Crypto Perception UK director Will Taylor argued in a brand new video that XRP is “buying and selling totally different” this cycle and stated he sees a reputable path for it to problem Ethereum’s long-held No. 2 place, with an out of doors likelihood of even pressuring bitcoin if the correct mix of narrative and market construction lands.

The “XRP Curveball” Idea

Taylor anchored his thesis to a remark he highlighted from Mark Yusko, a widely known bitcoin-focused investor, who warned of a possible “curveball” tied to XRP and a future the place policymakers clamp down on non-public stablecoins. Yusko, in Taylor’s telling, speculated {that a} “CBDC model” may emerge the place authorities successfully steer customers away from property like USDT and USDC, a framing Taylor stated resonated with what components of the XRP neighborhood have anticipated for years.

Mark Yusko says he’s awaiting a possible coverage curveball, together with a future CBDC framework that might prohibit non-public stablecoins like USDT and USDC, whereas noting $XRP exercise could also be taking place extra behind the scenes. 🤯 https://t.co/ba4aqu2dLN pic.twitter.com/bpWBw7lGX2

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) February 9, 2026

“Now, what have I been saying about XRP this cycle? I’ve stated that it appears totally different,” Taylor advised viewers. “I’ve stated that I feel it’s going to problem ETH for spot quantity two. And I additionally suppose that there’s a possible that it challenges Bitcoin for the primary spot this cycle. And I do know that lots of people don’t agree… however that’s really what I feel.”

Associated Studying

Taylor was cautious to border the concept as a non-base-case situation whereas emphasizing why he believes XRP is uniquely positioned if US coverage and institutional incentives shift in its favor. He pointed to Ripple’s US footprint, its endurance via regulatory “trials and tribulations,” and what he characterised as proximity to political energy in Washington. In his view, these elements may matter if the subsequent part of crypto adoption is formed as a lot by compliance structure as by ideology.

He additionally cited feedback from Ray Dalio, referenced by way of an interview Taylor stated aired “yesterday,” the place Dalio mentioned a way forward for diminished transactional privateness and the danger of being “shut off” if politically disfavored, a situation Taylor linked to broader CBDC discourse. Taylor emphasised that his level was not whether or not such an final result is fascinating, however that merchants ought to place for what they suppose is almost definitely to occur, not what they need to occur.

“If I may change the way in which that I assumed the world was going to be, I might put my capital someplace else and I’d make the world a unique place,” Taylor stated. “However I’m not born in a world that I get to decide on what occurs sooner or later. However I’m born right into a world the place I get to see what I feel goes to occur and place my bets accordingly. It’s similar to buying and selling. You don’t commerce or place an funding on one thing you need to occur. You place it on one thing that you simply suppose goes to occur.”

XRP Vs. ETH Vs. BTC

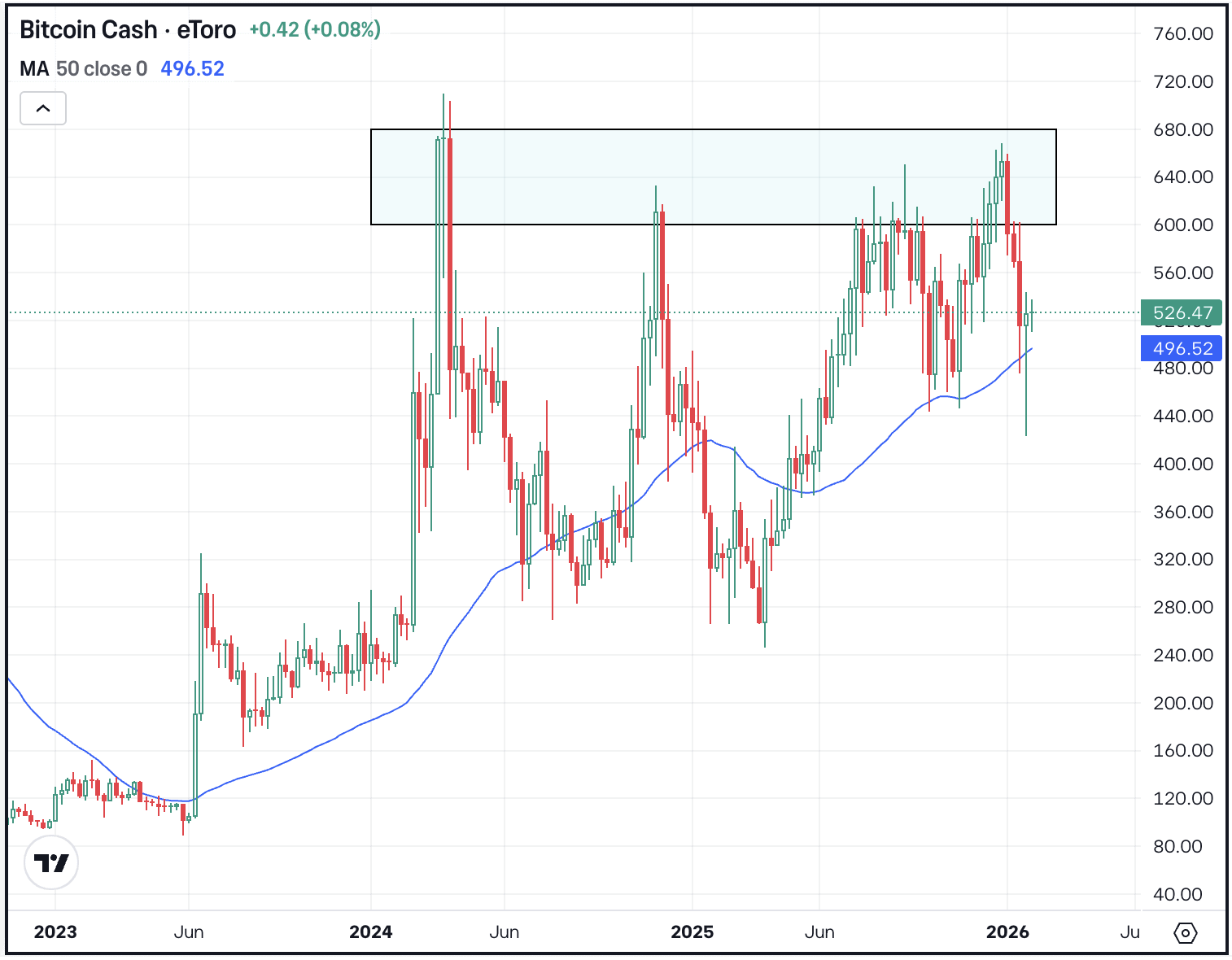

In the marketplace-structure facet, Taylor targeted on bitcoin dominance, arguing it’s “actually, actually tight” on Bollinger Bands, a situation he reads as a volatility setup. He revisited a historic instance the place an 11% bitcoin pullback preceded what he described as a 490% XRP surge, and argued that, traditionally, drops in bitcoin dominance have tended to coincide with sharp XRP outperformance.

Taylor’s core declare is that the compression in dominance has continued for roughly six months and is now at ranges he in comparison with an earlier period, “earlier than ETH and ICOs”, when dominance dynamics appeared structurally totally different. He allowed for the alternative final result, the place dominance squeezes greater and bitcoin “sucks the liquidity in,” however stated he more and more favors a draw back dominance break that will mechanically strengthen the case for altcoin beta, with XRP as a candidate beneficiary if narrative catalysts arrive alongside the transfer.

Associated Studying

Taylor additionally leaned on Binance quantity comparisons throughout three-day candles, arguing XRP’s restoration quantity appeared extra aggressive than the previous selloff, whereas he stated sellers appeared extra dominant in ETH and BTC over the identical framing. He tied that relative learn to XRP cross charts versus ETH and BTC, describing repeated makes an attempt at vary resistance and suggesting a “constructive worth motion” set off may speed up XRP’s relative breakout.

He flagged near-term calendar gadgets, together with yesterday’s Readability Act assembly and the XRP Group Day right this moment, whereas cautioning in opposition to assuming a reflexive pump. Nonetheless, Taylor’s broader level was about positioning right into a regime shift he believes may arrive rapidly, pointing to seen liquidity concentrated above spot ranges on his charts, extending from roughly $1.50 up towards $4.30, with comparatively much less liquidity stacked under.

“I feel persons are going to be shocked once we begin to reverse and we reverse rapidly,” Taylor stated, arguing {that a} quick upside transfer may pressure merchants out of short-term positioning. He then mapped his most bullish path: bitcoin returning to new highs – he floated 150K and “180-ishk plus” as targets – whereas bitcoin dominance “nukes,” establishing what he known as “loopy worth motion” for XRP if it captures share of that dominance unwind.

At press time, XRP traded at $1.3594.

Featured picture created with DALL.E, chart from TradingView.com