In a worldwide investor survey from Coinbase Institutional and Glassnode, 1 in 4 establishments agreed that crypto has now entered a bear market. But the vast majority of establishments nonetheless mentioned Bitcoin was undervalued, and most mentioned that they had held or elevated publicity since October.

That discrepancy issues as a result of it captures how establishments are positioning proper now: warning concerning the regime, a willingness to remain allotted, and a desire for concentrating danger in Bitcoin quite than in smaller, extra risky tokens that may unwind shortly when leverage comes out.

A bear market label, a price bid

The report’s market framing explains why the paradox exists.

October’s deleveraging did actual injury to altcoin worth motion, however Bitcoin dominance barely moved, edging from 58% to 59% within the fourth quarter of 2025.

That stability issues as a result of it exhibits the promoting wasn’t evenly distributed. It was a washout within the lengthy tail greater than a broad rejection of crypto, with Bitcoin performing just like the asset you retain whenever you’re slicing danger however not exiting the class.

David Duong, Coinbase Institutional’s international head of analysis, provided a clear option to reconcile the “bear market” language with “undervalued” conviction in an interview for CryptoSlate.

His level was that establishments usually use cycle labels to explain regime and positioning, whereas “worth” is a longer-horizon evaluation tied to adoption, shortage, construction, and the coverage backdrop.

“When establishments assess Bitcoin’s worth, they appear past near-term worth motion to elements similar to adoption, shortage, bettering market construction, and clearer regulatory frameworks.

Traditionally, bear markets usually sign intervals of tighter liquidity and weaker sentiment that finally lay the muse for renewed institutional participation and future development.

In different phrases, when an investor calls this a bear market (and that’s not our view, by the way in which), they’re describing the section of the cycle and prevailing danger urge for food.

Positioning could also be defensive, liquidity is selective, and worth motion would possibly both be trending decrease or chopping with a destructive skew.

They’re speaking concerning the regime we’re buying and selling in proper now, not the place they suppose Bitcoin ought to finally settle.”

The report’s personal knowledge strains up with that interpretation. It exhibits a market that has stopped rewarding indiscriminate risk-taking however hasn’t misplaced the bid for the biggest property.

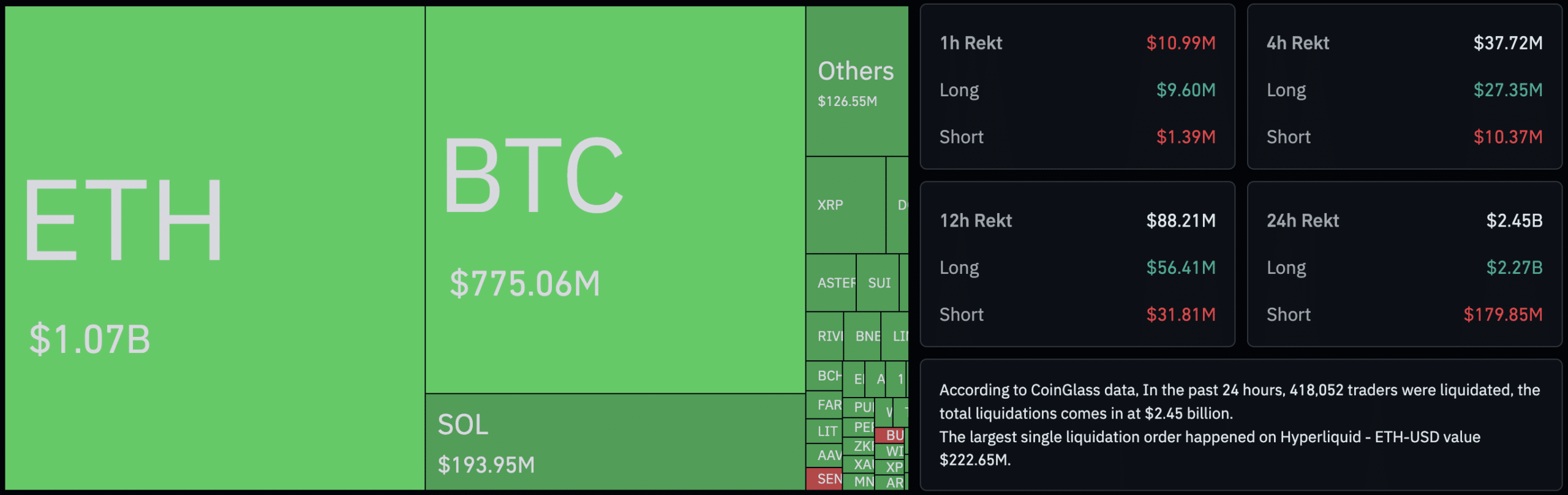

Coinbase and Glassnode say perpetual futures have been hit hardest, with their systematic leverage ratio falling to three% of the overall crypto market cap (excluding stablecoins).

On the identical time, choices open curiosity spiked as merchants rushed to defend towards additional worth weak point.

As an establishment, in case your intuition is that it’s a bear market, you purchase insurance coverage, scale back liquidation danger, and hold the publicity you continue to need by way of automobiles that gained’t pressure you out on the worst doable time.

From perps to safety

The simplest mistake to make right here is to deal with “undervalued” as a single valuation mannequin that everybody shares.

In apply, each the report and Duong describe a bundle of assumptions that appears extra like market construction than a neat discounted money stream argument.

Begin with what modified in derivatives.

The report says BTC choices OI has overtaken perpetual futures OI, with the 25-delta put-call skew in optimistic territory throughout 30-day, 90-day, and 180-day expiries, and that doesn’t occur in a market that’s making an attempt to maximise upside by way of leverage.

It occurs in a market that’s keen to remain lengthy, however decided to outline danger.

Duong described the identical migration to choices when requested what establishments did after October’s liquidation reset:

“Institutional curiosity in increasing on-chain remained after the October reset, however in a measured, multi-venue means.

Furthermore, establishments more and more expressed views by way of choices and foundation trades, which give convexity or carry with out the identical liquidation danger that drove the October transfer.”

That final line is the important thing, and it exhibits that establishments modified how they take publicity.

Choices and foundation trades aren’t headline-making methods, however they’re how knowledgeable e-book stays within the sport when the regime punishes overextension.

On-chain knowledge is telling the identical story.

Coinbase and Glassnode say sentiment, as measured by entity-adjusted NUPL, deteriorated from Perception to Nervousness in October and stayed there by way of the quarter. Whereas that’s actually not euphoric, it isn’t capitulation both.

The drop in entity-adjusted NUPL exhibits the market stopped paying you for optimism, however continues to be hanging round. This interpretation matches a world the place buyers might be cautious concerning the present section whereas nonetheless seeing the asset as low cost relative to the place they suppose the equilibrium sits.

The report additionally notes that, within the fourth quarter of 2025, BTC that moved inside three months rose by 37%, whereas BTC that remained unmoved for greater than a 12 months fell by 2%, which the authors interpret as a distribution section late in 2025.

If you wish to take the institutional viewpoint significantly, distribution doesn’t need to be a loss of life sentence. It could actually imply giant holders de-risked into power, and the market is now looking for the following set of fingers that may personal provide without having a relentless liquidity drip.

That is the place the declare about Bitcoin being “undervalued” stops being a few single fair-value quantity and begins being concerning the perception that Bitcoin has grow to be the one asset in crypto that may take up capital in measurement without having a retail bid to carry the construction collectively.

Duong explicitly separated Bitcoin’s underwriting framework from the remainder of the crypto market:

“In contrast to retail members, who usually give attention to short-term worth actions and market cycles, establishments place much less emphasis on timing and extra on Bitcoin’s long-term worth proposition.

On this context, Bitcoin is more and more handled as a strategic, store-of-value asset and macro hedge, quite than a speculative token inside the broader crypto universe.”

That maps onto what the report says about large-caps versus small-caps.

Their topline view for the primary quarter of 2026 favors larger-cap tokens, with smaller caps nonetheless coping with October’s aftermath.

Given this, seeing Bitcoin as “undervalued” could also be much less about it being low cost in isolation and extra about it being the one crypto asset that establishments can deal with as a sturdy allocation when the regime is unfriendly.

Liquidity is the actual cycle

The second pillar of the paradox is the time horizon.

Calling one thing a bear market is normally a shorter-window judgment, whereas calling one thing undervalued is usually a longer-window judgment. The bridge between them is whether or not establishments nonetheless consider the market is dominated by a four-year clock, or whether or not they have moved towards a macro framework the place liquidity, charges, and coverage do many of the work.

Duong’s view is that the four-year cycle nonetheless exists as a behavioral reference level, however establishments don’t deal with it as a tough mannequin.

He argued that the halving has much less energy for establishments when you management for the macro variables that drive all danger property:

“In our conversations with these entities, the four-year cycle continues to be a reference level, however largely as a behavioral template quite than a tough mannequin.

They’ll take a look at the place we’re relative to prior cycle lows/highs, halving dates, and typical drawdown/restoration patterns, as a result of these ranges matter for positioning and sentiment.

That mentioned, the proof that halvings causally drive every cycle is weak: we solely have 4 observations, and so they’re closely confounded by large macro and coverage shifts (QE, COVID stimulus, and many others.).

In our 2026 Outlook, we explicitly argue the financial relevance of the halving is considerably specious when you management for liquidity, charges, and greenback dynamics.”

The report factors to December CPI holding at 2.7%, and cites the Atlanta Fed GDPNow projecting 5.3% actual GDP development for the fourth quarter of 2025. It outlines a base case the place the Fed delivers the 2 charge cuts (50 bps whole) priced into fed funds futures, which the authors view as a tailwind for danger property.

Additionally they flag a cooling jobs market, with 584,000 jobs added in 2025 versus 2 million in 2024, and so they title AI adoption as one driver of that moderation.

You don’t want to purchase each macro inference to see what’s occurring: the institutional view of Bitcoin being “undervalued” is constructed on a macro-and-liquidity scaffold quite than a pure crypto-cycle scaffold.

The report’s liquidity part makes that specific with a customized International M2 index that Coinbase says leads Bitcoin by 110 days and exhibits a 0.9 correlation with BTC’s strikes throughout many look-back home windows. Should you settle for that framing, the paradox turns into simpler to know.

You may take a look at the regime, see the scars from October, see a market that also needs draw back safety, and nonetheless conclude that Bitcoin sits in a positive long-duration setup if coverage and liquidity do what you anticipate them to do.

Solely then does “bear market” grow to be an outline of how the market behaves at the moment, and “undervalued” turns into a press release about how that market reprices as soon as the macro inputs flip extra supportive.

So what would break this thesis?

Duong rejected the concept a routine pullback could be sufficient and as a substitute pointed to a cluster of macro and on-chain circumstances that must fail collectively:

“Establishments aren’t anchoring on worth alone, they’re anchoring on macro liquidity circumstances and onchain market construction.

The clearest sign that they is perhaps mistaken wouldn’t be a routine pullback, however a breakdown within the elementary drivers of that thesis.

In different phrases, it wouldn’t be one sign alone, nevertheless it must be a cluster of indicators.

For instance, if macro liquidity circumstances have been to show decisively towards danger property, if onchain accumulation metrics have been to reverse, if long-term holders have been distributing into weak point, and if institutional demand indicators have been to pattern persistently destructive, that mixture would possibly meaningfully problem the view that Bitcoin is undervalued or structurally supported at current.”

The survey numbers recommend establishments are cut up on what section the market is in, however aligned on Bitcoin’s relative attraction.

The report’s charts present how that perception expresses itself in actual positioning: much less reliance on fragile leverage, extra use of choices for outlined danger, and a market that has cooled with out absolutely breaking.

Duong’s solutions add connective tissue to this thesis that exhibits “undervalued” is a framework anchored to liquidity, construction, and time horizon, not a vibe examine of the market.

Whether or not establishments find yourself proper relies upon much less on profitable a short-term argument about cycle labels and extra on whether or not that framework holds collectively when the following macro check arrives.