The blockchain world runs on code that by no means stops bettering. When builders change that code, a fork occurs. Some updates are small and suitable—others divide total communities. Studying the fundamentals of a delicate fork vs. exhausting fork exhibits you the way these updates have an effect on cash, transactions, and even costs. Let’s unpack what forks are, why they occur, and what they imply for you as a crypto person.

Why Blockchain Forks Matter

A blockchain fork issues as a result of it adjustments the foundations that preserve a blockchain community working. Each fork—delicate or exhausting—impacts how transactions are verified, who follows the blockchain protocol, and what options customers get subsequent. For traders, a fork can create new cash or shift a venture’s worth. For builders, it’s a strategy to repair flaws or enhance efficiency. Forks present how decentralized programs evolve—not by power, however by way of neighborhood selections that form the way forward for crypto.

Learn extra: What Is a Blockchain Fork?

Mushy Forks Defined

A delicate fork is a change to a blockchain protocol that stays suitable with older variations of the community. Consider it like a system replace that also works together with your previous apps. In a delicate fork, new guidelines are added, however they don’t break the previous ones. That’s why it’s referred to as backward suitable—nodes that don’t improve can nonetheless validate new blocks, so long as they observe the tightened guidelines.

Mushy forks assist builders enhance blockchains with out splitting them into separate chains. They often replace block validation, add new guidelines, or restrict what’s allowed inside a block. This retains the community unified, since upgraded and non-upgraded nodes can nonetheless speak to one another.

How Mushy Forks Are Applied

A typical strategy to activate these upgrades is thru user-activated delicate forks (UASF). On this case, community validators and customers coordinate to sign assist for the change. As soon as sufficient miners or nodes settle for it, the fork turns into a part of the blockchain community.

Advantages and Potential Drawbacks

Mushy forks are sometimes used for safety patches, efficiency boosts, or including sensible options to enhance the unique Bitcoin blockchain and related networks. They’re safer and simpler to coordinate than exhausting forks as a result of they don’t create a brand new chain.

Nonetheless, delicate forks depend on consensus. If too few individuals observe the brand new guidelines, the community dangers short-term chaos or stalled transactions. Profitable forks depend upon belief, coordination, and clear communication throughout the neighborhood.

Mushy Fork Examples

Probably the greatest-known delicate forks on the Bitcoin community was Segregated Witness (SegWit), launched in 2017 by way of a Bitcoin Enchancment Proposal. It modified how knowledge blocks retailer signatures, releasing house for extra transactions in the identical block with out elevating the block measurement restrict. This improve improved scalability and diminished transaction malleability, a long-standing challenge in Bitcoin’s design.

SegWit was a user-activated delicate fork, supported by most miners and exchanges. It confirmed that the neighborhood might improve the blockchain protocol by way of coordination fairly than division. New blocks adopted stricter validation guidelines however stayed backward suitable, maintaining the community unified.

Since then, different blockchains have used related updates so as to add new options or enhance effectivity with out creating separate chains. Mushy forks stay an important means for blockchain builders to evolve programs whereas defending customers’ funds and transaction historical past.

Laborious Forks Defined

A tough fork is a serious replace to a blockchain’s underlying protocol that breaks compatibility with older variations. Not like a delicate fork, it introduces new guidelines that previous nodes can’t perceive. As soon as the fork prompts, nodes that don’t improve are left behind on the previous blockchain, following completely different validation guidelines.

How Laborious Forks Are Applied

Laborious forks create a everlasting break up within the blockchain community. When this occurs, one chain follows the brand new model, and the opposite continues underneath previous circumstances. Each stay legitimate from a technical standpoint, however they not acknowledge one another’s blocks. This may end up in two separate networks, every working its personal transaction historical past.

Builders usually launch exhausting forks so as to add new options, repair important bugs, or deal with points like block measurement and scalability. Some forks are deliberate, whereas others—referred to as unintended exhausting forks—happen when nodes disagree on updates or block validation timing.

A tough fork requires neighborhood coordination as a result of everybody should improve concurrently. If the blockchain tasks concerned can’t agree, a sequence break up kinds and customers should select which aspect to assist. That’s how fully new cryptocurrencies like Bitcoin Money first appeared.

Advantages and Potential Drawbacks

Laborious forks carry dangers but additionally alternative. They let blockchain builders experiment with radical enhancements with out disrupting the unique system. Whether or not you’re a miner, investor, or dealer, understanding exhausting forks helps you put together for community upgrades, potential coin duplication, and shifts in token worth.

Laborious Fork Examples

Bitcoin Money and Its Variants

The Bitcoin Money exhausting fork is among the clearest examples of a serious blockchain break up. It started when builders and miners on the Bitcoin community disagreed over transaction capability. Supporters pushed to lift the block measurement restrict to an eight MB block measurement, enabling extra transactions per block, whereas others argued it might weaken decentralization. The consequence was Bitcoin Money, a separate blockchain that prioritized pace over conservatism.

Later, Bitcoin SV and Bitcoin Money ABC emerged, every proposing completely different block sizes and governance fashions. These variations share roots with Bitcoin Core, the unique consumer for the Bitcoin protocol, however observe their very own paths and have their very own communities. Collectively, Bitcoin Money, SV, and ABC paved the best way for quite a few different Bitcoin forks, every born from the identical drive to push limits and check new concepts.

Ethereum and Ethereum Traditional

It wasn’t simply Bitcoin that went by way of high-profile splits. In 2016, the Ethereum community divided after a serious sensible contract exploit often called The DAO hack. Builders selected to roll again stolen funds, creating a brand new model of the chain—Ethereum—whereas purists who opposed the rollback continued as Ethereum Traditional. The occasion confirmed how values like immutability and belief can redefine a blockchain’s course.

Why Do Laborious Forks Occur?

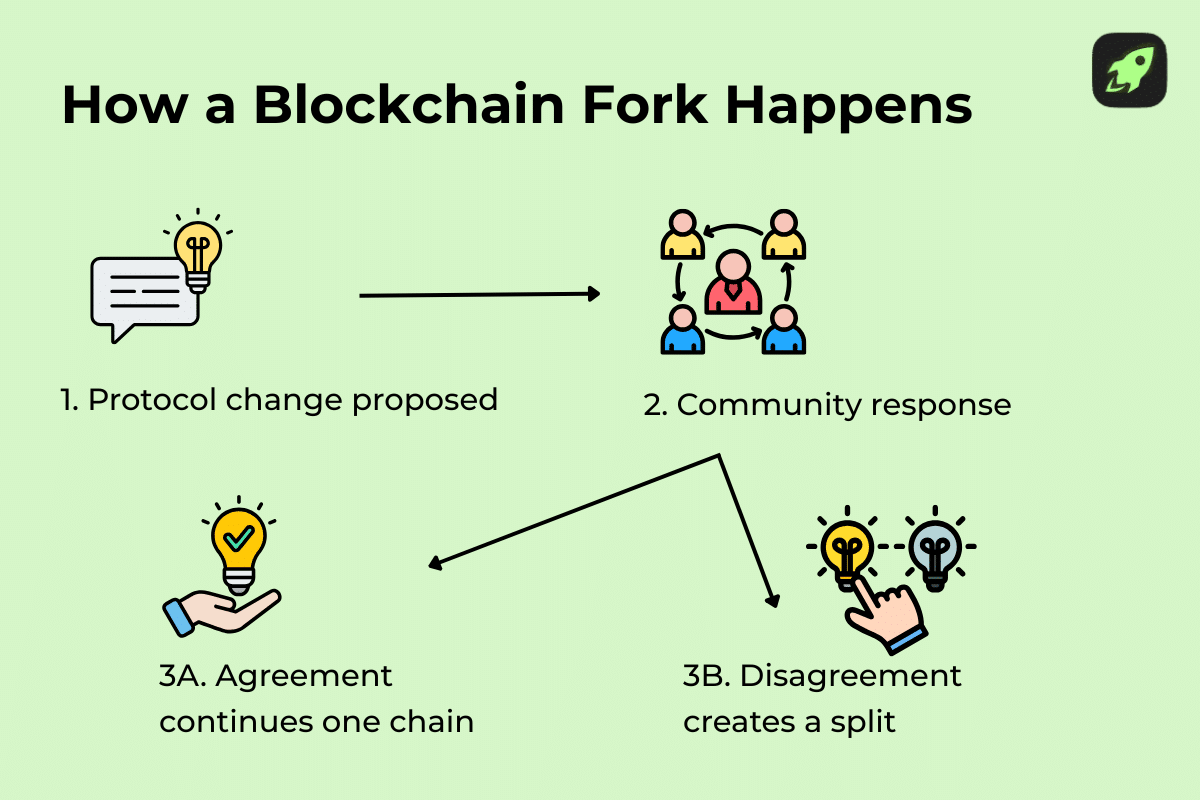

Laborious forks occur when a neighborhood can’t attain consensus on the community’s course. Typically it’s about scaling, different instances about ideology or governance. When blockchain builders suggest new guidelines or code adjustments, everybody should comply with replace. In the event that they don’t, the unique blockchain splits, and either side begin validating completely different blocks.

A fork formation may also happen after bugs, hacks, or incidents of stolen funds that require a brand new chain to repair errors or roll again injury. In these circumstances, the neighborhood chooses which predominant blockchain to assist, and the opposite turns into the previous blockchain with fewer customers and miners.

Whether or not they’re deliberate or unintended exhausting forks, these occasions mirror how decentralized programs deal with disagreement. They present that there’s no central authority—simply folks, code, and coordination. That freedom retains blockchain innovation alive, even when unity breaks.

The way to Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero value

Mushy Fork vs. Laborious Fork: A Detailed Comparability

You’ll usually hear folks confuse exhausting and delicate forks, however they work very in another way. A delicate fork updates guidelines whereas staying suitable with older variations. A tough fork rewrites them and breaks compatibility. Each form how blockchain tasks evolve and the way communities react to alter.

These adjustments can result in blockchain splits, the place two variations of the identical community transfer in numerous instructions. A delicate fork often avoids that by implementing new limits with out dividing customers. However when builders can’t agree, the community can break right into a forked community—one aspect following previous guidelines, the opposite transferring ahead.

Right here’s a side-by-side take a look at the important thing variations between the 2.

Comparability Desk: Mushy Fork vs. Laborious Fork

Understanding the Commerce-Off

Mushy forks are like mild updates that preserve everybody on the identical web page. They preserve safety tight and neighborhood alignment sturdy. However their flexibility ends when massive rule adjustments are wanted.

Laborious forks, however, rewrite the rulebook. They spark innovation but additionally invite disagreement and threat fragmentation. Unintended exhausting forks and disputed upgrades remind everybody that coordination issues simply as a lot as code.

Whether or not a fork succeeds is determined by timing, transparency, and communication. In the long run, each sorts drive blockchain progress. Crypto would stagnate with out them, however with them, it retains evolving, one improve at a time.

How Do Disagreements within the Group Have an effect on Whether or not a Fork Stays “Mushy”?

Most forks begin as minor updates to a blockchain’s underlying protocol, with easy adjustments to enhance efficiency, charges, or safety. However as quickly as builders, miners, or customers disagree on these adjustments, issues can escalate shortly. When consensus breaks, what begins as a delicate fork can flip right into a contentious exhausting fork.

This sort of break up creates friction and even produces a brand new blockchain with its personal guidelines, cash, and neighborhood. It’s how a number of the most well-known community divisions have occurred in crypto historical past.

Disagreements present the energy of decentralization. In a blockchain, no central authority decides what’s “proper.” The code and neighborhood collectively decide which model survives. That freedom to decide on retains blockchains adaptable, even when it typically means going separate methods.

Closing Phrases

Forks are how blockchain expertise evolves. From early Bitcoin forks to fashionable upgrades, each exhibits how open collaboration drives innovation. They repair bugs, add options, and let communities determine the way forward for their networks. Whether or not a fork is delicate or exhausting, it protects a blockchain’s censorship resistance, maintaining management in customers’ palms. In crypto, each disagreement sparks progress, and sometimes, lasting change.

FAQ

Is a delicate fork not backward suitable?

No, it’s the other. Each delicate fork is designed to be backward suitable, which means older nodes can nonetheless work together with upgraded ones. Mushy forks try and tighten present guidelines, not change them. This permits builders to enhance the community with out splitting it. If coordination succeeds, customers received’t even discover the change, as transactions proceed seamlessly throughout upgraded and non-upgraded nodes.

Is a tough fork good or unhealthy?

Each, relying on why it occurs. Laborious forks can unlock innovation but additionally threat division. Evaluating exhausting forks and delicate ones exhibits the trade-off: Mushy forks protect unity, whereas exhausting forks allow greater leaps ahead. A well-planned exhausting fork can repair long-standing points or develop options. However when coordination fails, it will possibly break up the community and confuse customers till one model good points assist.

Do forks imply the venture failed or is in bother?

No, by no means. Forks usually imply progress, not failure. The Bitcoin Money fork, for example, emerged from a debate about transaction measurement, not collapse. Builders used it to experiment with scalability on a distinct chain. Forks enable communities to check concepts with out shutting down the unique community, proving that disagreement can drive innovation, not destruction, within the crypto world.

Can forks be used to repair bugs or safety points in a blockchain?

Sure, completely. Forks are typically deployed as emergency patches to appropriate errors or get well stolen funds. For instance, Bitcoin Gold and Bitcoin Diamond had been each launched to enhance mining equity and improve safety. Such upgrades present how versatile blockchain programs are—builders can apply fixes, strengthen defenses, and restore belief with out rebuilding the whole community from scratch.

Is one sort of fork higher or safer than the opposite?

There’s no common reply. Each sorts have strengths and dangers. A delicate fork provides enhancements with out breaking the previous guidelines, whereas a tough fork introduces a brand new model of the community. Mushy forks preserve customers aligned and scale back disruption, however they’re restricted in scope. Laborious forks allow quicker innovation however threat fragmentation. Security is determined by coordination, clear guidelines, and the way properly the neighborhood executes the improve.

Why do some forks create fully new cryptocurrencies?

When consensus breaks, one aspect could launch a brand new blockchain. That’s what occurred with the Bitcoin Money blockchain, which began as an offshoot of Bitcoin after builders disagreed on block measurement. As soon as a brand new chain good points sufficient assist, it turns into its personal cryptocurrency with distinctive guidelines, tokens, and neighborhood. These splits protect selection and experimentation throughout the crypto ecosystem.

Who decides whether or not a blockchain ought to fork?

In decentralized programs, no single individual makes that decision. Builders suggest updates to the blockchain protocol, miners vote with their hash energy, and customers present assist by working upgraded nodes. When sufficient individuals agree, the fork prompts. It’s democracy in code type, the place consensus decides the result. That’s what makes blockchain governance each highly effective and unpredictable.

Disclaimer: Please notice that the contents of this text usually are not monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.