DeFi has moved past the “AMM experimentation” part and entered an period that calls for intelligence: liquidity should not solely be considerable but additionally pushed by knowledge; person expertise should not solely be easy but additionally sensible in actual time.

Inside this context, Momentum (MMT) emerges as a subsequent era DEX, powered by AI and ve(3,3) constructed on the idea that algorithms can exchange emotional reflexes and protocols can evolve on their very own.

Whereas conventional AMMs merely react to market situations, Momentum goals to go a step additional to predict and coordinate with the rhythm of information, block by block, commerce by commerce.

What’s Momentum (MMT)?

What’s Momentum (MMT) – Supply: Momentum

On the floor, Momentum capabilities as a decentralized change (DEX). However at its operational core, it’s a self adaptive liquidity protocol constructed upon three foundational pillars:

AI-driven choice engine: A synthetic intelligence layer that analyzes on-chain knowledge together with worth actions, buying and selling quantity, pool depth, and MEV patterns and, when relevant, off chain alerts similar to information sentiment or volatility indicators, to be able to constantly alter the protocol’s conduct.ve(3,3) tokenomics: An incentive mannequin that encourages customers to lock their tokens (veMMT) to maintain long run development. The longer the lock interval, the better the person’s voting energy and share of buying and selling charges, permitting them to affect the emission movement towards probably the most environment friendly liquidity swimming pools and techniques.Dynamic liquidity routing: A mechanism that redistributes and routes liquidity in actual time to reduce slippage, optimize buying and selling charges, and stability threat publicity throughout the ecosystem.

The core philosophy is to show knowledge into buying and selling actions, and to remodel veMMT holders from passive yield farmers into energetic development coordinators of your entire protocol. With mission is to make liquidity not solely decentralized but additionally clever.

Momentum operates as an AI powered Automated Market Maker (AMM) that constantly learns from on chain conduct. Each commerce, each liquidity shift, and each person interplay feeds right into a suggestions loop the place knowledge turns into intelligence, and intelligence turns into motion. The result’s a DEX that doesn’t merely exist on the blockchain, however one which adapts to it.

Momentum subsequently represents a brand new paradigm in DeFi a transition from passive liquidity to energetic intelligence, from human reflex to machine prediction, and from fragmented incentives to autonomous equilibrium. The place anybody can commerce any asset, unconstrained by area, time, or the rest.

Be taught extra: What Is Morpho Crypto? The DeFi Protocol Optimizing Lending on Ethereum

Core Merchandise of Momentum

Momentum isn’t only a DEX, it’s a whole monetary working system designed for the tokenized financial system. Every product in its ecosystem contributes a significant operate: safety, liquidity, and capital effectivity, forming an built-in suite that powers the following period of worldwide finance.

MSafe – Safe Treasury Infrastructure

MSafe is Momentum’s institutional-grade, multi signature (multi sig) pockets answer constructed particularly for Transfer based mostly chains similar to Sui, Aptos, Motion, and IOTA. Designed to handle treasuries, token vesting, and on chain execution, MSafe gives versatile approval flows and prime tier safety turning into the spine of governance and capital administration for main tasks within the Transfer ecosystem.

Treasury Administration: Protects protocol treasuries with configurable multi sig entry, guaranteeing collective management and minimizing single level of failure dangers.Token Vesting: Permits groups and traders to securely lock, schedule, and launch tokens through clear, on chain sensible contracts stopping manipulation or untimely unlocks.dApp Retailer: Presents safe integrations with DeFi purposes by a wise contract based mostly App Retailer, permitting DAOs and groups to work together safely whereas sustaining multi sig safety.

Trusted by main protocols throughout Sui, Aptos, and past, MSafe has grow to be the de facto safety customary for treasury operations, token distribution, and DAO stage governance inside the Transfer ecosystem.

Momentum DEX – The Central Liquidity Engine

On the middle of the ecosystem is Momentum DEX, a subsequent era decentralized change constructed on a concentrated liquidity mannequin (CLMM) impressed by Uniswap v3. The platform permits liquidity suppliers to allocate their capital inside particular worth ranges, creating deeper liquidity and tighter spreads the place buying and selling exercise truly occurs.

Since its beta launch on March 31, 2025, Momentum DEX has rapidly grow to be a key liquidity engine for the Transfer ecosystem, surpassing 1.6 million distinctive swap customers, over $600 million in whole worth locked (TVL), and a cumulative buying and selling quantity exceeding $25 billion.

However the numbers solely inform a part of the story. Momentum DEX leverages Sui’s programmable transaction blocks (PTB) to compress complicated actions, similar to swapping, including liquidity, staking LP tokens, and claiming rewards, right into a single atomic transaction. This makes DeFi execution smoother, cheaper, and safer.

Retail customers take pleasure in an intuitive CEX like interface with low charges and guided buying and selling, whereas establishments entry deep liquidity, clear pricing, and safe self custody by MSafe integration.

Cross chain compatibility through Wormhole ensures belongings transfer seamlessly throughout ecosystems. Whereas Sui’s Programmable Transaction Blocks (PTB) allow merchants to bundle a number of actions, similar to swap → add liquidity → stake LP → declare rewards, right into a single atomic transaction. One click on, one signature, one final result: both all the pieces executes, or nothing does.

Leveraging Sui’s object centric, parallel execution, Momentum DEX achieves larger throughput, close to instantaneous finality, and decreased MEV publicity, making it one of the crucial environment friendly and safe DEX infrastructures in DeFi at present.

By combining CLMM structure, PTB capabilities, and Sui’s excessive efficiency atmosphere, Momentum DEX delivers an unprecedented mixture of capital effectivity, institutional grade infrastructure, and composable DeFi innovation, the true liquidity engine of the tokenized period.

xSUI – Liquid Staking, Unlocked Liquidity

xSUI – Liquid Staking, Unlocked Liquidity – Supply: Momentum

The second pillar of Momentum’s ecosystem is xSUI, a liquid staking protocol that transforms staked SUI right into a yield bearing, composable asset. Customers can stake SUI to validators with one click on and obtain xSUI, a token that represents their staked place incomes staking rewards whereas remaining totally liquid for DeFi actions.

With xSUI, customers can earn native staking yield and concurrently deploy their capital throughout lending, liquidity swimming pools, or collateralized merchandise. It successfully turns idle staked belongings into productive capital, permitting customers to stack a number of yield layers from staking rewards to buying and selling charges and ecosystem incentives.

The synergy between xSUI and Momentum DEX amplifies effectivity: xSUI injects yield bearing liquidity into the DEX, whereas the DEX enhances xSUI’s utility by swaps, farming, and composable DeFi markets. Each liquidity supplier holding xSUI earns each buying and selling charges and Sui staking rewards, making a twin yield construction that strengthens your entire Sui financial system.

As adoption grows, xSUI is poised to grow to be a cornerstone of Sui DeFi, merging community safety, liquidity depth, and yield era right into a single, fluid mechanism.

To put the inspiration for a DeFi dream, Momentum begins by constructing its core infrastructure and liquidity on Sui, with three important flagship merchandise: Momentum DEX, xSUI (liquid staking), and MSafe (treasury administration and token allocation).

From this basis, Momentum expands into cross chain belongings and ultimately unlocks actual world belongings (RWA), bridging the hole between conventional worth and the on chain financial system.

The Working System for the Subsequent Period of World Finance

Momentum’s ambition is to construct a monetary working system for your entire crypto market. Reshape, grow to be the working system for the following period of the monetary world.

Not like most DeFi platforms that concentrate on a single use case, Momentum takes a modular and interoperable strategy. Every of its core merchandise, Momentum DEX, xSUI, MSafe, Token Technology Lab (TGL), Vaults, and Momentum X, performs a particular position within the broader structure, whereas remaining deeply built-in with each other. Collectively, they type a self-sustaining system the place liquidity, safety, and compliance constantly reinforce one another.

We have now analyzed Momentum DEX, xSUI, MSafe intimately within the earlier half. On this half, we’ll go into the remaining elements.

Token Technology Lab – Bluechip Launchpad for the Subsequent Wave of Initiatives

Momentum isn’t simply shaping how we commerce. It’s redefining how tasks launch. On the coronary heart of that imaginative and prescient lies the Token Technology Lab (TGL), Momentum’s new age bluechip launchpad for prime quality groups who need greater than hype cycles and fast listings.

Whereas most launchpads deal with quick token gross sales, TGL prioritizes long run alignment. It brings collectively probably the most influential gamers within the Sui ecosystem. These embody the Sui Basis, main traders, market makers, centralized exchanges, and prime tier protocols. The objective is to provide each challenge the identical place to begin: actual liquidity, verified companions, and speedy market entry.

No upfront charges, no dump tradition, no quick time period hypothesis. As a substitute, TGL locks launchpad charges for twelve months. This pushes liquidity instantly into the markets and rewards Momentum’s neighborhood of over 150,000 members, together with DEX referrers and NFT holders. In consequence, the launch feels natural. Initiatives debut with robust neighborhood backing and deep liquidity already in place.

Furthermore, the story doesn’t finish there. Each token launched by TGL integrates instantly into Momentum DEX, seeding new swimming pools and buying and selling pairs from day one. This regular influx of contemporary belongings turns the DEX right into a dwelling, increasing market. It’s not only for buying and selling, but additionally for discovery.

TGL is actually a bridge between challenge creation and sustainable liquidity. It provides builders a quick monitor to the market and provides the Momentum neighborhood early entry to excessive conviction alternatives.

In an trade outlined by quick consideration spans, TGL bets on depth over velocity. That focus might make it the go to launchpad for severe builders.

Momentum Vaults – Automated Yield for the Remainder of Us

Momentum Vaults – Automated Yield for the Remainder of Us – Supply: Momentum

Momentum’s subsequent frontier is making DeFi yield easy once more. The Momentum Vaults are designed for one factor: to let customers earn like execs with out buying and selling like execs.

These vaults act as automated portfolios powered by curated methods from skilled DeFi builders. Customers deposit their belongings, and the vaults do the remainder, optimizing liquidity ranges, rebalancing positions, and compounding rewards in actual time.

Momentum’s rollout begins with auto rebalancing vaults, instantly plugged into Momentum DEX, the place every vault dynamically manages liquidity for a particular buying and selling pair. Later phases introduce multi technique and multi chain vaults, permitting customers to mix leverage, looping, and yield farming throughout chains similar to Ethereum, Solana, and Sui.

For retail customers, the vaults imply fingers off earnings, no charts, no bots, no sleepless nights. For establishments, they characterize capital effectivity at scale, giving funds and DAOs a option to deploy liquidity with clear, auditable logic.

Past comfort, vaults serve a strategic position: they maintain liquidity on the platform “sticky.” As a substitute of funds hopping between protocols for the following yield farm, capital stays productive inside Momentum’s ecosystem, reinforcing the DEX’s depth and worth stability.

In essence, the vaults flip DeFi’s greatest problem, complexity, into its greatest energy. By wrapping superior methods into automated, composable instruments, Momentum is setting a brand new customary for accessible, knowledge pushed yield era on Sui.

Momentum X – The place Compliance Meets Composability

If Momentum DEX is the engine that powers liquidity, Momentum X is the belief layer that retains your entire system compliant, clear, and able to scale globally.

Momentum X – The place Compliance Meets Composability – Supply: Momentum

Fixing DeFi’s Lengthy-Standing Compliance Problem

Within the race to construct sooner and smarter DeFi, one outdated impediment nonetheless stands in the way in which, regulatory compliance. Whereas blockchains can settle trades in seconds, establishments nonetheless want weeks to onboard, confirm identities, and fulfill jurisdictional guidelines.Momentum X goals to alter that by creating the primary institutional grade buying and selling layer that merges compliance, liquidity, and actual world belongings below a single on-chain roof.

Fixing Fragmentation in Tokenization

For years, the tokenization area has been deeply fragmented. Every chain runs its personal KYC course of, forcing traders to repeat verification throughout platforms simply to commerce the identical asset.Momentum X solves this drawback with a “confirm as soon as, entry in every single place” strategy constructed on Sui’s full stack structure, powered by Walrus and Seal.

When a person begins a transaction by a related DApp, Momentum X quietly handles the heavy lifting behind the scenes.

Actual Time, Privateness Preserving Compliance

An actual time eligibility request is shipped to the Momentum X API, which confirms that the DApp is allowed to request id checks.Utilizing Seal, encrypted id knowledge is fetched from Walrus, and solely the mandatory data is decrypted to show compliance.No pointless private knowledge ever leaves the system.

If the person meets the asset’s regulatory necessities, similar to jurisdiction, certification, or switch limits, the transaction is accepted immediately, on chain.

This course of feels invisible to the person, but it enforces regulatory requirements, privateness safety, and velocity suddenly.For establishments, it removes one of many greatest boundaries to DeFi participation. In the meantime, for people, it means frictionless entry to regulated merchandise with out giving up management of their knowledge.

Compliance Baked Into Good Contracts

Below the hood, Seal’s programmable entry management embeds compliance instantly into sensible contracts, eliminating the necessity for centralized gatekeepers.Furthermore, when mixed with zero data id proofs for privateness and Wormhole bridges for cross-chain interoperability, Momentum X transforms a patchwork of remoted pilots right into a unified, composable monetary community.

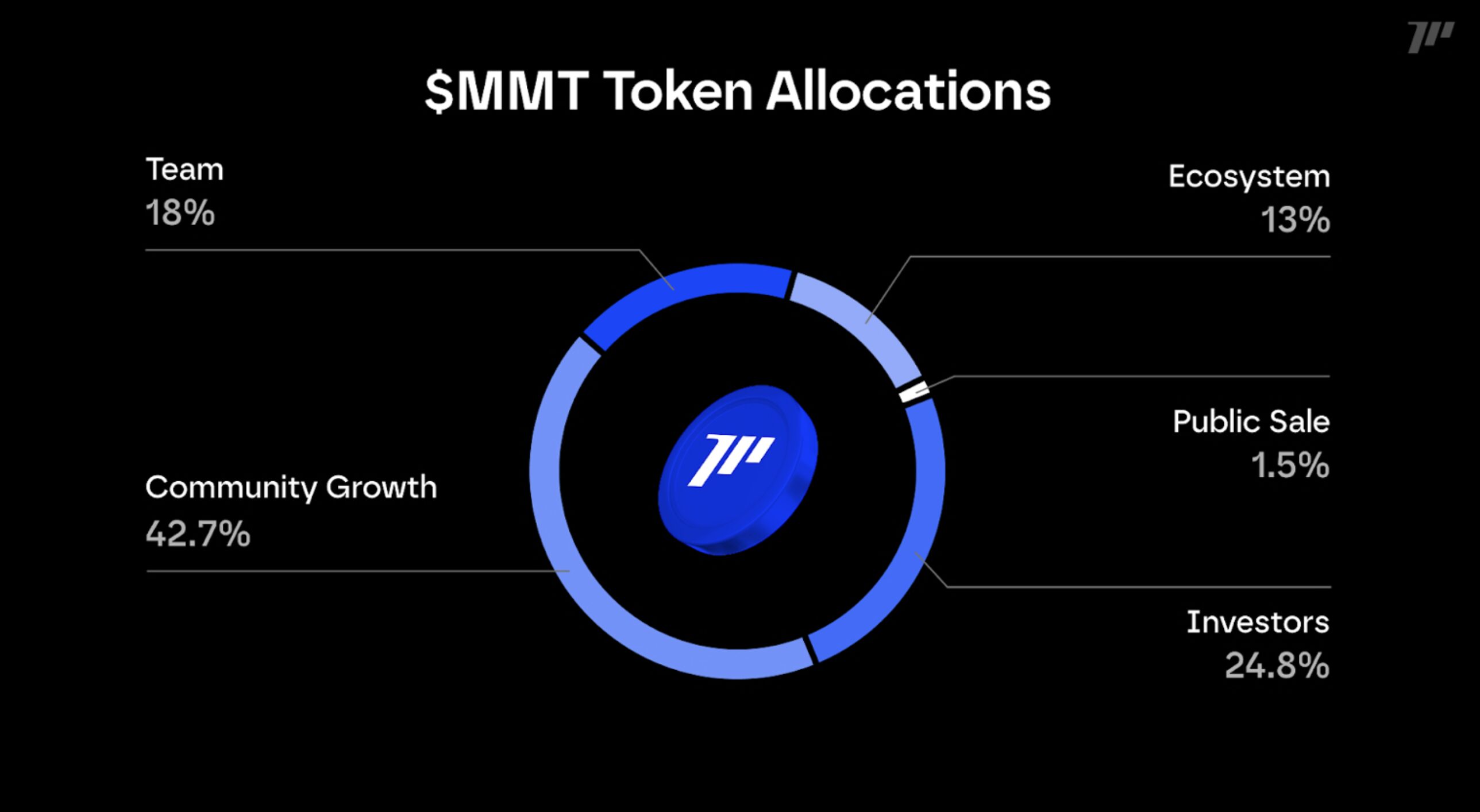

MMT Tokenomics

Momentum’s native token, MMT, serves because the financial and governance core of its monetary working system, powering buying and selling, liquidity, incentives, and neighborhood participation throughout all merchandise. With a complete provide of 1,000,000,000 MMT, the token’s design fastidiously balances early market liquidity with long run sustainability, guaranteeing each development and stability because the ecosystem expands throughout DeFi and tokenized finance.

On the Token Technology Occasion (TGE), an preliminary 204,095,424 MMT (roughly 20.41% of the overall provide) will enter circulation.

MMT Tokenomics – Supply: Momentum

Ecosystem (13%) Neighborhood Development (42.72%) Buyers and Early Supporters (24.78%)Public Sale (1.5%)Group (18.00%)

Be taught extra: Momentum (MMT) Will Be Listed on Binance HODLer Airdrops!

Learn how to Purchase MMT Token

Shopping for MMT on centralized exchanges (CEXs) is fast and easy.

Select an change

MMT will likely be listed on main exchanges similar to Binance, KuCoin, Gate.io, and MEXC. All the time test official bulletins from Momentum Finance for verified listings.

Purchase MMT

Seek for the buying and selling pair (e.g., MMT/USDT) and place a market or restrict order to buy your required quantity.

Safe your tokens

As soon as bought, retailer MMT in your CEX pockets or switch to MSafe, Momentum’s official pockets for staking, governance, or participation in DeFi merchandise.

FAQ

What’s Momentum (MMT)?

Momentum is an AI powered, ve(3,3) based mostly decentralized change (DEX) constructed on the Sui Community, designed to offer deep liquidity, dynamic routing, and clever, knowledge pushed buying and selling. It’s greater than only a DEX, Momentum is constructing a full monetary working system that connects DeFi, actual world belongings (RWA), and institutional infrastructure.

What makes Momentum completely different from different DEXs?

Momentum integrates AI algorithms, programmable transaction blocks, and the ve(3,3) mannequin to constantly optimize liquidity and person expertise. It doesn’t simply react to markets it predicts and adjusts dynamically, providing a CEX like expertise with DeFi transparency.

What are the core merchandise of Momentum?

Momentum’s ecosystem contains six interconnected merchandise:

Momentum DEX – AI powered, concentrated liquidity market maker.xSUI – Liquid staking for Sui with DeFi integration.MSafe – Institutional-grade treasury and asset administration.TGL (Token Technology Lab) – Bluechip launchpad for brand new tasks.Vaults – Automated, high-performance yield methods.Momentum X – Compliance and RWA buying and selling layer connecting DeFi and TradFi.

What’s the whole provide of MMT?

The overall provide of MMT is 1,000,000,000 tokens, with an preliminary circulating provide of roughly 204 million (20.41%) at TGE. This design balances early liquidity with long-term governance and ecosystem stability.

How does the ve(3,3) mannequin work in Momentum?

Momentum’s ve(3,3) mannequin encourages long run alignment: Customers lock MMT to obtain veMMT, which grants governance energy, buying and selling price rebates, and boosted yields. veMMT holders resolve how emission rewards are distributed, guaranteeing incentives movement to productive markets.