Bitcoin mining shares jumped after Riot Platforms signed a long-term cope with chip big AMD, whereas Galaxy Digital pushed forward with an enormous Texas enlargement. Shares moved as buyers linked these offers to steadier income at a time when Bitcoin USD trades in a good vary. The backdrop issues: file community competitors is squeezing miners, forcing them to rethink how they generate income.

(Supply: RIOT Inventory Worth / TradingView)

DISCOVER: Prime Ethereum Meme Cash to Purchase in 2026

What Simply Occurred With Riot, Galaxy, and AMD?

Riot Platforms agreed to a 10-year information middle lease with AMD at its Rockdale, Texas, website, valued at $311 million, with enlargement choices that might push the overall to $1 billion. Consider this like renting out unused warehouse area to a dependable company tenant as a substitute of leaving it empty. Based on Riot, the deal can scale as much as 200 megawatts.

We’re excited to share a sequence of transformative transactions that firmly set up our quickly scaling information middle enterprise – together with charge easy acquisition of our Rockdale website and signing our first information middle lease with AMD.

Learn the total press launch right here:…

— Riot Platforms, Inc. (@RiotPlatforms) January 16, 2026

Galaxy Digital is taking an identical path. The agency lined up $460 million in contemporary funding, on high of a previous $1.4 billion mortgage, to increase its Helios campus in Texas towards 3.5 gigawatts. About 800 megawatts are already dedicated to AI agency CoreWeave.

Why ought to a newbie care? As a result of mining corporations earn much less when competitors rises. Renting energy and information facilities to AI shoppers creates earnings that doesn’t rely upon Bitcoin’s every day value swings.

Why This Issues for Bitcoin Buyers

Bitcoin mining works like a lottery the place everybody buys extra tickets every year. The full computing energy, generally known as hashrate, retains setting data. Which means every miner earns fewer Bitcoin except the value climbs quick.

Bitcoin mining replace:

At $90,436 per BTC, my 27 machines are making $4,800 a month now (0.053019 BTC)

It prices me $3,752 a month to maintain them working (internet hosting/electrical), for a revenue of $1,048/month.

So far, I've stacked 3.84 BTC value $348,462 and can proceed to stack. pic.twitter.com/7mvRaHFh3K

— Your Good friend Andy (@YourFriendAndy) January 10, 2026

By pivoting towards AI and high-performance computing, miners flip low cost Texas energy right into a second enterprise line. Riot now controls about 1.7 gigawatts of energy throughout Texas after promoting roughly 1,080 BTC to fund enlargement, based on MarketChameleon. For shareholders, that appears extra like a utility firm with long-term contracts.

This shift additionally ties into the broader Bitcoin story. When mining companies stay solvent throughout flat Bitcoin-to-USD intervals, they dump fewer cash onto the market. That may ease promoting strain over time.

DISCOVER: Prime 20 Crypto to Purchase in 2026

The place the Dangers Nonetheless Sit

This isn’t a free win. Constructing AI information facilities prices severe cash upfront, and delays can hit money move. If AI demand cools, these long-term plans lose shine.

Mining shares additionally transfer quicker than Bitcoin itself. A 5% dip in Bitcoin usually turns right into a double-digit inventory swing. In case you are new, deal with mining shares as high-volatility bets, not financial savings accounts.

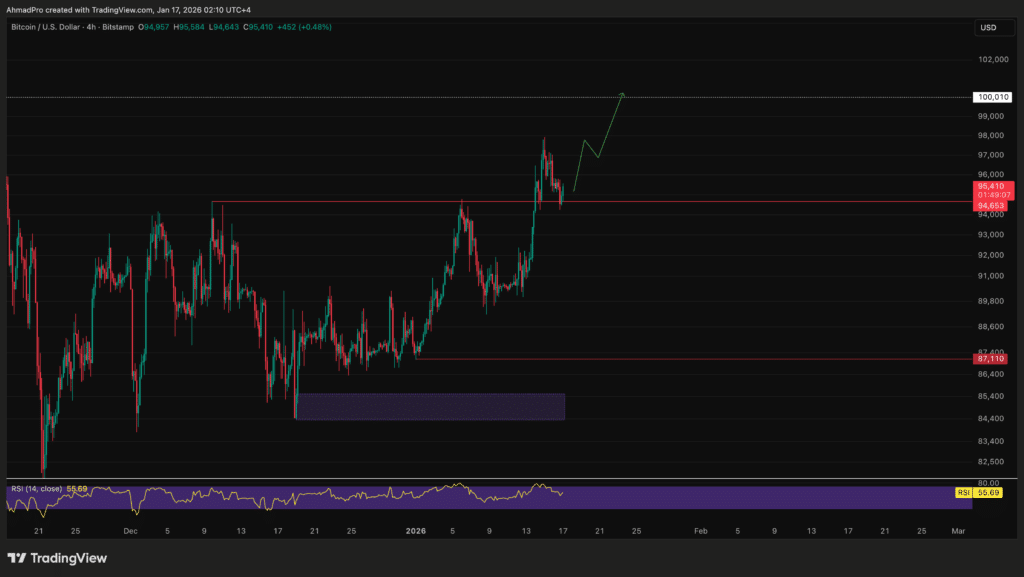

(Supply: BTCUSD / TradingView)

For readers monitoring the larger image, this matches with themes round Bitcoin value predictions and rising institutional Bitcoin investments. Stronger miners are inclined to assist a more healthy community.

Going ahead, watch how a lot income these AI leases really herald. If the money flows present up as promised, mining shares might commerce much less like pure Bitcoin bets and extra like power-backed infrastructure performs.

DISCOVER: Prime Solana Meme Cash to Purchase in 2026

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Professional Market Evaluation

The submit Bitcoin Mining Shares Soar as Riot Faucets AMD, Texas Builds Develop appeared first on 99Bitcoins.