The Day by day Breakdown dives into the software program selloff, taking a more in-depth have a look at valuation, earnings expectations, and key technical ranges.

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our every day insights, all you have to do is log in to your eToro account.

Deep Dive

Software program shares are being pummeled as issues develop that AI may cannibalize elements of their companies. For now, traders aren’t looking for worth — they’re indiscriminately promoting the group, although many main companies stay basically stable. Progress estimates have held up or moved larger, whereas valuations for a number of names are approaching, or already under, their long-term troughs.

In latest days, the promoting has spilled past software program. Strain has unfold to monetary rankings companies, exchanges, cybersecurity names, and journey corporations. Whereas the decline could also be nearing a capitulation level, the larger query is much less about whether or not this group can bounce, and extra about whether or not a darkish cloud will proceed to hold over the area.

Technically Talking

Beneath is a have a look at the IGV ETF, the most important software program ETF by AUM. For reference, the highest 5 shares within the IGV ETF embody: Microsoft, Palantir, Salesforce, Oracle, and Intuit.

Now down greater than 30% from its all-time excessive in September, IGV is approving the $80 degree. There it finds a zone that has been assist for 2 years, in addition to the rising 200-week shifting common. That doesn’t imply the decline will cease proper right here, proper now. However it’s a technical reference level for traders in search of a possible assist space.

For a refresher on technical evaluation, make sure you try our latest Boot Camp.

Future Progress Projections

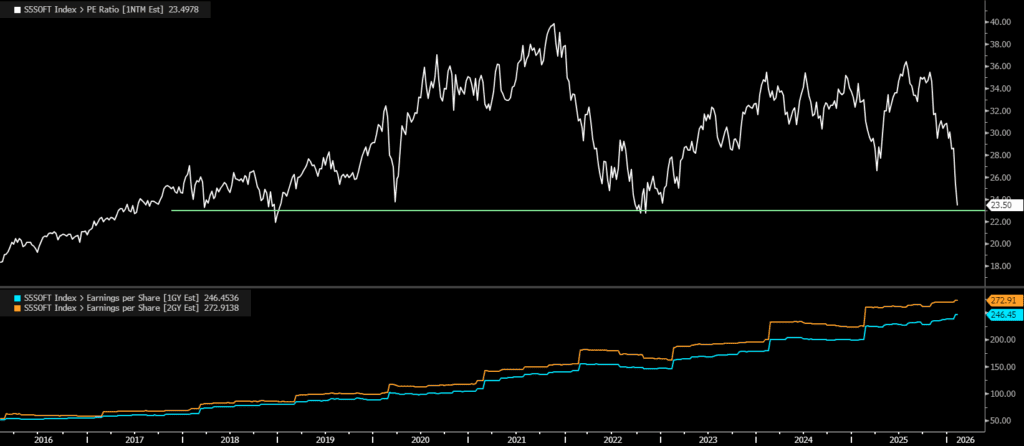

Taking a look at Bloomberg’s S&P 500 Software program Index, analysts undertaking stable development over the following 12 and 24 months:

Earnings Progress: 19.2% over the following 12 months, 14% within the following 12 months

Income Progress: 16.1% over the following 12 months, 16% within the following 12 months

Wish to obtain these insights straight to your inbox?

Join right here

Diving Deeper — Valuation

A better have a look at the Bloomberg S&P 500 Software program Index highlights two key factors. First, valuations are nearing a zone that has supplied assist since 2018. That doesn’t assure this decline will make a low in the identical space, however traditionally these ranges have helped stabilize the group. Second, ahead earnings estimates (the chart’s backside pane) proceed to rise for the following 12 and 24 months, whilst inventory costs have fallen.

Dangers

Traders are reacting to fears that AI will upend software program — and even adjoining industries. Within the close to time period, the extra excessive “existential” issues look overstated. AI will evolve shortly, however demand for software program and cybersecurity isn’t going away. The bigger threat could also be valuation: not whether or not these companies survive, however whether or not the market is keen to pay the identical multiples it as soon as did. If the “valuation ceiling” shifts decrease, upside could possibly be capped even when fundamentals stay robust.

The Backside Line

Some traders might keep on the sidelines amid volatility and the danger of a number of compression. Others will see high-quality companies which were repriced sharply and look at this as an affordable entry level. The market has overreacted to narrative-driven fears earlier than. The query is whether or not that’s taking place once more — or whether or not this time is completely different.

Disclaimer:

Please observe that resulting from market volatility, a number of the costs might have already been reached and eventualities performed out.