Briefly

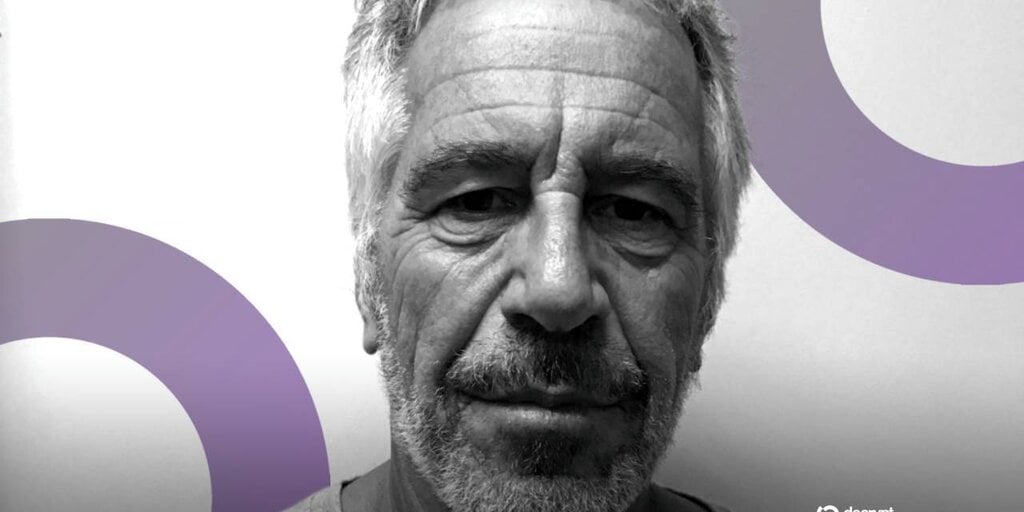

The FDIC agreed to pay Coinbase $188,440 in authorized charges and overhaul FOIA insurance policies following a court docket ruling that discovered the company violated federal disclosure regulation.

The settlement concludes a multi-year authorized battle that uncovered dozens of “pause letters” the FDIC despatched to banks ordering them to halt crypto-related actions.

Below new management, the FDIC pledged that it will not categorically withhold all financial institution supervisory paperwork.

The FDIC has agreed to pay $188,440 in authorized charges and drop its battle to withhold crypto-related “pause letters,” settling a FOIA lawsuit tied to alleged Operation Choke Level 2.0 debanking ways and shutting a case that compelled the regulator to launch information displaying how banks have been allegedly pressed to halt or restrict crypto exercise.

In a joint standing report filed Friday in federal court docket in Washington, D.C., the Federal Deposit Insurance coverage Company agreed to pay the complete legal professional’s charges from Historical past Associates Included, the analysis agency that filed the information request at Coinbase’s course, and revise sure FOIA practices.

The FDIC’s appeal-denial letter had acknowledged its “resolution to withhold was based mostly upon a willpower that the kind of information being requested could be exempt, slightly than making exemption determinations on a document-by-document foundation,” in line with the standing report.

]]>

The information turned public after the FDIC’s Workplace of Inspector Common revealed their existence in an October 2023 report, which criticized the company for sending letters to banks “asking them to pause, or not increase, deliberate or ongoing crypto-related actions.”

The settlement follows a November court docket ruling that formally discovered the FDIC “violated FOIA” by initially categorically withholding the letters and “redacting data within the pause letters that’s not topic to Exemption 8 or wouldn’t impair any curiosity protected by Exemption 8.”

Joe Ciccolo, founder and president of BitAML, informed Decrypt the ruling reveals crypto oversight within the earlier administration was formed as a lot by “political and reputational concerns” as by conventional safety-and-soundness evaluation.

“Disgrace on the FDIC—they’re speculated to exemplify transparency given their mandate to guard shoppers and insure the general public’s cash,” Ciccolo mentioned.

“Operation Choke Level 2.0” refers to alleged coordinated efforts by U.S. financial institution regulators, together with the FDIC, Federal Reserve, and OCC, to limit crypto corporations’ banking entry, borrowing its identify from an Obama-era program that pressured banks to chop off gun sellers and payday lenders.

When Coinbase sought the letters in November 2023, the FDIC denied the request as exempt “by their very nature,” later saying its resolution to withhold was based mostly on file kind slightly than a “document-by-document” exemption evaluation.

After Historical past Associates sued in June 2024, U.S. District Choose Ana Reyes ordered the FDIC to provide the letters and later warned of a “lack of good-faith effort” in its redactions, directing the company to make extra considerate ones.

It took 4 court docket orders and 6 productions for the FDIC to produce all responsive paperwork.

“The years of litigation have been price it,” Coinbase CLO Paul Grewal posted on X following the settlement. “We efficiently uncovered dozens of crypto ‘pause letters’—indeniable proof of OCP2.0 and the coordinated effort to sideline the trade.”

Below the settlement, the FDIC dedicated to coverage modifications, together with including language to coaching supplies instructing workers to “liberally construe” FOIA requests and declaring it doesn’t preserve a blanket coverage of categorically withholding all financial institution supervisory paperwork beneath FOIA Exemption 8.

Ciccolo mentioned oversight needs to be “clear, risk-based, and grounded in clear supervisory requirements, not casual strain conveyed by way of cryptic ‘pause letters,’” warning that behind-the-scenes regulatory actions erode belief within the supervisory framework.

The events will file a proper dismissal as soon as the FDIC remits cost. The regulator didn’t instantly return Decrypt’s request for remark.

Every day Debrief Publication

Begin day-after-day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.