You log into your compliance dashboard and all of it appears to be like reassuring – each message flagged, each file scanned, alerts stacked neatly.

It’s comforting: virtually sufficient to overlook that compliance is rarely tidy.

Behind the screens, UC automation strains underneath a patchwork of legal guidelines, conflicting guidelines, and contextual nuances that no machine can totally grasp.

Throughout america, privateness and consumer-protection statutes differ sharply from state to state – not solely in definitions of private data, however in consent necessities, retention obligations, and enforcement thresholds.

California, Virginia, and Colorado every have privateness frameworks that overlap however diverge in vital methods. Add Europe’s GDPR, the AI Act, and NIS2, and the panorama turns into a tangle of generally contradictory obligations.

Trade-specific guidelines – HIPAA for healthcare, PCI DSS for funds, and sector-specific finance or vitality laws – layer additional complexity on high.

Jon Arnold, Principal at J Arnold & Associates, frames the dilemma succinctly. “AI’s effectiveness rests largely on utilizing a standardised algorithm that apply equally to all use circumstances, and within the US, the atmosphere for communications compliance is something however standardised,” he says.

“Given the significance of this for information safety, private privateness and fraud mitigation, the real-time capabilities touted by UCaaS and CCaaS distributors for compliant communications have to be taken with a grain of salt.”

Bridging the Hole

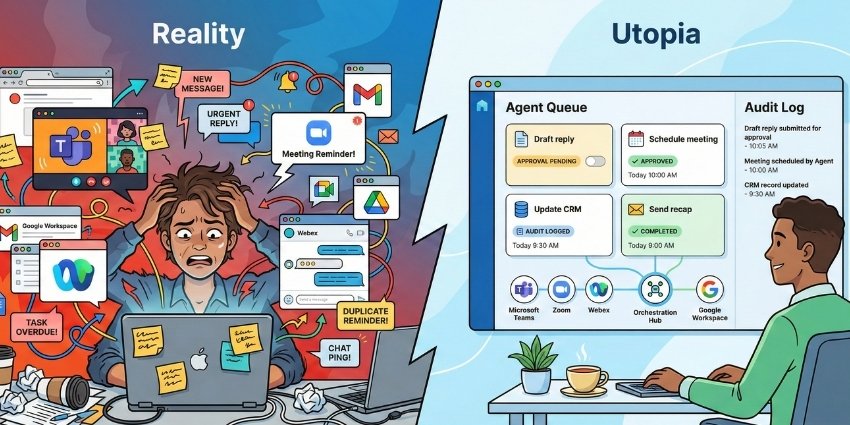

Automation instruments could promise simplicity: flag every thing, alert the precise individuals, implement coverage in actual time.

However whereas sophistication on paper is one factor, communications within the wild are one other.

In a current business survey, PwC discovered that 85 p.c of execs say compliance necessities have grown extra complicated over the previous three years.

“With a lot variance of privateness and shopper safety legal guidelines on a state-by-state degree, this diploma of automation would require human-in-the-loop involvement for a while to come back,” Arnold provides.

Integration with legacy techniques or third-party platforms typically introduces gaps that automation can not bridge. Alerts pile up, refined violations slip by means of, and human judgement stays important.

The stakes are excessive, as misinterpretation or misclassification of information can result in regulatory publicity, fines, and even enforcement actions.

The patchwork nature of laws implies that a apply thought-about compliant in a single state or sector could also be unlawful in one other.

Even massive enterprises with mature compliance programmes report problem managing a number of frameworks concurrently.

Automation’s Sensible Limits

UC platforms deal with huge volumes of messages, calls, recordings, and recordsdata.

Every is laden with jargon, abbreviations, and context-dependent that means. Automated classifiers could misinterpret content material, producing false positives or lacking violations totally. A message that appears innocent in isolation could breach regulation when seen as a part of a broader dialog.

Even superior instruments battle to resolve contradictions, anticipate gray areas, or contextualise native guidelines. In apply, compliance groups incessantly report that automation alone can not preserve tempo with the nuances of real-world communications.

Human oversight stays vital – somebody should learn between the traces, interpret intent, and make judgement calls machines can not.

Compliance tooling typically fails to attach seamlessly to legacy archives, third-party collaboration platforms, or exterior companions. Information flows exterior automated monitoring, leaving blind spots that no dashboard can visualise. Even minor gaps can result in severe violations if delicate data strikes unmonitored.

The Confidence Entice

Modern dashboards and real-time alerts give a comforting sense of management. However they’ll additionally foster overconfidence. Behavioural analysis describes this as automation bias – the tendency to defer to machine outputs, even when flawed. In compliance, that bias can have tangible penalties.

Zach Bennett, Microsoft Groups MVP and principal architect at LoopUp, has seen this play out repeatedly.

“There may be numerous hype round ‘real-time compliance automation’ in UC&C proper now, however the actuality is extra nuanced.

“I’ve seen circumstances in Microsoft Groups and different platforms the place automated classifiers misunderstood business language and both over‑protected or utterly missed delicate data.”

Automated classifiers generally over-protect delicate data, generally fail to flag it in any respect.

False positives waste time and assets; false negatives go away organisations uncovered.

“These instruments also can battle when totally different regulators impose conflicting guidelines, resembling retention on one facet and deletion on the opposite. The true threat will not be the expertise, it’s the overconfidence it creates.

“When organisations assume the system has every thing lined, they cease validating the automations and simply belief every thing it produces. Compliance is essential and nonetheless wants human oversight, particularly from authorized and governance groups.”

Many AI-driven compliance instruments function as black bins, producing choices with out clear reasoning. Regulators and auditors anticipate traceability, and with out it, automation can turn out to be a legal responsibility relatively than a safeguard.

Third-party communications and supply-chain interactions incessantly fall exterior automated monitoring, creating blind spots that dashboards can not totally seize.

UC&C platforms amplify these challenges. Tens of millions of every day messages, recordings, and shared recordsdata stream by means of collaboration instruments, typically with abbreviations, business jargon, or ambiguous phrasing. Automated classifiers battle to know nuance.

A phrase that seems innocent in a single context could set off obligations underneath a selected legislation or sector rule.

Vendor Guarantees vs Actuality

Distributors proceed to market real-time compliance as a near-complete resolution.

In apply, most platforms carry out properly at routine monitoring however falter when guidelines battle, context shifts, or laws evolve. Delays, partial protection, and jurisdictional blind spots are widespread.

The organisations that handle these challenges efficiently don’t deal with automation as an alternative to judgement. Machines deal with scale and pace; people deal with interpretation, accountability, and edge circumstances.

Insurance policies are repeatedly reviewed, alerts validated, and integrations maintained. Automation catches the plain; people catch the refined.

A strong compliance programme combines expertise with human oversight.

Authorized and governance specialists interpret ambiguous legal guidelines, assess proportional threat, and establish edge circumstances that machines can not.

Audit cycles, overview protocols, and cross-functional possession are simply as essential because the instruments themselves. Even in organisations with extremely automated UC&C techniques, alerts have to be manually verified, and insurance policies revisited at any time when laws or inside processes change.

The Human-Machine Stability

Actual-time compliance automation is seductive – it gives pace, effectivity, and reassurance.

However its biggest hazard is the boldness it conjures up.

Machines can not change judgement, contextual understanding, or the flexibility to reconcile conflicting obligations. In a fragmented regulatory panorama, compliance stays half artwork, half science.

“Automation is extremely useful, however it’s not an alternative to a correct compliance technique,” Bennett says.

“[But] it ought to help compliance groups, not create ensures or change them.”