Recent waves of bearish forces have captivated the crypto markets. The Bitcoin worth can also be going through vital upward strain because the begin of the day, with the sellers making an attempt to tug the value into the important thing help vary under $90,000. Whereas the market situations are bearish, the larger concern for the merchants is not only the dip however what’s occurring beneath. The derivatives should not cooled but, whereas the BTC worth maintains a steep bearish development. This mix often indicators that leverage hasn’t flushed, conserving the draw back threat alive.

Bitcoin Value Right this moment: BTC Retests $91K as Bears Defend $98K Resistance

The BTC worth has been printing consecutive bearish candles for practically per week, hinting in the direction of rising bearish affect over the token. With this, it has reached a pivotal worth vary, which has been a robust help earlier. However contemplating the present situation, the rebound seems to be extra distinct than anticipated. At the moment, the Bitcoin worth is buying and selling at round $90,865 with greater than a 2.6% pullback, flashing extra bearish prospects.

As seen within the above chart, the BTC worth has examined the higher resistance of the rising channel quickly after it rebounded from the lows near $80,000. Nonetheless, issues modified when the value started to commerce inside the decrease bands, signalling the draining power of the bulls. At the moment, the value is just not solely testing the decrease help of the channel but additionally the 50-day MA at $90,430, which has been a robust base throughout the bearish occasions. Then again, the value is but to enter the demand zone that sits simply above the help zone between $86,400 and $86,700.

Subsequently, a day by day shut under the 50-day MA might weaken the construction, extending the correction to the earlier lows.

Why Bitcoin’s Selloff Doesn’t Look Like Capitulation But

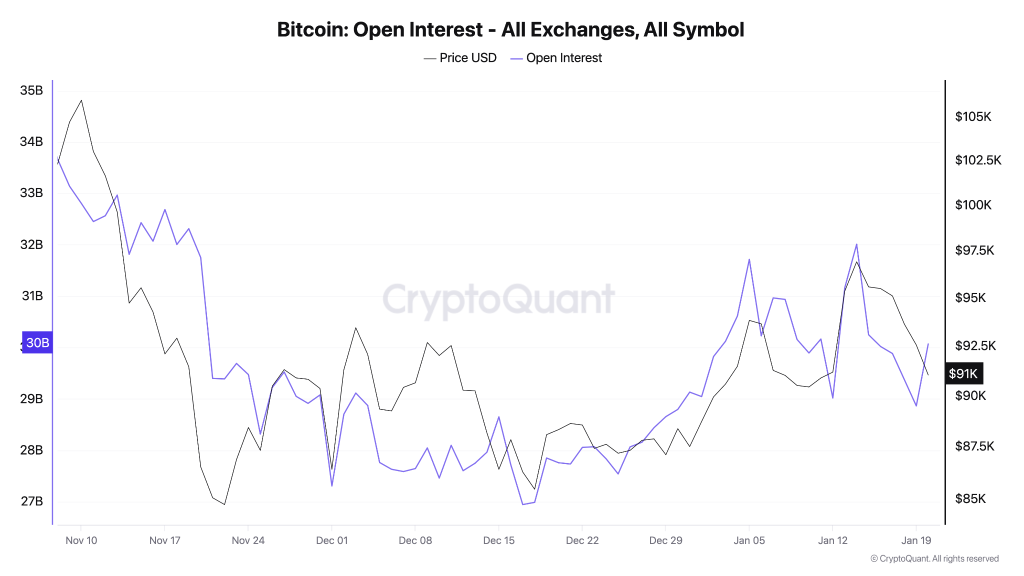

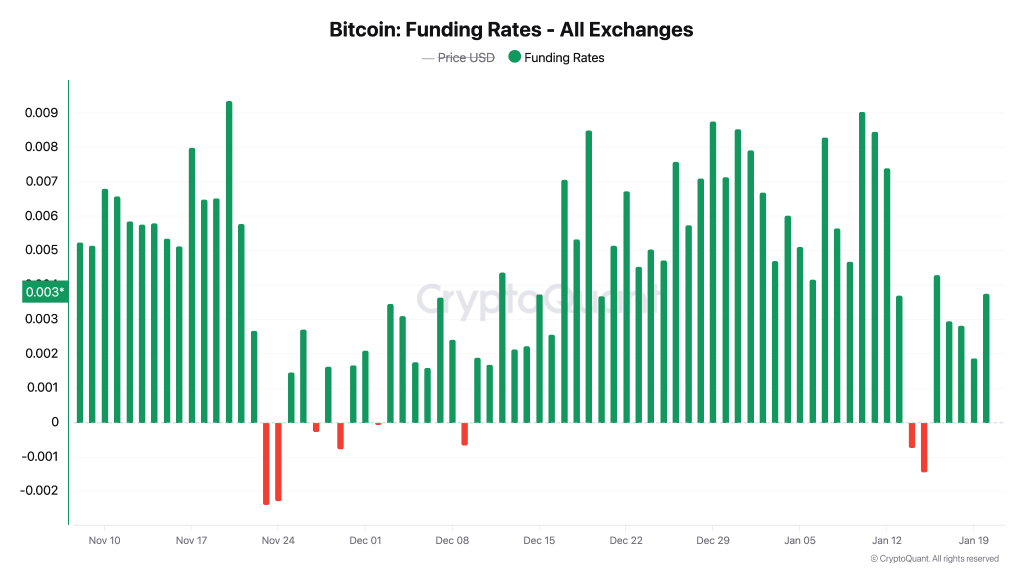

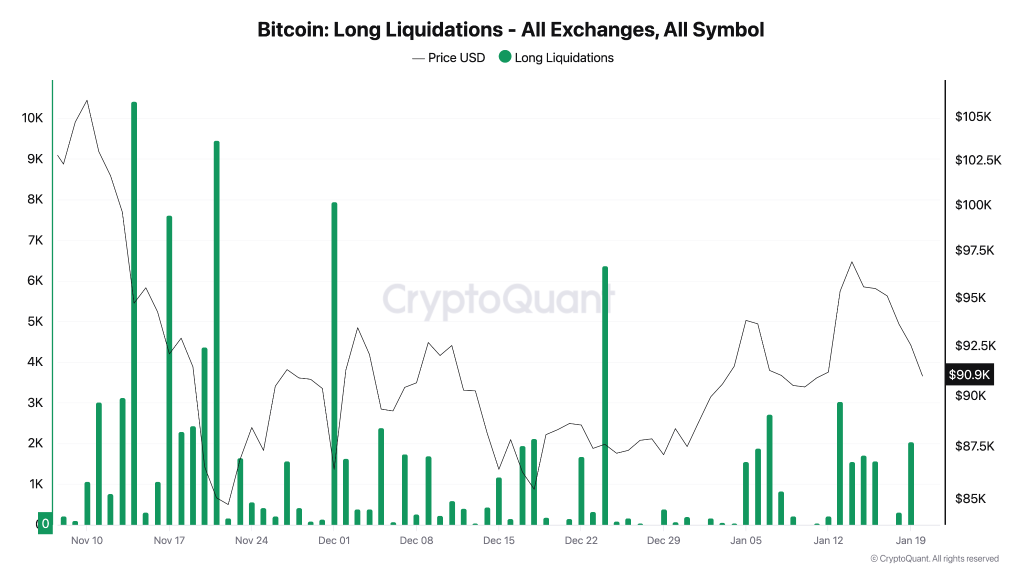

Bitcoin is sliding once more, however the derivatives knowledge recommend this isn’t a full panic flush. Open curiosity is rising as worth falls, funding stays barely constructive, and lengthy liquidations are nonetheless comparatively small. That mixture sometimes indicators leverage hasn’t totally reset, conserving the chance of one other draw back sweep on the desk. The Value vs OI setup is the important thing purpose merchants are staying cautious.

Rising Open Curiosity Throughout a BTC Dip = New Leverage Coming into

When open curiosity will increase whereas BTC worth drops, it sometimes means merchants are opening new positions into the decline fairly than closing threat. That often retains volatility elevated as a result of leverage could be compelled out later.

Constructive Funding (0.003) Suggests Longs Nonetheless Leaning In

Funding staying constructive whereas the value falls typically implies the market remains to be barely long-skewed. In a real washout, funding generally cools sharply or flips detrimental as longs exit and shorts dominate.

Lengthy Liquidations (~2K) Are Too Small for a “Flush” Backside

The lengthy liquidation chart reveals current liquidations are principally ~1K–3K, nowhere close to the sooner giant spikes. That helps the “not capitulation” learn: the market hasn’t seen a compelled liquidation occasion large enough to reset positioning.

The above charts recommend the BTC worth is dropping, however leverage has not cleared. That makes the present help check extra harmful, as a result of the market should still want a sharper shakeout to completely reset sentiment.

Bitcoin at a Key Help, However Leverage Alerts Elevate Draw back Danger

Bitcoin worth is approaching a decisive help zone close to $90K–$88K after failing to interrupt by way of $98K resistance. Whereas the chart reveals a essential demand band that might spark a bounce, the Value vs OI knowledge suggests this selloff is just not capitulation but. Rising open curiosity, constructive funding, and comparatively gentle lengthy liquidations suggest leverage stays within the system. If help holds and BTC reclaims $98K–$100.6K, a restoration towards $110.7K is again on the desk. If it breaks, the market may have a deeper flush earlier than a sturdy backside varieties.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict Editorial Tips based mostly on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked towards respected sources to make sure accuracy, transparency, and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We try to offer well timed updates about every part crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market situations. Please do your individual analysis earlier than making funding choices. Neither the author nor the publication assumes duty to your monetary selections.

Sponsored and Ads:

Sponsored content material and affiliate hyperlinks might seem on our web site. Ads are marked clearly, and our editorial content material stays solely unbiased from our advert companions.