling platform.

What Is a Crypto Trade?

A crypto trade is a digital platform that facilitates the shopping for and promoting of digital currencies powered by blockchain know-how. It’s hosted by entities or corporations that assist customers commerce a number of cryptocurrencies from a single platform. You can too commerce different property resembling non-fungible tokens (NFTs) and fiat currencies by way of crypto exchanges.

Moreover, sure exchanges provide DeFi companies like staking, lending, and liquidity mining to assist crypto traders generate passive earnings.

Furthermore, many exchanges assist several types of crypto buying and selling. These embody spot, margin, peer-to-peer (P2P), over-the-counter (OTC), and derivatives (futures and choices) buying and selling. Additionally they present superior instruments, market reviews, reside costs, and studying sources to assist customers make the precise funding choices.

Some cryptocurrency exchanges additionally facilitate copy buying and selling. This function helps customers, particularly learners, emulate the buying and selling methods of consultants to garner income.

Nevertheless, most platforms strictly require contributors to commerce digital currencies in pairs. Solely particular exchanges like Binance permit customers to purchase (on-ramping) and promote (off-ramping) digital property utilizing a number of fiat currencies.

How Do Cryptocurrency Exchanges Work?

Whereas crypto exchanges are tailor-made to digital currencies like Bitcoin and Ethereum, they function like conventional inventory and commodities exchanges.

Usually, cryptocurrency exchanges facilitate transactions by matching consumers and sellers. They preserve an order ebook, which lists and types purchase and promote orders by meant buy and sale costs.

While you place a purchase order, the platform’s matching engine appears for a competing promote order from one other consumer. It searches primarily based on the required lot measurement and one of the best executable worth.

As soon as matched, the transaction is carried out. You switch funds into the vendor’s crypto pockets in fiat foreign money or cryptocurrency, primarily based on the buying and selling pair. Conversely, the vendor transfers the bought digital asset into your digital pockets. The trade follows the identical course of for promote orders.

Sorts of Cryptocurrency Exchanges

Centralized Exchanges (CEXs)

Centralized exchanges are on-line buying and selling platforms which are owned and managed by a specific agency or central authority. They’re much like conventional inventory exchanges, the place central authorities preserve full management over all consumer accounts. Additionally they function intermediaries between consumers and sellers. Furthermore, all transactions should be permitted by the centralized trade. Therefore, customers want to totally belief the trade operator.

Benefits

Deep liquidity: Centralized exchanges have larger liquidity, defending merchants from market manipulations.Simple account retrieval: With CEXs, it’s simpler to recuperate entry to digital property in case you overlook or misplace login credentials. Quicker transactions: CEXs have a better common transaction velocity of 10 milliseconds, making them conducive for high-frequency buying and selling.Superior options: Centralized exchanges provide refined charting instruments and customizable buying and selling interfaces. Additionally they permit customers to leverage their cryptocurrency investments with borrowed funds to spice up potential income.

Disadvantages

Safety dangers: CEXs facilitate billions of trades day by day and retailer consumer knowledge on centralized servers. Thus, they’re sizzling targets for malicious actors. In 2014, Mt. Gox, a number one trade of that point, misplaced 740,000+ Bitcoins to hackers, resulting in its closure.Market manipulation: Some centralized exchanges have been accused of manipulating buying and selling volumes and costs or participating in insider buying and selling. Geographical restrictions: CEXs are often unique to customers inside sure jurisdictions. Customers primarily based in different areas can’t entry the exchanges with out digital personal networks (VPNs).Much less anonymity: Centralized exchanges require customers to finish anti-money laundering (AML) and know-your-customer (KYC) formalities.

Decentralized Exchanges (DEXs)

Decentralized exchanges are autonomous dApps which are constructed on public blockchain networks. In contrast to centralized exchanges, DEXs are usually not operated by a government and don’t retailer consumer knowledge on centralized servers.

Furthermore, decentralized exchanges conform to the core rules of blockchain know-how. They’re ruled by decentralized autonomous organizations and are categorized into the next varieties:

On-chain order books (e.g., Dexalot)Off-chain order books (e.g., dYdX)Automated Market Makers (e.g., Uniswap).

Benefits

Larger safety: Decentralized exchanges run on open-source distributed ledger infrastructure. This distributed internet hosting makes them much less weak to cyberattacks. Self-custody: “Not your keys, not your crypto” is a well-liked adage within the crypto {industry}. It implies that the one who has the personal keys to the account holding the cryptocurrencies is the true proprietor. As DEXs don’t possess personal keys, customers management their digital property, knowledge, and keys. Subsequently, customers’ property are more likely to stay secure even when the trade enters chapter or is hacked. Extra anonymity: Since DEXs foster P2P transactions in a trustless surroundings, you don’t have to replenish know-your-customer (KYC) types. They’re censorship-resistant and provide larger anonymity and privateness for customers.

Disadvantages

Much less user-friendly: DEXs have a fancy consumer interface (UI) and are extra appropriate for seasoned cryptocurrency merchants.Low liquidity: Centralized exchanges allow 99% of crypto transactions. Thus, they’re accountable for a big proportion of the buying and selling volumes. Consequently, DEXs wrestle with liquidity for a lot of token pairs, making them inclined to market manipulations.No blockchain interoperability: DEX customers can not commerce digital property that exist on completely different distributed ledgers with out utilizing further networks or software program. Sensible contract dangers: Poorly coded clever contracts with bugs could be exploited, resulting in losses and unintended outcomes.

Hybrid Exchanges

Hybrid exchanges provide one of the best of each worlds by merging the strengths of centralized and decentralized exchanges. On one hand, hybrid exchanges facilitate centralized order matching. However, they allow decentralized storage of cryptocurrencies. The trade neither controls customers’ digital property nor stops them from withdrawing funds into their crypto wallets.

Benefits

Closed ecosystems: As hybrid exchanges perform as closed ecosystems, organizations can harness blockchain know-how with out compromising knowledge privateness. Higher privateness: Hybrid crypto exchanges safeguard a corporation’s privateness when it’s interacting with the general public or stakeholders. Subsequently, corporations needn’t use personal blockchains for privacy-focused use circumstances.

Disadvantages

Poor liquidity: Hybrid cryptocurrency exchanges are within the fledgling phases of growth. Thus, they lack enough liquidity and buying and selling volumes, leaving them uncovered to cost manipulations. Consequently, you can’t purchase and promote digital property on these exchanges swiftly and should fall prey to malpractices like spoofing.

The right way to Select the Proper Crypto Trade?

1. Repute

Go to aggregator web sites like CoinGecko or CoinMarketCap to seek out an up to date listing of cryptocurrency exchanges. These websites rank exchanges primarily based on buying and selling volumes, liquidity, trustworthiness, and visitors. Choose higher-ranked crypto exchanges as they’re more likely to be respected, extremely liquid, and dependable.

2. Regulatory compliance

The chosen trade should adjust to native and worldwide legal guidelines, resembling Know Your Buyer. It also needs to possess the required licenses to function in each jurisdiction during which it renders companies. Info on its founders and licenses fosters belief, particularly amongst potential prospects.

To know whether or not a CEX is legally compliant, verify the Monetary Crimes Enforcement Community or equal techniques in your nation. When selecting decentralized exchanges, you should solely depend on evaluations and different data sources.

3. Safety

Because the safety of your digital property is paramount, it’s best to solely go for crypto exchanges with potent security options. The chosen trade ought to have safety measures like two-factor authentication(2FA), insurance coverage protection, and chilly storage. It ought to carry out penetration testing, run bug bounty applications, and endure third-party audits recurrently. Moreover, it should preserve proof-of-reserves (PoR). This means that the trade has funds and cryptocurrency reserves to cowl all consumer property 1:1.

4. Charges

Transaction charges are a vital determinant of income. They represent a share of your commerce worth that should be paid to exchanges. For makers (those that present liquidity), the charges are often decrease than these for takers (those that take away liquidity). Equally, transaction charges for spot trades are decrease than these for by-product trades.

Moreover, verify the charges for withdrawing funds into your crypto pockets. Consider if the trade collects deposit charges or hidden prices (e.g., inactivity prices).

5. Person expertise

Choose exchanges with responsive desktop and cell apps which are straightforward to navigate. Their buying and selling interfaces also needs to be intuitive and appropriate for each newcomers and consultants.

6. Choices

It’s best to go for cryptocurrency exchanges that provide quite a few token pairs together with a variety of services. It ought to assist the digital property you like to commerce and supply options that align together with your necessities.

7. Liquidity

The deeper an trade’s liquidity, the quicker trades execute at favorable costs. Thus, it’s best to select platforms with greater buying and selling volumes and order ebook depths.

8. International protection

Crypto exchanges that function in a number of areas worldwide provide broader market entry and deeper liquidity. Additionally they assist customers commerce throughout international locations and time zones seamlessly. Therefore, it’s best to choose a legally compliant world cryptocurrency trade that operates in your jurisdiction. Moreover, verify if it helps your native fiat foreign money for deposits and withdrawals.

Finest Cryptocurrency Exchanges

1. Binance

Binance is a number one centralized trade for buying and selling digital property. Additionally it is the world’s largest crypto trade by buying and selling volumes. It was launched by Chengpeng Zhao, an skilled developer who beforehand constructed buying and selling techniques for the Tokyo Inventory Trade. As of July 2025, Binance serves over 250 million prospects throughout 180+ international locations.

Binance permits cryptocurrency traders to transact in 1400+ spot pairs. It additionally facilitates margin, futures, and choices buying and selling. Furthermore, its P2P market helps 800+ fee choices, whereas the Binance Pockets serves as your on-platform custodial digital pockets.

For newcomers, the trade affords a one-click copy buying and selling performance. You can too automate crypto transactions utilizing the platform’s pre-programmed bots, resembling spot grid, futures TWAP, and so forth.

If you wish to earn passive earnings in your crypto holdings, you’ll be able to discover Binance Earn’s choices. They embody staking, good arbitrage, on-chain yields, and twin funding.

By way of safety, Binance has applied strong measures like two-factor authentication(2FA), anti-phishing codes, and withdrawal whitelists. It additionally maintains a PoR ratio larger than or equal to 100%.

Concerning buying and selling charges, the maker and taker prices for normal customers begin from 0.1% on Binance. Furthermore, BNB holders are eligible for payment reductions.

Lastly, all exchanges on our listing, together with Binance, observe a volume-based or tiered payment construction. Subsequently, the upper your 30-day buying and selling volumes, the upper your VIP tier, and the decrease your transaction charges.

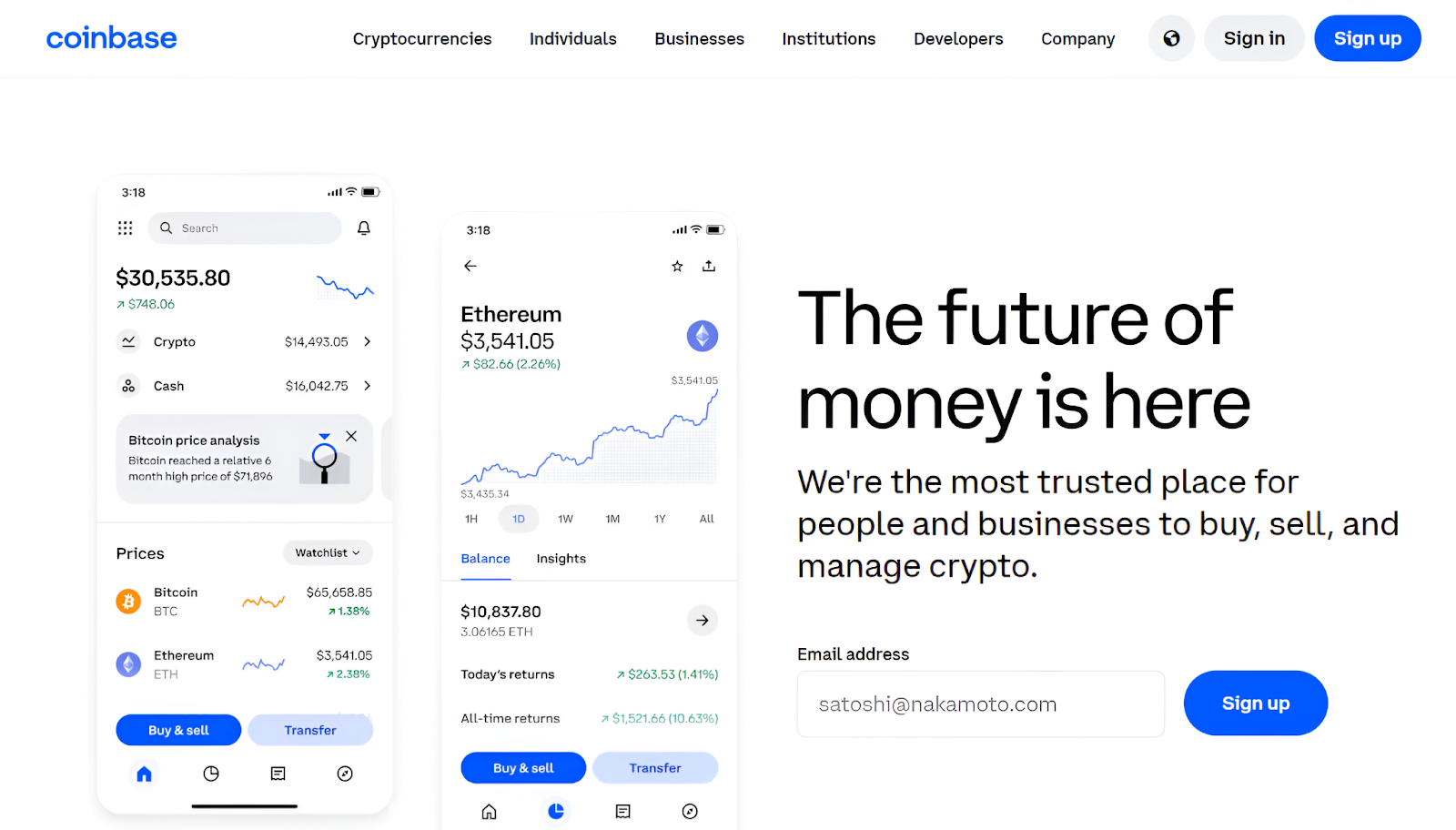

2. Coinbase

Coinbase is a prime cryptocurrency trade, particularly in the USA of America (USA). Additionally it is the most important Bitcoin custodian. Based in 2012 by crypto evangelists Brian Armstrong and Fred Ehrsam, Coinbase goals to advertise financial freedom and operates in 100+ international locations.

Coinbase Pockets can be among the best self-custody crypto wallets. It helps you retailer cryptocurrencies, NFTs, and personal keys in a single place.

On Coinbase Superior, you’ll be able to commerce 550+ spot pairs utilizing superior instruments powered by TradingView. You can too customise the buying and selling interface and leverage a number of technical indicators to establish worthwhile alternatives.

For by-product merchants, Coinbase affords expiry futures and perpetual contracts. It gives entry to elevated leverage and has constructed contracts tailor-made to various threat appetites.

Its safety features embody bug bounty applications, 2FA, PoR, industry-leading encryptions, allowlists, cell biometrics, and multi-approval withdrawals.

Coinbase’s transaction charges are comparatively greater. For customers with 30-day volumes under $10,000, the maker and taker charges are 0.4% and 0.6%, respectively.

3. KuCoin

KuCoin is a well-liked crypto trade, with 900+ listed tokens and 40 million customers throughout 200+ international locations. Established in 2013 by know-how lovers Michael and Eric, Kucoin goals to foster inclusion by making cryptocurrencies accessible to all.

You’ll be able to entry 1280+ token pairs on Kucoin. The trade helps spot, margin, perpetual futures, and choices buying and selling. It additionally permits crypto purchases by way of 70+ fee strategies, together with fiat foreign money deposits.

Furthermore, Kucoin has designed industry-leading safety features to safeguard consumer knowledge and property. These embody multi-factor authentication, machine integrity checks, AI-powered anti-fraud detection, knowledge leak prevention, and PoR. It additionally separates sizzling, heat, and chilly crypto wallets, with a majority of consumer property saved in offline wallets.

Kucoin’s payment construction is comparatively extra complicated. It levies transaction charges primarily based on 30-day volumes in addition to the asset class. Normal customers should pay a 0.1% maker or taker payment for spot buying and selling of sophistication A property. For sophistication B and sophistication C property, the payment will increase to 0.2% and 0.3%, respectively.

4. OKX

OKX is without doubt one of the greatest digital asset exchanges for crypto-to-crypto conversions and DeFi companies. With a big consumer base throughout 100+ international locations, OKX is a extremely liquid digital platform for buying and selling cryptocurrencies. It helps spot, derivatives, and OTC buying and selling, with nominal charges beginning at 0.08% for makers and 0.1% for takers.

A standout facet of OKX is that it lets you swap cryptocurrencies with zero buying and selling charges and no slippage. You can too purchase or promote crypto in its P2P market utilizing 100+ fee choices with out incurring transaction charges.

In case you’re fascinated with buying and selling automations, OKX has a relatively greater variety of good pre-built bots. Moreover, the trade helps customers commerce 300+ property and 490+ energetic cryptocurrency markets on OKX instantly from the TradingView platform.

To guard consumer property, OKX maintains PoR and has engineered a potent safety system. A number of authorizations, air-gapped chilly storage, tackle whitelisting, threat management checks, and dynamic transaction limits are its core options. Moreover, its sizzling crypto wallets retailer personal keys in risky reminiscence.

5. Bybit

Bybit is a prime cryptocurrency trade with over 70 million customers throughout 195+ international locations. It was launched in 2018 as a crypto ark and a gateway to the Web3 ecosystem. It gives deep liquidity and quite a lot of cutting-edge options for novice and superior merchants alike.

It helps spot buying and selling in 660+ pairs and affords as much as 10x leverage for margin buying and selling. If you wish to spend money on derivatives, you’ll be able to contemplate Bybit’s perpetual futures and choices contracts.

Bybit’s buying and selling interface can be clear and user-friendly, with TradingView integration and superior charting instruments. Different functionalities provided by Bybit are copy buying and selling, automated bots, and TradeGPT (AI-powered transactions).

For crypto traders who need to earn passive rewards, Bybit facilitates on-chain staking that yields excessive annual share returns. It additionally gives AMM-based liquidity mining swimming pools.

Bybit’s buying and selling charges are aggressive. For non-VIP customers, the trade levies a 0.1% payment for each makers and takers.

Lastly, Bybit has applied highly effective safety measures like 2FA, Yubikey authentication, anti-phishing code, authenticity verify, and FIDO passkeys.

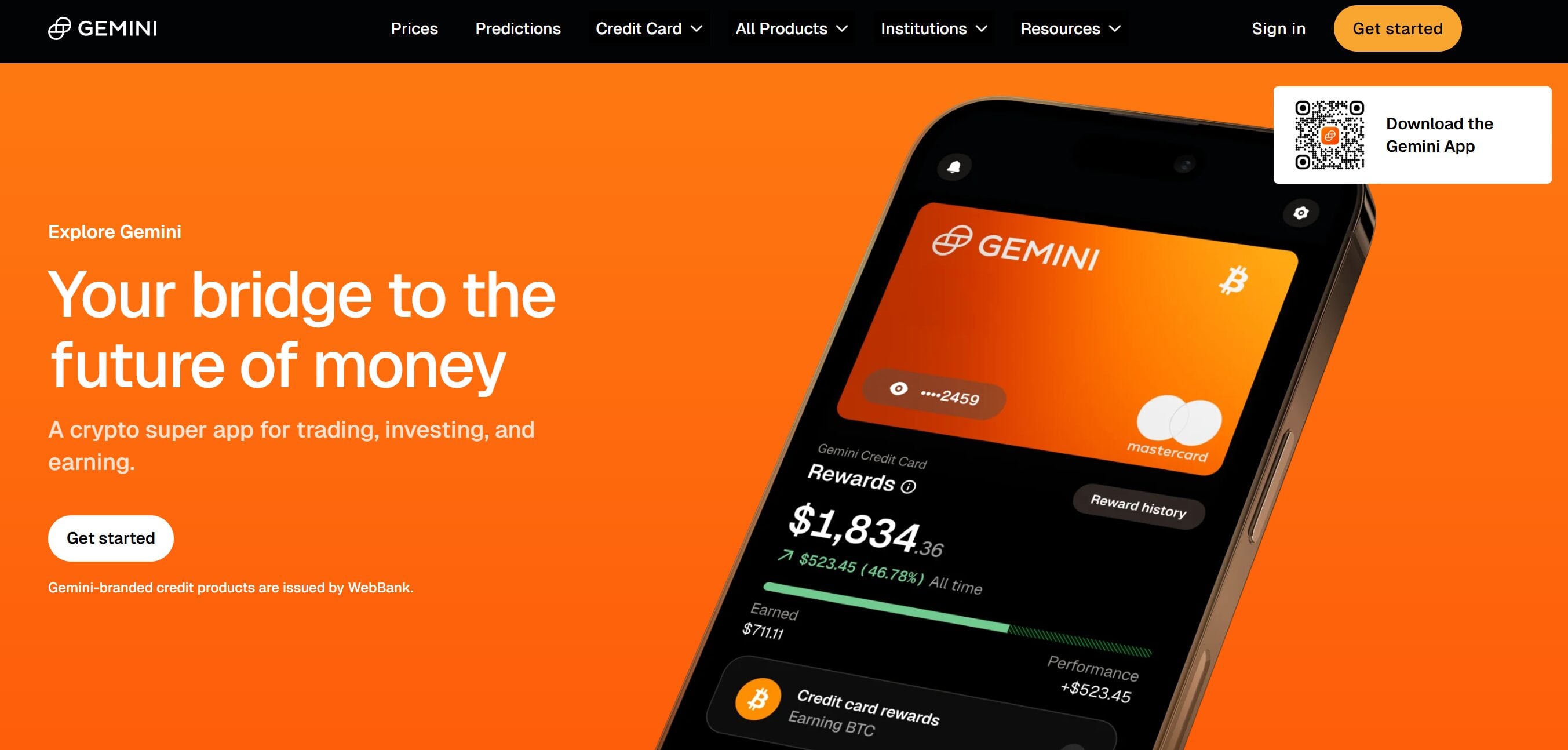

6. Gemini

In case you’re searching for a buying and selling platform that helps you spend money on tokenized shares together with cryptocurrencies, Gemini is one of the best. It lets you commerce in 100+ pairs throughout 70+ crypto and provides 20+ new shares weekly. The trade even has its personal US Greenback-backed stablecoin, the Gemini Greenback (GUSD).

Gemini can be the highest trade for safety and compliance. It’s the world’s first trade to acquire Techniques and Group Controls (SOC) certifications. Additionally it is licensed by the Worldwide Group for Standardization (ISO-27001). Its safety measures embody 2FA, Yubikey, tackle allowlisting, and multi-signature chilly storage.

For skilled merchants, Gemini gives a high-performance buying and selling interface, ActiveTrader. Outfitted with superior technical indicators and mixed order books (USD and GUSD), ActiveTrader executes crypto transactions in milliseconds. Different key choices of Gemini embody staking, OTC buying and selling, and institutional-grade custodial companies.

Lastly, Gemini’s transaction charges are fairly excessive. It imposes a 0.2% maker and 0.4% taker charges on common customers with 30-day volumes under $10,000.

Crypto Trade Vs. Crypto Pockets – Key Variations

Crypto exchangeCrypto pocketsCrypto exchanges are digital platforms that allow the shopping for and promoting of digital currencies.Crypto wallets are digital functions (software program) or bodily units ({hardware}) that retailer private and non-private keys. They provide help to ship, obtain, and retailer cryptocurrencies.They are often centralized exchanges, decentralized exchanges, or hybrid exchanges.They are often {hardware} wallets, software program wallets, paper wallets, or net wallets.The trade operator controls your personal keys. They’re self-custody crypto wallets. You’ve full management over your digital property and personal keys.Account restoration and entry to buyer assist are simpler. Nevertheless, withdrawals could also be restricted, denied, or delayed. No person can censor or confiscate your funds, as all transactions want your signature. Nevertheless, retrieving passwords or accessing buyer assist could also be difficult.As exchanges retailer consumer funds and property in custodial crypto wallets, they’re extra weak to hacks. Entry to funds could also be blocked as a consequence of regulatory freezes or trade outages. Storing personal keys or seed phrases in on-line wallets will increase the chance of shedding property to hackers. Preserving keys and restoration phrases in offline or {hardware} wallets is safer.Examples of cryptocurrency exchanges embody Binance, Pancakeswap, and Qurrex.Examples of cryptocurrency wallets embody Metamask, Phantom, and Zengo. The highest {hardware} pockets suppliers are Trezor and Ledger.

Conclusion

The above cryptocurrency exchanges provide 24/7 buyer assist and early entry to new tokens and airdrops. Additionally they provide complete studying libraries to reinforce your crypto data. In addition to, you’ll be able to earn commissions by way of referral applications.

Although centralized and decentralized exchanges have important variations, you should utilize each for higher flexibility, comfort, and profitability. Nevertheless, regardless of the place you commerce, safeguarding offline and on-line wallets’ personal keys is crucial to forestall asset losses.

FAQs

What’s a crypto buying and selling platform?

Crypto buying and selling platforms are centralized, decentralized, or hybrid exchanges that allow customers to purchase, promote, and commerce cryptocurrencies. They might additionally provide further services like staking, margin buying and selling, crypto loans, twin funding, and NFT marketplaces.

How do crypto exchanges earn cash?

Crypto exchanges predominantly earn cash by way of transaction charges. Additionally they earn from deposit charges, withdrawal prices, new token itemizing charges, and leveraged buying and selling curiosity. Some exchanges generate income or commissions from paid premium companies, institutional companies, subscription-based buying and selling instruments, and custodial companies.

What are one of the best locations to commerce crypto?

One of the best locations to commerce crypto are respected centralized and decentralized exchanges. In order for you a beginner-friendly platform for shopping for, promoting, and storing Bitcoin, you’ll be able to contemplate Money App. You’ll be able to rapidly ship and obtain BTC on the Lightning community utilizing Money app.

What’s an instance of a crypto trade?

Binance and Coinbase are examples of centralized crypto exchanges, whereas Orca and Pancakeswap are examples of decentralized cryptocurrency exchanges. Qurrex and Unodex are examples of hybrid exchanges.

Are Crypto Exchanges Secure?

Most exchanges, particularly CEXs, have strong safety features like 2FA, chilly storage, multi-signature wallets, and anti-phishing codes. In distinction, DEXs guarantee consumer safety by deploying battle-tested good contracts. Some even use decentralized oracles to feed exterior worth knowledge into these contracts. General, DEXs are extra hack-proof than CEXs as a consequence of their autonomous nature.

Which Is the Most secure Crypto Trade?

Among the many above exchanges, Gemini is the most secure. It’s the first cryptocurrency trade with SOC1 Kind 2 and SOC2 Kind 2 certifications. Additionally it is ISO-27001 and PCI-DSS-certified. Different key options of its compliance program embody common third-party safety audits and annual penetration testing. It has additionally applied safety measures like 2FA, {hardware} safety keys, chilly storage, and tackle allowlisting.