Bitcoin has proven early indicators of calm, however the temper is fragile. Costs pulled again from a weekend peak and buying and selling has been uneven as buyers weigh contemporary tariff headlines and slowing progress in elements of Asia.

Associated Studying

Spot Market Indicators Ease

In keeping with Glassnode, spot buying and selling quantity has picked up modestly whereas the online purchase–promote imbalance moved above its normal higher band. That shift factors to much less sell-side strain, even when demand continues to be patchy.

Experiences observe that markets are slowly rebuilding after late-2025 profit-taking, with long-term holders much less prepared to promote each rally. The result’s a market that’s consolidating moderately than breaking down.

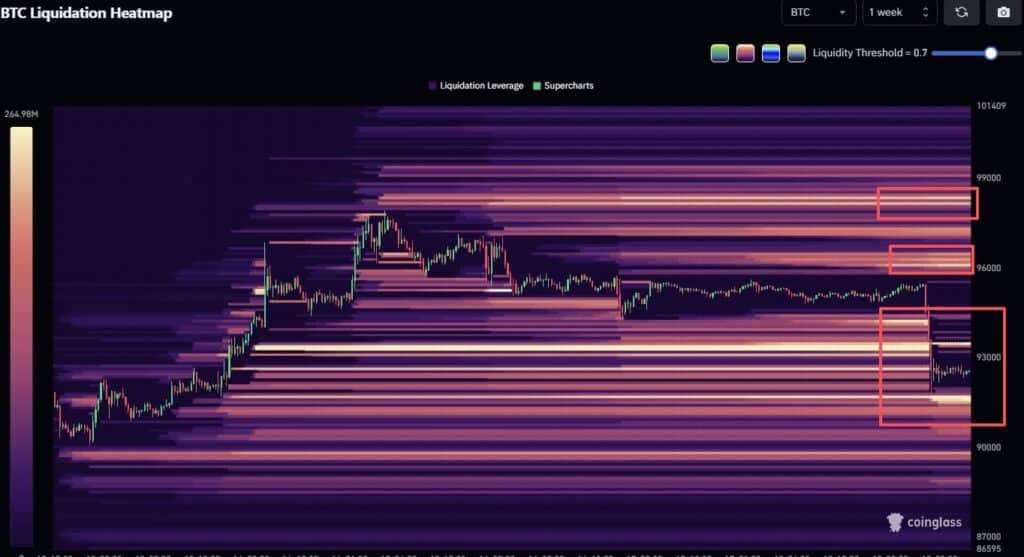

Derivatives Stress And A Sharp Retest

Over the weekend Bitcoin slid by 3.2% from its excessive, prompting a retest of the $92,000 stage that shocked some bulls. That transfer worn out about $215 million in leveraged futures longs, a big hit that raised alarms about deeper losses.

Supply: Glassnode

On the identical time, weak exercise in derivatives markets has flagged a cooling of speculative urge for food, which makes it more durable for Bitcoin to behave as a dependable hedge proper now.

Nasdaq futures fell after US President Donald Trump introduced new tariff proposals geared toward a number of European nations, and such macro shocks usually push merchants out of riskier holds.

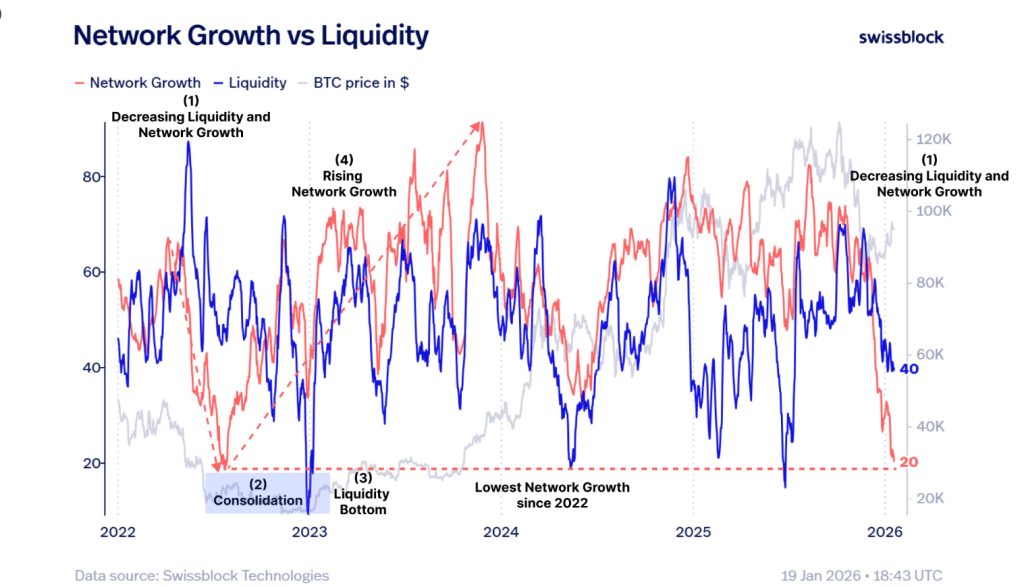

Liquidity Patterns Echo Previous Cycles

Analysts at Swissblock pointed to a fall in community progress and liquidity that appears much like circumstances seen in 2022. Again then, low liquidity and a pause in progress led to an extended consolidation, just for each indicators to surge later and gasoline an enormous value run.

Primarily based on reviews, the present setup might be the prelude to an identical rebuild if community exercise recovers and buy-side momentum strengthens.

Community progress has hit lows not seen since 2022, whereas liquidity continues to empty. Again in 2022, comparable community ranges triggered a $BTC consolidation section as community progress started to recuperate, even whereas liquidity remained weak and bottoming out.

Historical past reveals that the… pic.twitter.com/24sC3aoyAD

— Swissblock (@swissblock__) January 19, 2026

Institutional Flows And Hedge Narratives

Analysts stated that ETF flows present establishments shopping for on pullbacks and that long-term holders should not dashing to promote.

Gold has climbed previous $4,650, and that safe-haven transfer, along with softer progress information in China, is nudging some buyers to deal with Bitcoin as a portfolio hedge moderately than a fast commerce.

A Cautious Outlook

General, indicators level to a gradual rebuild moderately than a contemporary breakout. Purchase-side dynamics have improved, however they aren’t but sturdy or broad sufficient to name a brand new uptrend. Volatility stays a characteristic, and geopolitical or coverage shocks may push value swings wider.

Associated Studying

In the intervening time, the market is steadying whereas staying watchful — extra restoration in liquidity and clearer institutional conviction can be wanted to show this consolidation into an enduring advance.

Featured picture from Gemini, chart from TradingView