Many had speculated that the rally within the crypto market was going to wane following the Spot Bitcoin ETF rumors fading out. That hasn’t been the case, although, and a latest revelation from a outstanding crypto analyst means that the 2 largest cryptocurrencies by market cap, Bitcoin and Ethereum, may proceed to see an upward development.

New Liquidity Coming Into The Market May Increase Bitcoin, Ethereum

In a put up shared on his X (previously Twitter) platform, Crypto analyst Ali Martinez revealed that the crypto market has seen near $10.97 billion in constructive capital inflows, which represents the best stage this yr. In response to him, this influx of capital into crypto may probably imply that buyers are closely bullish on these belongings.

Supply: X

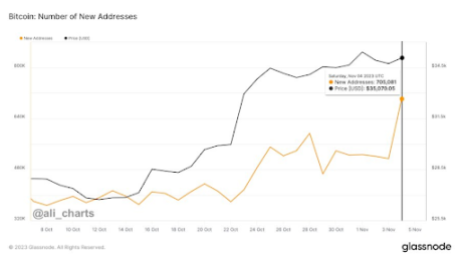

In the meantime, there may be additionally additional proof that the market, most particularly Bitcoin, may see an inflow of recent cash within the coming days, as Martinez talked about in a subsequent put up that over 700,000 new BTC addresses have been created on November 4. The analyst believes that such a occurring is a crucial milestone as Bitcoin’s community development is without doubt one of the greatest worth predictors.

Supply: X

It’s unsure what could possibly be behind these inflows and the revived curiosity within the crypto market. Nonetheless, some consider that it could possibly be institutional buyers who’re taking positions forward of a attainable approval of the pending Spot Bitcoin ETF functions by the Securities and Alternate Fee.

Others consider that the Bitcoin Halving could possibly be contributing to the resurgence in Bitcoin’s worth and the crypto market by extension. Traditionally, Bitcoin has seen vital positive factors within the interval main as much as the Halving occasion. The following Halving is anticipated to occur in April 2024.

Regardless of the cause, there isn’t a doubt the inflow of recent cash into the ecosystem is a constructive growth. A specific crypto analyst had as soon as famous that many altcoins have been tepid because of the lack of liquidity out there and that they might choose up as soon as there may be renewed curiosity out there.

Institutional Curiosity Coming From Abroad

In response to a Bloomberg report, Hong Kong’s monetary regulator, the Securities and Monetary Fee (SFC), is contemplating permitting the launch of exchange-traded funds (ETFs) that permit buyers to speculate immediately within the cryptocurrency itself (Spot buying and selling).

This growth comes amid the US SEC’s reluctance to approve the pending Spot Bitcoin ETF functions, which might permit US buyers to have direct publicity to the flagship cryptocurrency, Bitcoin.

This additional highlights the stark distinction between the remedy that the crypto trade has obtained abroad and in the USA. The constructive method taken by regulators abroad is, nonetheless, commendable because the crypto trade continues to see curiosity from such areas.

BTC bulls attempt to reclaim $35,000 | Supply: BTCUSD on Tradingview.com

Featured picture from iStock, chart from Tradingview.com