Right here’s an fascinating truth: Most individuals don’t lose their crypto to hackers, however to dangerous custody selections. You purchase Bitcoin, retailer it someplace, and assume it’s secure—however that security will be fragile. This information explains what self-custody is in crypto, how a crypto pockets actually works, what occurs to your non-public keys, and the way these components form safety, freedom, and danger within the crypto ecosystem.

What Is Self-Custody in Crypto?

Self-custody means you management your crypto, not an organization, a pockets app, or another platform. If you use self-custody, you’re the one holding your non-public keys, which supplies you direct entry to your digital property on the blockchain. There are not any middlemen who management something “for you”, and no exterior approvals wanted to do what you need together with your cash. Nobody can freeze or transfer your funds with out your consent.

With self-custody, you maintain all of the keys—and all of the accountability. That management comes with freedom, but in addition danger. Should you lose entry to your keys, no one can restore them. However when you defend them effectively, no one can take your funds. It’s the place the favored saying comes from: “Not your keys, not your cash.”Self-custody is deeply rooted in crypto, which was designed to take away the reliance on banks and different conventional monetary establishments. Bitcoin launched in 2009 as a response to the 2008 monetary disaster, when belief in centralized programs collapsed. Its core concept was easy: give folks direct possession of cash with out intermediaries. To at the present time, this stays the core objective of self-custody.

Key Ideas in Self-Custody

Earlier than you should use self-custody safely, you might want to perceive its important constructing blocks. These ideas clarify how management, entry, and possession work in crypto.

Personal keys.A personal secret is a secret quantity that proves possession of your digital property. Whoever controls it controls the funds. There is no such thing as a approval step and no assist when you attempt to recuperate what you’ve misplaced.

Public keys and addresses.A public secret is created out of your non-public key. It generates your pockets tackle, which others use to ship you crypto. Do not forget that sharing that is secure. It doesn’t give spending entry.

Transactions.A transaction occurs when your crypto pockets makes use of its non-public key to signal a switch. The community verifies that signature and data it completely. As soon as confirmed, it can’t be reversed.

Seed phrase.A seed phrase is a human-readable backup of your non-public keys, normally 12 or 24 phrases. Anybody with it might probably entry your funds. Lose it, and restoration turns into inconceivable.

Management and responsibilitySelf-custody provides you full management. There are not any intermediaries, but in addition no security internet. Safety turns into your sole accountability, not any firm’s.

How Self-Custody Works (Personal Keys and Seed Phrases)

Self-custody works by providing you with full management over your non-public keys, which implies solely you possibly can entry and transfer your crypto. Let’s check out every step of that course of in additional element.

A personal secret is created.Your crypto pockets generates a personal key. This can be a lengthy, random quantity that proves possession of your crypto. Whoever controls it controls the funds.

A public key and tackle are derived.The non-public key creates a public key, which then generates your crypto pockets tackle. This tackle is secure to share. It lets others ship you crypto, nevertheless it can not spend something.

Your pockets shops and makes use of the important thing.The pockets holds your non-public key and makes use of it to signal transactions. The important thing by no means leaves the pockets. It merely proves that you just licensed the motion.

A seed phrase backs every little thing up.The pockets additionally creates a seed phrase, normally 12 or 24 phrases. This phrase can recreate all of your non-public keys. In case your gadget breaks or disappears, the seed phrase restores entry.

Transactions are signed and despatched.If you ship crypto, the pockets indicators the transaction regionally utilizing your non-public key. The community checks the signature together with your public key, and data it completely.

There is no such thing as a undo button.As soon as confirmed, the transaction can’t be reversed or appealed. Due to this, in case your seed phrase is misplaced or uncovered, your funds are nearly as good as gone.

Tips on how to Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero price

Self-Custody vs. Custodial

With self-custody, you handle your crypto instantly. With custodial pockets companies, a 3rd social gathering does it for you. That one alternative modifications how entry, danger, and possession work.

Learn extra: Custodial vs. Non-Custodial Wallets

Professionals and Cons of Self-Custody

Self-custody provides you actual possession, nevertheless it additionally means you’re the one chargeable for every little thing. That tradeoff issues, and it’s best to perceive it earlier than committing funds.

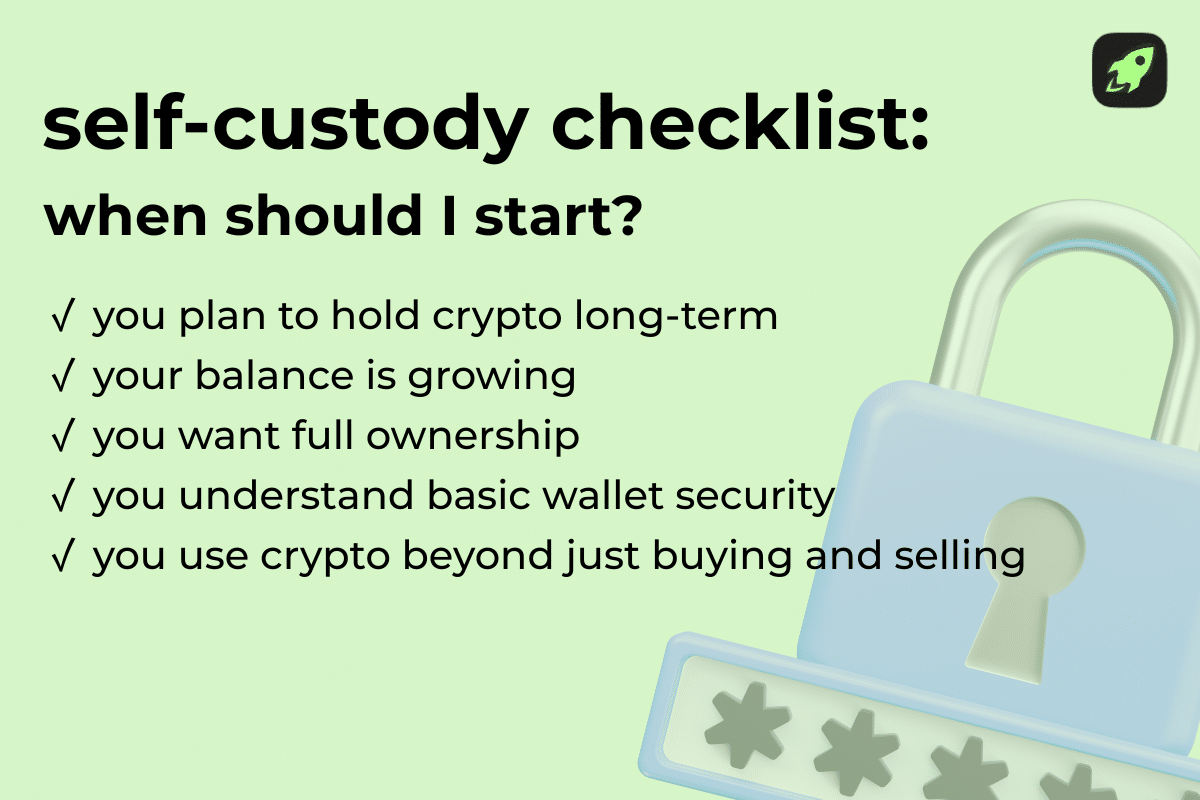

When Ought to I Begin Utilizing Self-Custody?

It’s best to begin utilizing self-custody if you need actual possession of your crypto and are able to take accountability for it. There is no such thing as a one good second. The proper time relies on how a lot you maintain, how usually you transact, and the way snug you might be managing safety your self. Listed here are some widespread “tells” that it’s time to consider utilizing self-custody.

You maintain crypto long-term.Should you plan to maintain Bitcoin or different property for months or years, self-custody reduces publicity to trade failures and account freezes.

You’ve moved previous small experiments.As soon as your stability grows past what you’re snug shedding, counting on a 3rd social gathering turns into dangerous.

You need actual possession.Self-custody provides you direct entry to your property with out permission from a platform or service supplier.

You perceive fundamental pockets safety.If you know the way to retailer a seed phrase and defend your gadget, you’re able to handle your personal setup.

You utilize crypto past shopping for and promoting.Should you work together with decentralized apps, transfer funds between networks, or handle a number of property, self-custody turns into essential.

Is a Self-Custody Pockets Protected?

It’s secure when you use it appropriately. That security comes from eradicating any third events that would acquire entry to your funds. Self-custody removes publicity to trade hacks, frozen accounts, and platform failures. No firm can lock you out or transfer your funds. That already removes a significant supply of loss in crypto historical past.

As an alternative, the chance shifts to the way you handle safety. Malware, phishing, and careless backups can nonetheless do injury. In case your gadget is compromised or your restoration phrase leaks, funds can disappear quick. There is no such thing as a assist desk to reverse errors, and all of the accountability is on you.

A powerful setup provides additional layers of safety to assist with this. Many individuals use a {hardware} pockets for long-term storage and preserve solely small quantities in a software program pockets for each day use. This provides distance between attackers and your property.

What Errors Ought to I Keep away from with Self-Custody?

Most losses in self-custody don’t come from hackers. They arrive from easy errors. Avoiding these widespread errors can defend you from everlasting loss.

Storing your seed phrase digitally.Screenshots, cloud notes, emails, or password managers are dangerous. In case your gadget will get compromised, your funds can vanish.

Dropping your backup.Should you lose your seed phrase and your gadget fails, recovering your property turns into inconceivable. At all times preserve a safe bodily backup.

Conserving every little thing in a single place.Storing your pockets and backup collectively creates a single level of failure. Separate them bodily.

Skipping take a look at transactions.At all times ship a small quantity first. One unsuitable tackle or community can price you every little thing.

Trusting random hyperlinks or messages.Phishing assaults usually look extremely practical. By no means enter your restoration phrase anyplace besides inside your pockets throughout setup.

Utilizing one gadget for every little thing.A compromised telephone or laptop computer can expose your pockets. Devoted or clear gadgets scale back danger.

Assuming you possibly can repair errors later.Blockchain transactions are remaining. There is no such thing as a undo button.

Tips on how to Retailer Crypto Safely with Self-Custody

Protected self-custody comes all the way down to good habits, not instruments. The proper setup reduces danger lengthy earlier than one thing goes unsuitable. Listed here are a couple of tricks to get you began:

Use a {hardware} pockets for long-term storage.A {hardware} pockets retains your non-public knowledge offline. This protects your property from malware and distant assaults. It’s the most secure choice for holding bigger quantities.

Maintain your seed phrase offline and preserve it safe.Write it on paper or engrave it on steel. By no means retailer it on a telephone, cloud drive, or laptop. Digital copies create simple assault paths.

Use safe bodily storage.Retailer backups in a fireproof and waterproof location. Think about using two areas to cut back single-point failure.

Separate entry from storage.Don’t preserve your {hardware} pockets and restoration phrase collectively. If somebody finds each, safety is gone.

Check restoration earlier than trusting it.Get well your pockets utilizing the seed phrase on a clear gadget. Verify it really works earlier than storing actual worth.

Restrict publicity.Maintain spending funds in a software program pockets. Maintain long-term holdings in chilly storage.

Shield your gadgets.Use sturdy passwords, gadget encryption, and updates. Deal with each gadget as a safety boundary.

Kinds of Self-Custody Wallets

Virtually all self-custody pockets varieties work in basically the identical manner. Nonetheless, every sort balances safety, comfort, and danger otherwise. Let’s have a look.

{Hardware} Wallets

This can be a bodily gadget constructed to retailer your crypto securely offline. It retains delicate knowledge remoted from the web, which makes distant assaults far more durable. Transactions are signed internally, so secret data by no means touches your laptop or telephone. Even when your laptop computer has malware, the pockets stays protected. {Hardware} wallets work greatest for long-term storage. Many individuals use them to guard bigger quantities and solely join them when they should transfer funds.

Learn extra: What Is a {Hardware} Pockets?

Software program Wallets

A software program pockets runs in your telephone or laptop. It connects to the web, which makes it a sort of scorching pockets. That makes it simple to make use of but in addition will increase publicity to threats. These wallets are fashionable for each day exercise. They allow you to ship, obtain, and work together with apps shortly. Most individuals use them for smaller balances or frequent transactions. They commerce comfort for increased danger.

Paper Wallets

A paper pockets is a bodily copy of your seed phrase or non-public key, normally printed or written down. That makes it a sort of chilly pockets. It comprises the data wanted to entry your funds with none digital storage. This methodology removes on-line assault danger, nevertheless it introduces bodily danger. Paper can burn, tear, fade, or be misplaced. If somebody finds it, they will take every little thing. Paper wallets work provided that saved extraordinarily fastidiously. Right this moment, they’re much less widespread, however some nonetheless use them for deep chilly storage.

Remaining Ideas: Is Self-Custody Proper for You?

Self-custody provides you actual possession, actual management, and actual accountability. It removes middlemen and places you in command of your property. Should you worth independence, perceive the fundamentals, and are keen to guard your setup, self-custody is price it. If not, begin small and study first.

FAQ

Is self-custody just for folks with giant quantities of crypto?

No. You should use self-custody at any degree. Many individuals begin with small quantities to learn the way wallets work earlier than storing bigger balances.

How can I inform if a pockets is custodial or non-custodial?

If the service holds your keys or can freeze entry, it’s custodial. Should you management the restoration phrase and nobody else can entry your funds, it’s a non-custodial pockets.

Can I exploit each a custodial trade and a self-custody pockets?

Sure. Many individuals purchase or commerce on exchanges, then transfer funds to self-custody for storage. This balances comfort with management.

Disclaimer: Please notice that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.